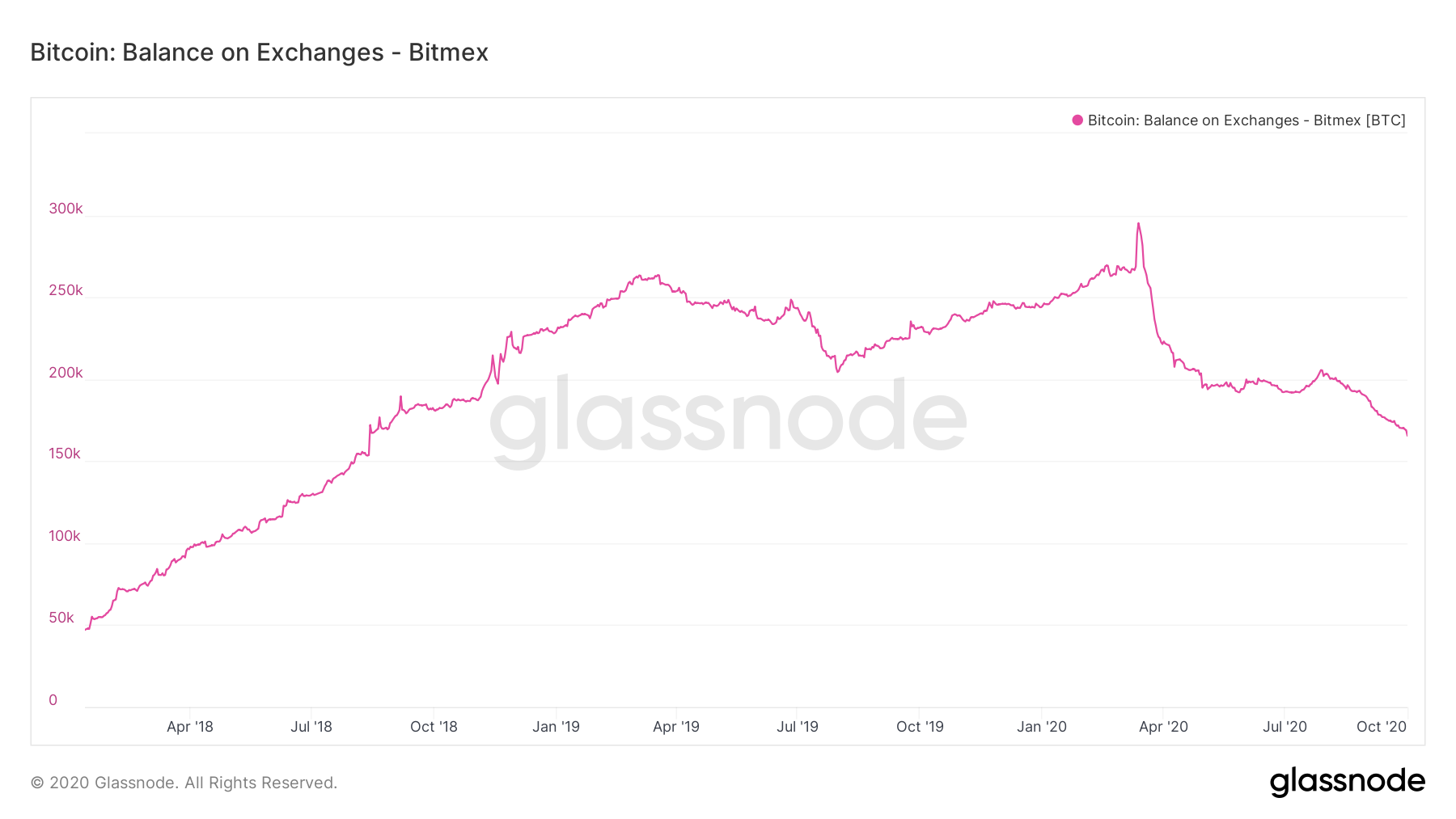

Over 45,000 Bitcoin has been withdrawn from BitMex since the U.S. government levied charges against the exchange and its leadership. October 1 brought two devastating blows to BitMex. First, the CFTC and DOJ brought charges against the exchange. Shortly thereafter, its founders (including CEO Arthur Hayes), were indicted by the U.S. government. The market reacted to the news with a sharp decline across many of Blockchain’s biggest assets. BitMex Bitcoin reserves. Source: Glassnode. This isn’t the first time in recent months that BitMex has contributed to a downward turn. The exchange first began losing the…

Day: October 3, 2020

Venezuela’s State-Run ‘Defi’ Crypto Exchange Goes Live After Maduro’s Anti-Blockade Speech

Decentralized finance (defi) is allegedly coming to Venezuela after a recent decree from Venezuelan President, Nicolás Maduro and the United Socialist Party of Venezuela. The government recently introduced a defi platform called BDVE that purportedly provides Venezuelan citizens with the means to swap ERC20 tokens in a noncustodial manner. For quite some time now Venezuela has had to deal with strict economic sanctions. President Nicolás Maduro spoke about these sanctions in a new mandate called the “Anti-blockade Law for National Development and the Guarantee of Human Rights.” On October 1,…

Yearn.finance (YFI) Drops 10% Despite These 2 Fundamental Trends

Despite resilience in the price of Bitcoin, it’s been another brutal day for Yearn.finance (YFI) and other DeFi coins. The leading decentralized finance coin, based on Ethereum, has dropped 10% in the past 24 hours. The cryptocurrency currently trades for $20,900, far below its all-time high at $44,000. YFI’s decline comes as other DeFi coins have undergone strong pullbacks of 5-15%, underperforming Bitcoin, Ethereum, and most altcoins. Yearn.finance’s decline comes in spite of positive fundamental trends for the project and all of the DeFi space. Yearn.finance is a decentralized finance…

Uniswap’s UNI Token Plunges as Investors Fear a Regulatory Crackdown

Uniswap’s UNI token has taken a hit over the past few days. Although it isn’t the only cryptocurrency currently plunging lower as the market continues being plagued by uncertainty, it has been hit particularly hard. The recent news regarding the CFTC’s decision to pursue criminal charges against the BitMEX creators has contributed to the entire market’s recent weakness and may be sparking some concerns amongst investors in governance tokens over decentralized trading platforms. One trader explained in a recent tweet that it is “naïve” to believe that regulators won’t eventually…

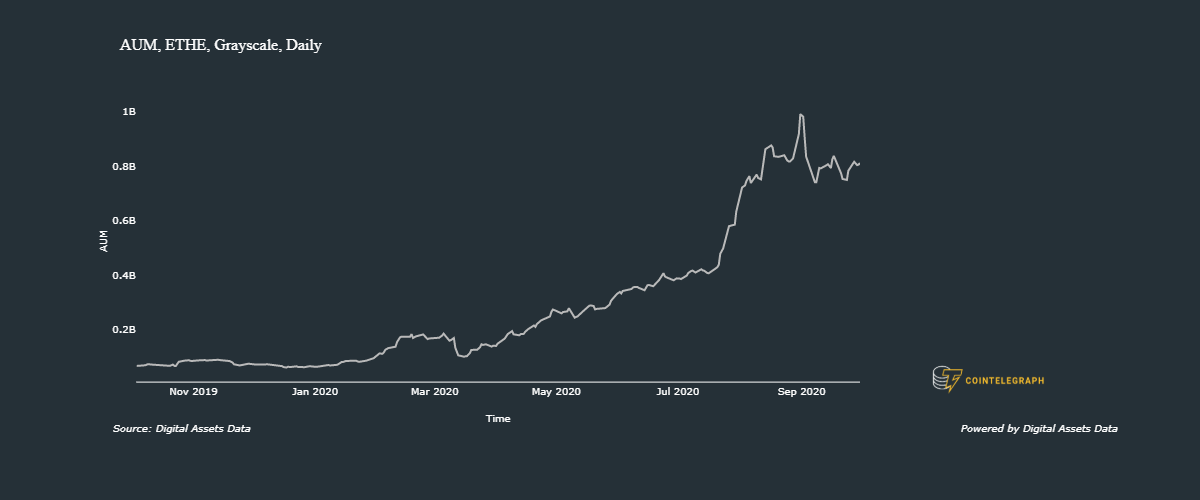

ETH 2.0 represents a material risk to Grayscale’s Ethereum Trust, says SEC filing

According to the latest SEC disclosure by the Grayscale Ethereum Trust, or ETHE, the impending transition of Ethereum (ETH) to the proof-of-stake consensus represents a risk that could have a “material adverse effect” on its shares. The ETHE recently filed an application with the regulator to become an SEC-reporting company. Companies of this nature are required to discuss the risk factors that may have an adverse impact on the their performance within all quarterly and annual reports. One section, meant to outline potential risks for the fund’s future, outlines that…