Bitcoin price (BTC) has been in a sidewards range for several weeks now, with some people on team bear calling for fresh lows in the region of $3,000 while the bulls have been calling for astronomical all-time highs soon. One thing that is apparent in the market, is that you have to take it one week at a time.

With Bitcoin currently heading towards the mid-$7,000 range, is it time to flip bullish? Or is this yet another low liquidity Sunday pump to create CME gap-filling opportunities?

Daily crypto market performance. Source: Coin360.com

But Sir, the CME gap

Whether you are leverage trading, or simply moving your Bitcoin into a stablecoin during the dips, if you are not capitalizing on the weekly CME gap, you’re missing a trick. However, the more obvious these gap fill trades become, the more likely it is that they will soon become a thing of the past.

Christmas week is a week that I took off trading. The reason is that the CME was closed on the 24,25 and 26th of December, which meant attempting to trade a gap fill was slightly more difficult. As the gap left on Friday, Dec. 20 would have needed to fill on Monday, Dec. 23, and then Monday, Dec. 23 left a new gap to be filled on Friday, Dec. 27.

Next week is set to be the same, with the CME Holiday Calendar citing that trading will be closed Dec. 31 to Jan. 2, 2020.

BTC USD daily chart. Source: TradingView

It seems that traders with greater exposure to Bitcoin are driving the price during the weekend when the volume is thinner, and then waiting on institutional traders to fill the gap the following week.

However, with institutional money taking an extra 6 days off over the holiday break, it means more thin volume periods for the price to be driven by whales in this 24/7 market.

So while the bankers may sleep, Bitcoin, in fact, does not sleep, and this could open up a window for a short-term rally before the bear cycle resumes.

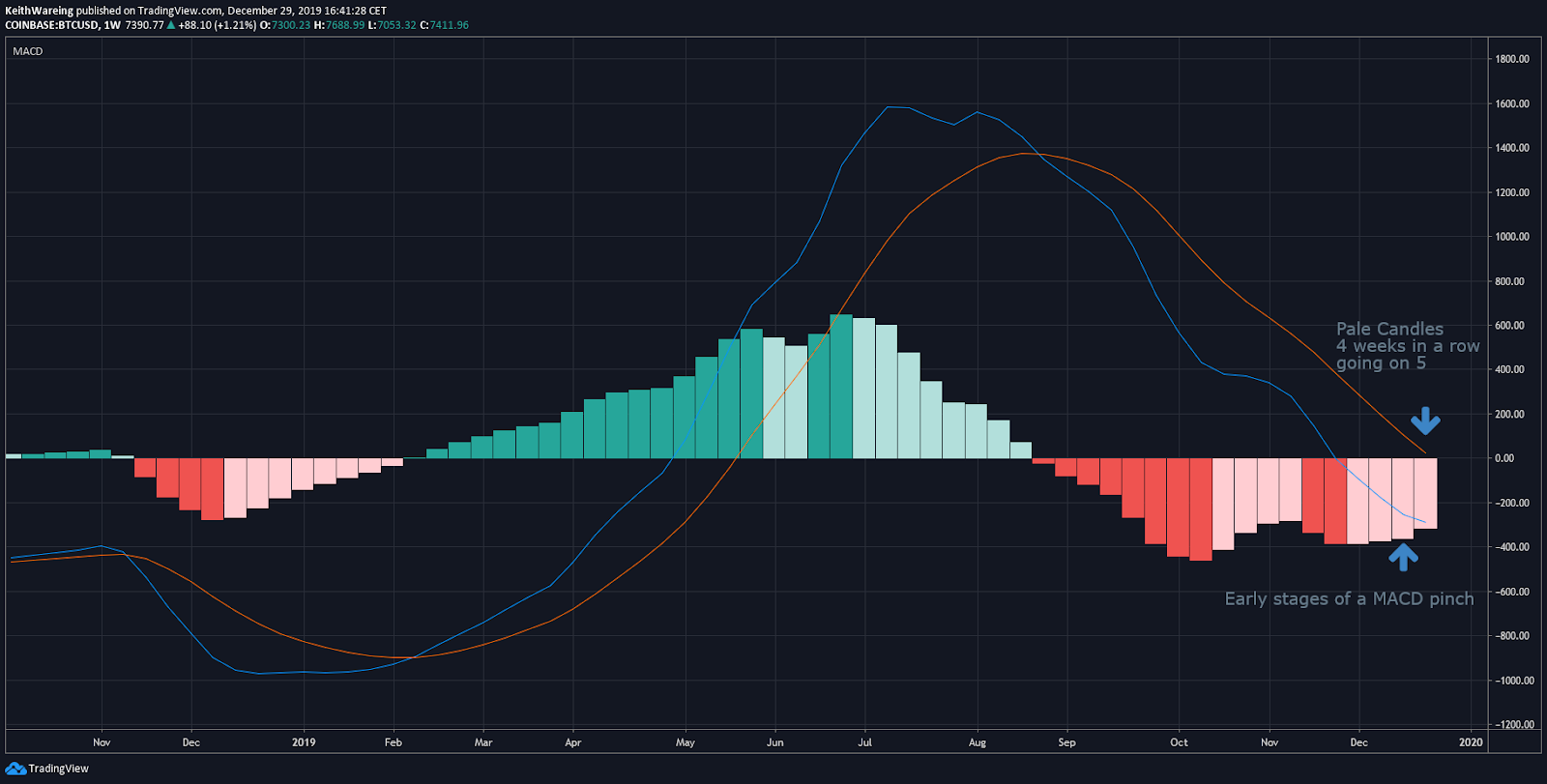

The weekly MACD has started to lean bullish

BTC USD MACD weekly chart. Source: TradingView

The Moving Average Convergence Divergence (MACD) indicator is showing early tell-tale signs of a bullish reversal. However, I don’t expect this to continue. As can be seen in the image above, the MACD line changed its bearish course on Dec. 16, but why?

I believe that due to a lack of institutional interest over the Christmas period, the market was easily moved upwards, which has changed the trajectory and with it, has continued to print pale pink candles, which are getting shorter by the week, usually indicating a cross into green territory. This has given some hope of a relief rally before the real pain begins for Bitcoin.

But where could we see the digital asset move?

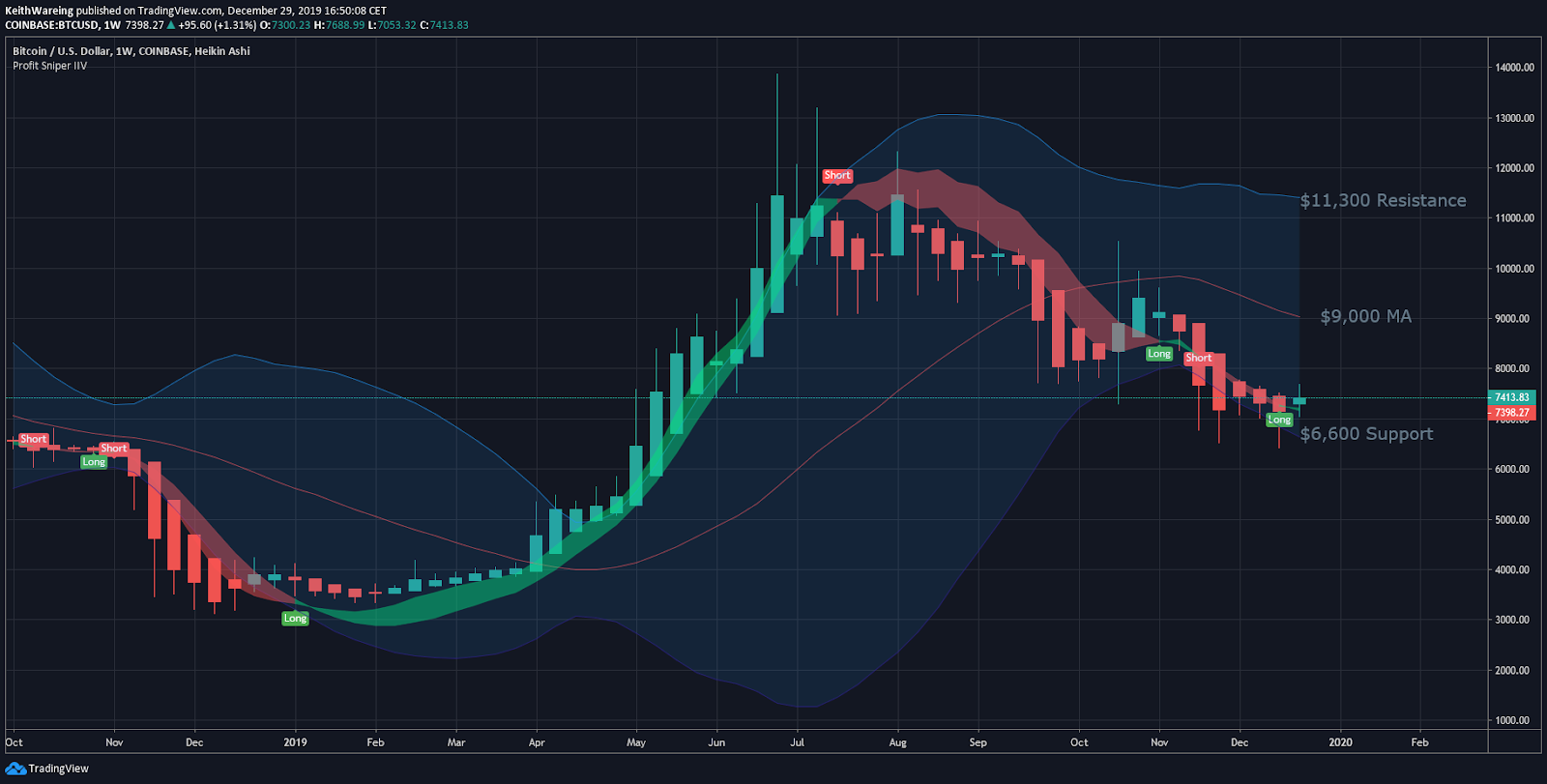

The weekly Bollinger Bands suggest a temporary bottom

BTC USD BB Weekly chart. Source: TradingView

Using Bollinger Bands (BB) Indicator overlayed with my indicator that shows pivot points based on momentum, Bitcoin appears to have entered a short-term bull phase that will most likely see a rejection around the moving average of $9,000.

I believe this to be the case, as short-term low liquidity pumps falter around the moving average, as can be seen at the end of October. This is where Bitcoin price experienced an unnatural pump, which saw the digital asset climb around $2,500 in 48 hours, and despite a momentary wick above the MA, it failed to hold above this point and soon resumed its bear trend, feeding off the blood of hodlers at the bottom of the BB.

As such, with the institutional players easing up over the holiday period, it’s a perfect opportunity for the price of Bitcoin to be pushed up to around this level.

At this stage, you may be asking why I only see a short-term relief rally and not a full reversal. The reason for this lies in the Relative Strength Index (RSI) indicator.

The RSI shows no clear buy signal

BTC USD RSI weekly chart. Source: TradingView

The RSI is currently very much in the middle with a reading of 42.20 on the weekly. This doesn’t signal anything to anyone, and as such, would not attract any significant money into the market. When the RSI is planted between 30 and 70, we’re simply in a ranging market where scalpers feed and hodlers bleed.

Right now, anyone with any significant cash holdings would be hesitant to go all-in on an asset at this point, whether it be Bitcoin or anything else. As such, this to me says we must first see more downside before Bitcoin becomes an attractive investment opportunity for smart money.

You only have to look at the end of 2018 and the beginning or 2019 where Bitcoin held an average price of $4,000 to see why the RSI is a valid indicator for buying Bitcoin, as buying in the oversold territory would have seen you gain over 300% on your investment throughout 2018.

The Daily RSI is Neutral

BTC USD RSI DAILY chart. Source: TradingView

The daily RSI is also incredibly neutral, more-so than the weekly RSI. It’s currently sitting on 52.16, which again sends no buying or selling signal to investors.

A pump towards $9,000 would certainly plant this in oversold territory, which could spark a sell-off, with people trying to cover their hemorrhaging losses after FOMO-ing in at $10,000 levels earlier this year thanks to a wave of social media influencers prematurely declaring that BTC is in a bull market.

Incidentally, the monthly RSI is reading the same as the daily, so no need to look at that today. However, I will look at the monthly BB.

Bitcoin is struggling to stay above the Moving Average

BTC USD BB monthly chart. Source: TradingView

As Bitcoin continues to stay in a sidewards range, the inevitability of an extinction-level event that will cause even the die-hard Bitcoin maximalists to question why they HODL lines of code, looks more and more likely.

Having pierced through the MA two months in a row, and with the red candles getting longer by the month, it seems that Bitcoins support is only around $400 away, before falling to painful lows.

The support on the Bollinger Bands is currently $2,550 and whilst Bitcoin has never actually touched the support on the monthly BB, that’s not to say it won’t have a good run towards it should $7,010 fail to hold in the short term.

Bullish scenario

With the CME only being open 2 days next week, expect the unexpected. This could go both ways (and I expect it probably will). But from a bull’s perspective, I’d be looking at the moving average on the weekly of $9,000 as the target before being rejected. If it continues past this price, the next level of resistance is $11,300. However, this doesn’t seem likely.

Bearish scenario

After the CME gap fills at $7,265 — which is likely to happen tomorrow — history tells us that the price will revert to the previous trend. However, should it continue to fall, the Bitcoin price only needs to fall a further $150 before it finds itself at the support of $7,010.

If this fails to hold, it’s game over Bitcoin, and the road of pain will truly begin. Any move below $7,000 could quickly recover on Friday, Jan. 3 depending on when the CME closes Monday evening.

But since this is still the holiday season, I don’t expect the real bear trend to resume until the week commencing on Jan. 6 once all the suckers have gone long. That being said, if it did continue to fall, $6,800 is the support on the daily BB for Bitcoin, which is a key level to take note of.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.