It was a controversial year for the crypto indutrsy. Let’s have a closer look at the major crypto-related events that too place in 2023.

The year 2023 has been a rollercoaster ride for the cryptocurrency ecosystem, defined by important events that have impacted the industry’s direction. From stablecoin woes to regulatory disputes, institutional acceptance, and the advent of meme coins, the crypto sector has seen a wide range of stories.

Here are the top 10 major crypto headlines that have defined the year.

USDC Stablecoin Falters amid Silicon Valley Bank Collapse

March kicked off with a seismic event as Silicon Valley Bank (SVB) collapsed, sending shockwaves through the cryptocurrency market. The USDC stablecoin, closely tied to Circle, one of SVB’s top depositors lost its dollar peg, plummeting to a record low of 87 cents.

Analysts dub SVB’s collapse the largest US banking failure since the 2008 financial crisis, underscoring the vulnerability of stablecoins tied to traditional financial institutions. SVB clients had taken a whopping $42 billion from deposits at the time triggering a bank run.

Notably, when the bank announced its closure, it had a $958 million negative cash balance.

Rise of Meme Coins

May witnessed the rise of meme coins, with a market value reaching pushed to new heights by these new asset classes. The rise of meme coins on the Bitcoin blockchain is primarily due to the growing popularity of Ordinals.

The Ordinals code, released earlier this year, has a good impact on miner’s earnings on digital assets. Since the introduction of Ordinals, around 25,000 meme tokens have been registered on the Bitcoin blockchain.

BlackRock Triggers Spot Bitcoin ETF Application Wave

In June, BlackRock Inc (NYSE: BLK), alongside other traditional financial institutions, applied to offer spot Bitcoin Exchange-Traded Funds (ETFs).

BlackRock’s filing marked a turning point in institutional adoption, triggering a reversal in Bitcoin’s price trajectory. The filing encouraged other firms like Bitwise, Invesco, and WisdomTree to follow suit, signaling a growing acceptance of cryptocurrencies within mainstream finance.

According to the facts, BlackRock applied with the US Securities and Exchange Commission (SEC) through Nasdaq, citing Coinbase Global Inc (NASDAQ: COIN) as the exchange to provide oversight for the proposed ETF. For the first time in about 10 years, the expectation that this product will finally be greenlighted is high.

Ripple vs SEC

In July, US District Judge Analisa Torres rejected the SEC’s accusations against Ripple Labs Inc., partially declaring XRP a non-security. The SEC accused Ripple of violating securities laws while the court ruled that XRP sales on crypto exchanges were not securities.

However, the Judge handed the SEC a win, noting that Ripple Labs violated securities laws when it sold XRP to institutional investors. The settlement hearing for this aspect of the case is poised to be held in H1 2024.

Other pending cases bordering on the role of Brad Garlinghouse and Chris Larsen in the case were dropped by the markets regulator.

SEC Charges Binance, Coinbase, and Kraken for Operating Unregistered Securities Exchanges.

In June, the SEC filed charges against Binance, Coinbase Global Inc (NASDAQ: COIN), and much later, Kraken, accusing them of operating unregistered securities exchanges. The charges ranged from misrepresenting trading controls to selling unregistered securities. The legal actions highlight the intensifying regulatory scrutiny faced by major crypto exchanges.

As a part of this lawsuit, SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO were identified as securities by the SEC.

3AC Co-founder Su Zhu Arrested, Do Kwon’s Extradition Approved

In September, Singapore police arrested Three Arrows Capital (3AC) co-founder Su Zhu and the extradition of Terraform Labs co-founder Do Kwon was approved. Zhu was detained at Singapore’s Changi Airport for failing to cooperate with a liquidation probe. Three Arrows Capital declared bankruptcy in the middle of the 2022 crypto market upheaval, owing creditors more than $3.5 billion.

Additionally, Montenegro’s Higher Court approved the extradition of Terraform Labs co-founder Do Kwon to either South Korea or the United States, with the Minister of Justice making the ultimate choice on the destination.

AI and Bitcoin Integration

The integration of artificial intelligence into the crypto space gained momentum this year, with ChatGPT from OpenAI being a notable development. The combination of AI and crypto was seen as a match made in heaven, with predictions of a bullish market fueled by crypto and AI advancements.

One of the primary advantages of integrating AI with Bitcoin is the capability to bolster security measures. Traditional cryptographic techniques employed by the Bitcoin network can be complemented by AI algorithms to detect and prevent fraudulent activities, hacking attempts, and other malicious activities. Machine learning algorithms can analyze transaction patterns, identify anomalies, and provide real-time alerts, creating an additional layer of security for users

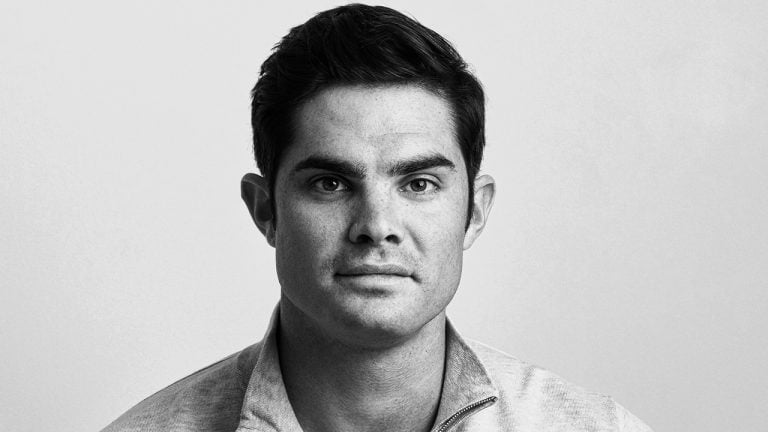

Former FTX CEO Sam Bankman-Fried Found Guilty

In November, after a five-week trial, Sam Bankman-Fried, the former CEO of FTX Derivatives Exchange, was found guilty on seven charges, including wire fraud, commodities fraud conspiracy, securities fraud, and money laundering conspiracy.

The verdict marked a notable development in holding crypto executives accountable for their actions. Sam Bankman-Fried’s sentence hearing is slated for March 28, 2024 with many projections tagging the likely jail term at 20 years.

Binance Settlement with DOJ for $4.3 Billion

Shortly after, Binance CEO Changpeng ‘CZ’ Zhao entered a guilty plea to charges of violating the Bank Secrecy Act, leading to a $4.3 billion settlement between the trading platform and the United States Department of Justice (DoJ), the Commodity Futures Trading Commission (CFTC) and the Treasury Department.

The charges accused Binance of allowing US customers to trade on its platform without proper KYC and AML checks, highlighting regulatory scrutiny in the crypto industry.

Bitcoin Bull Run

In December, Bitcoin surged past $42,000 and grew as high as $44,000, signaling the potential for a new crypto supercycle. The bullish momentum was attributed to expectations of a Bitcoin ETF approval in early 2024. Despite the optimism, some noted a lack of fervor compared to previous bull cycles.

Coinbase CEO Brian Armstrong even suggests that Bitcoin could be critical to the advancement of Western civilization. According to Bloomberg, predictions for Bitcoin’s future range from $50,000 to more than $530,000 in the coming years.