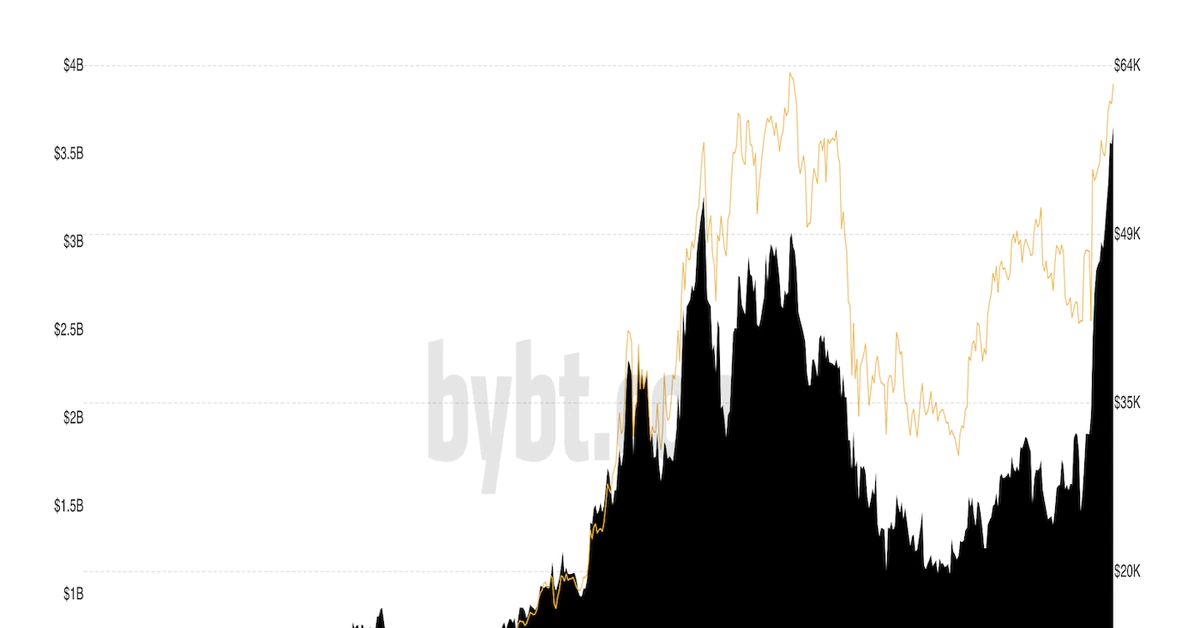

The amount of money locked in the bitcoin futures contracts on the global derivatives giant Chicago Mercantile Exchange (CME) surged to record highs on Friday as the U.S. Securities and Exchange Commission (SEC) greenlighted futures-based exchange-traded funds (ETF) tied to the cryptocurrency.

CME Sees Record Open Interest in Bitcoin Futures Ahead of ETF Debut