The price of Bitcoin (BTC) broke the psychological barrier of $10,000 and is currently stabilizing above it. Not only Bitcoin has been showing strength, but altcoins have also been popping left and right. Is the bullish momentum back in the market? Let’s analyze the charts.

Crypto market daily performance. Source: Coin360

Bitcoin price hovering below a significant resistance

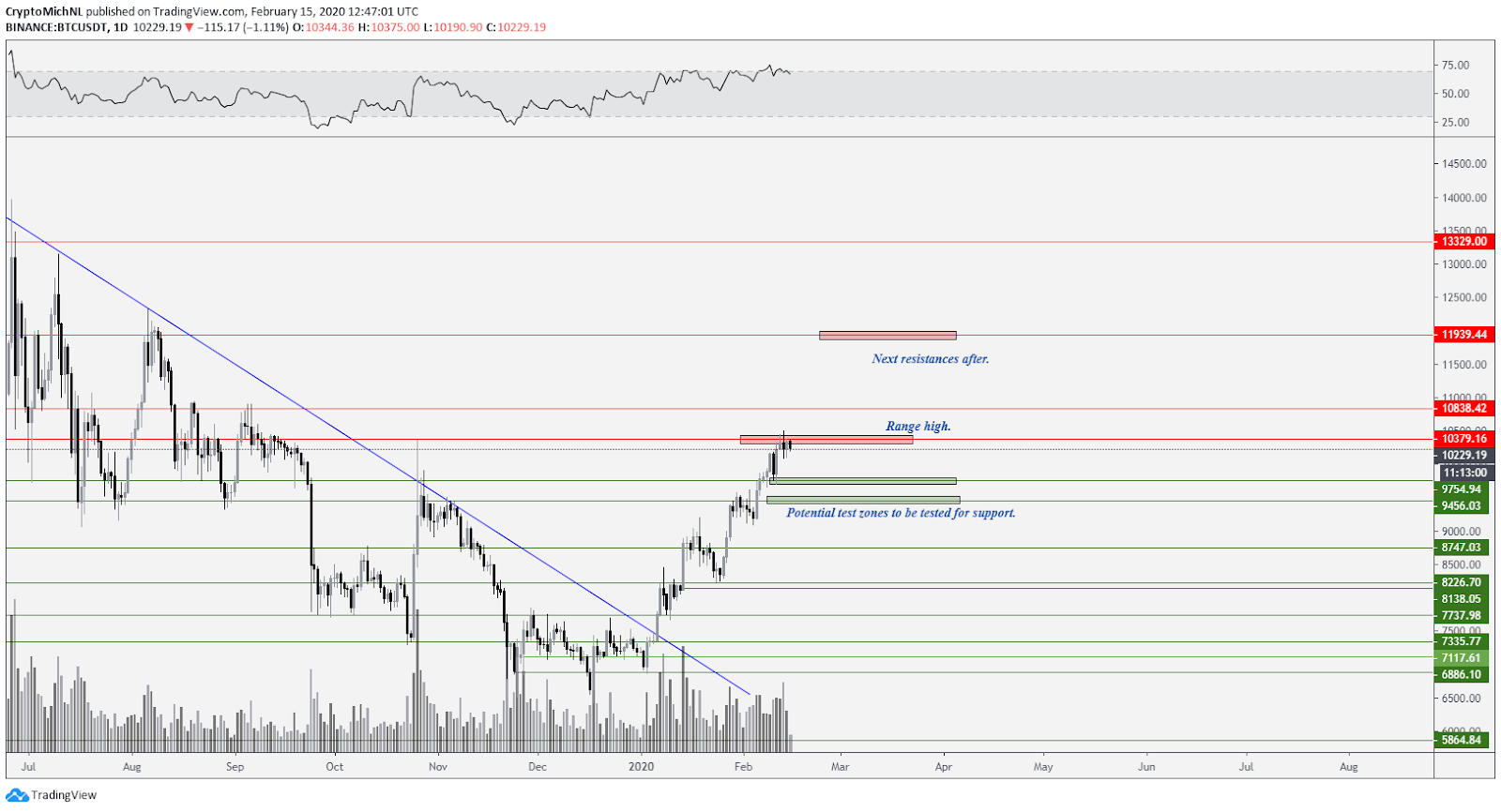

The price of Bitcoin broke the psychological barrier of $10,000. However, the price is facing significant resistance: the $10,400 level. A breakthrough in this zone could make the price move towards $11,000 and higher.

BTC USDT 1-day chart. Source: TradingView

However, would such a move be natural in the current market environment?

Bitcoin went from $6,900 to $10,400 in six weeks. Some consolidation would not be unhealthy for the market, as that would give the market some space to accumulate and generate strength for further upward momentum.

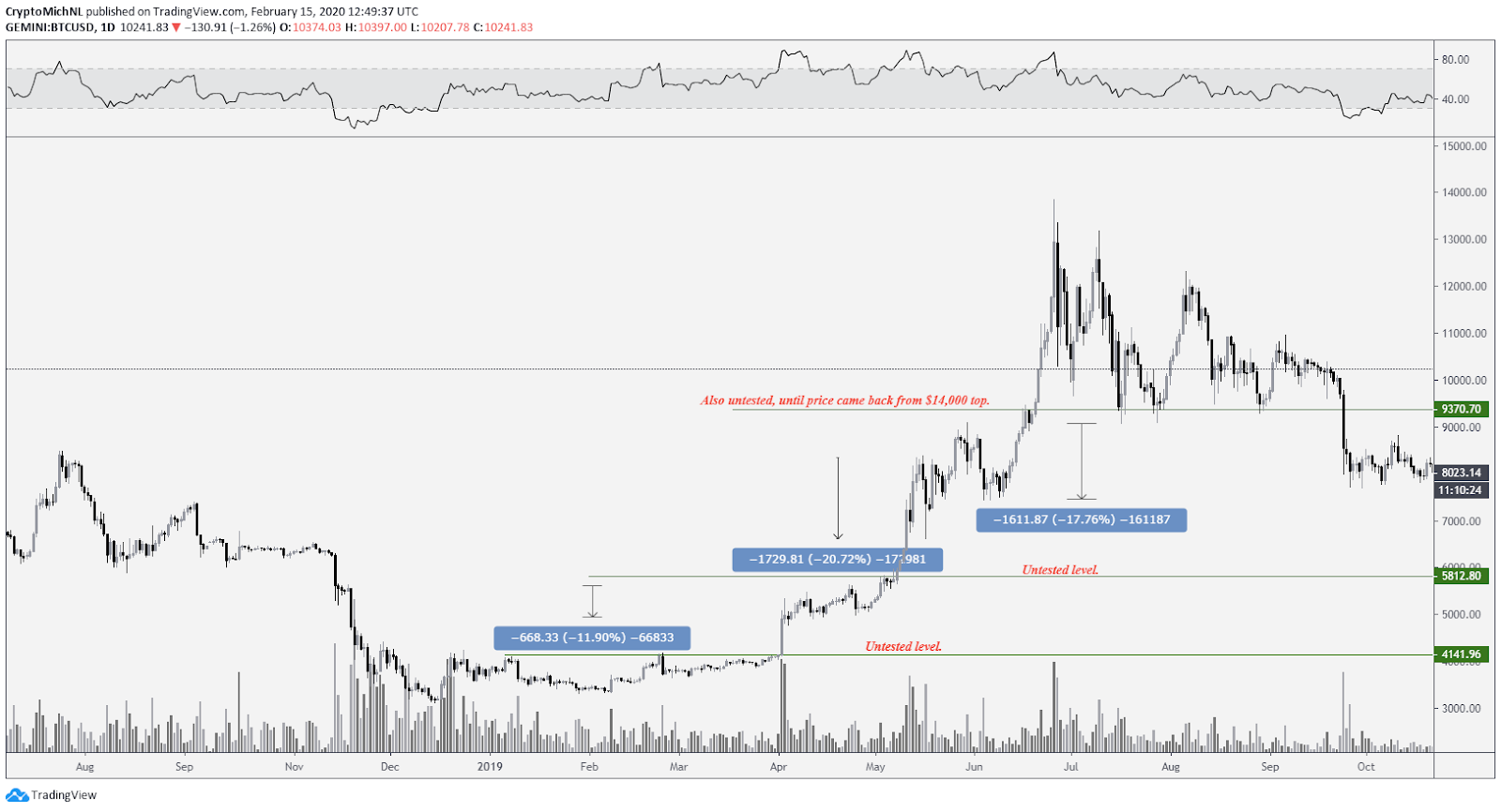

Investors should keep in mind that retracements will be very short-lived. Dips are seemingly being bought up very quickly in bull markets as we have seen in the past few weeks. One such example is last year’s move during the rally of $3,100 to $13,900.

BTC USD 1-day chart. Source: TradingView

A few remarkable things can be spotted from this chart. The “major” levels are not being retested before continuation, leaving significant gaps and investors behind. Waiting for a retest of these levels could mean that you’d be left behind before the big move occurs.

Another anticipation is the size of the retracement. In this particular case, retracements were not larger than 21%. In 2017, the retracements were 25-30%. Conclusions can be drawn that waiting for the “most obvious” level would most likely make you end up being left behind.

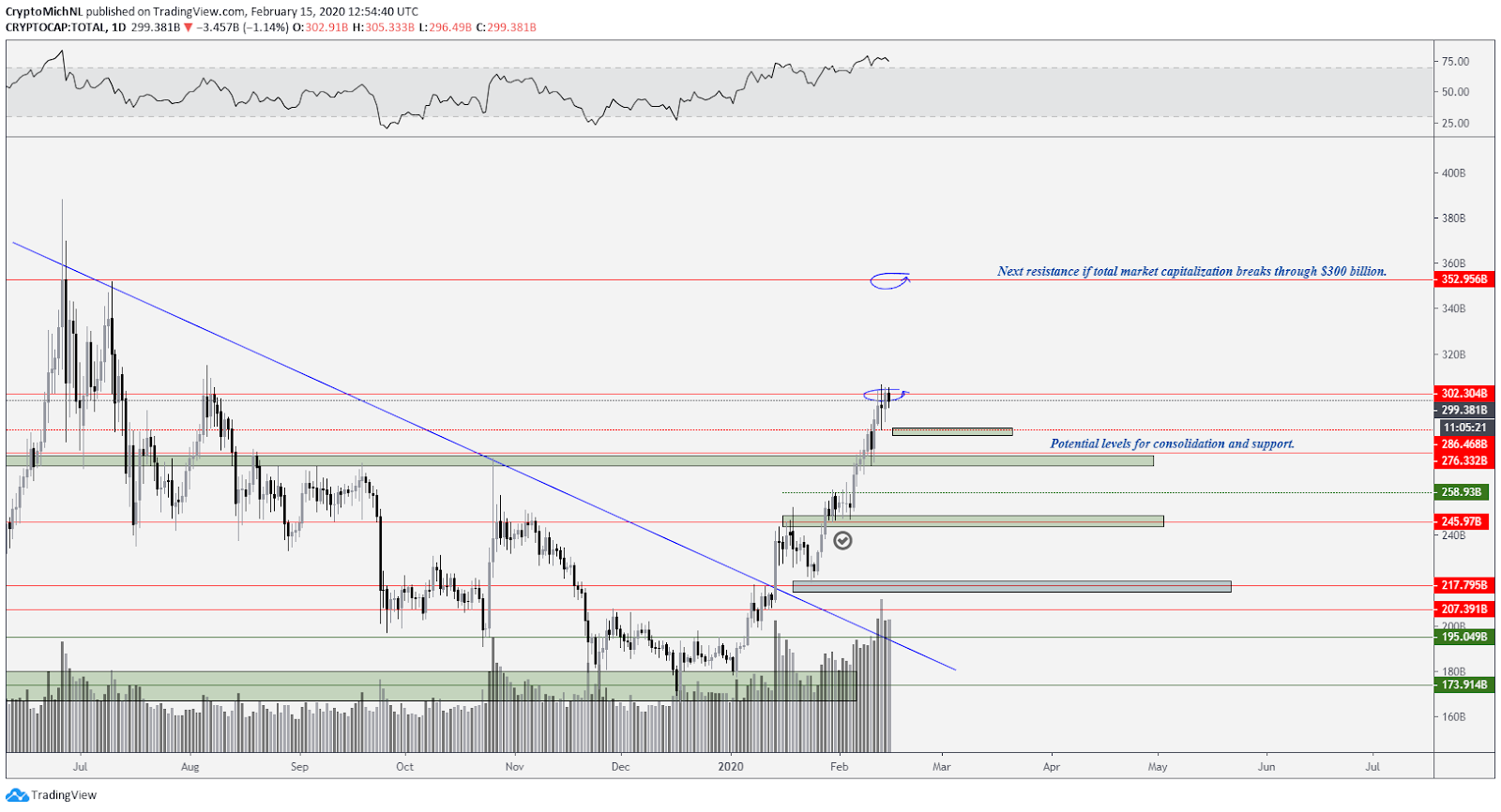

Total market capitalization facing the $300 billion barrier

The total market capitalization is also facing the last hurdle before another big move, similar to Bitcoin.

Total market capitalization cryptocurrency 1-day chart. Source: TradingView

The $300 billion level is an outstanding resistance and the last one before the total market capitalization can attack the $350 billion resistance. The chart is also showing a beautiful structure of support/resistance flips since the breakout of the seven-month-old downtrend.

Would it be healthy to see some consolidation on the total market capitalization? It would be. Levels worth watching for potential support area are the $275 and $285 billion regions, marked by the green rectangles.

Total market capitalization cryptocurrency chart. Source: Cointrader.pro

The overall picture of the total market capitalization is showing a pretty clear new uptrend. The main argument is found in the support/resistance flip at $175 billion, which marked a higher low. Since then, the market capitalization has been moving upwards to $300 billion, seeking a new top.

But what is required for the continuation and more confirmation of an uptrend? A new higher high.

For that, the total market capitalization needs to break above $368 billion. However, the total market capitalization could test some support levels before approaching this resistance area. Therefore, $250 and $273 billion will be the potential support zones before continuation.

If support is found and the market breaks above $368 billion, the primary new resistance is seen at $568 billion and a smaller one at $463 billion.

Altcoin market capitalization showing impressive strength

Altcoin market capitalization cryptocurrency 1-day chart. Source: TradingView

The altcoin market capitalization chart is showing impressive strength as the market capitalization rallied from $52 to $112 billion in 6 weeks, a surge of 115%. The altcoin market capitalization is also currently facing the last hurdle before the next big surge upwards.

If the altcoins can break through the resistance at $112-114 billion, continuation towards $140-145 billion is on the table. However, some retests of previous resistances before extension are not unhealthy.

When the market starts to make some corrective movements, I’d be watching the $100-103 and $93 billion levels as potential support zones before continuation. Just like with the total market capitalization, the altcoin market capitalization is in an overall uptrend, where dips are being bought up.

The bullish scenario for Bitcoin

There are two bullish scenarios for Bitcoin in play.

BTC USDT bullish scenario. Source: TradingView

The main bullish scenario would be a retest at $9,750-9,800 before continuation. Buyers have to step in at that level to continue the bullish momentum.

But can the price of Bitcoin hold $9,750-9,800 (or even $9,450)? That would be great as that would mean another higher low is made and continuation to the upside is likely to happen. Continuation to the upside would mean continuation towards $11,000 and, most likely higher.

Meanwhile, the CME chart is still providing a CME gap of $11,600, which is a significant indicator of the market. The next primary resistance after $10,400 is, therefore, found at $11,600-12,000.

However, does the market grant such retests? As discussed, upwards trending markets don’t see massive pullbacks. If something like this occurs, it usually ends up in a fast wick, after which the market bounces back up immediately. And such a test doesn’t even have to occur. In fact, the price of Bitcoin is currently seeing such strong bullish momentum that a breakthrough from current levels wouldn’t be a surprise.

The bearish scenario for Bitcoin

BTC USD bearish scenario. Source: TradingView

The bearish scenario is pretty straightforward. The price of Bitcoin needs to be rejected at $10,400, after which a retracement towards $9,500 should occur. If there are not many buyers stepping in, a weak bounce needs to happen with immediate rejection at $9,800 (a bearish retest).

A bearish retest and weak bounce would be a signal for downwards continuation with the first targets being $8,750. This bearish scenario doesn’t have many arguments right now, however, since the market is in an upward trend. Unless there are more bearish arguments starting to line up, I don’t think we’ll see this scenario play out.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.