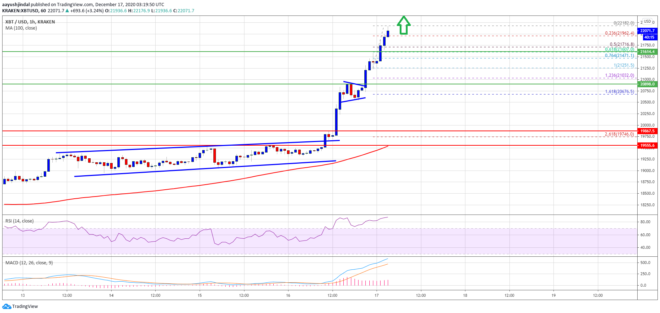

Bitcoin price is up over 12% and it broke many hurdles near $20,000 and $22,000 against the US Dollar. BTC is showing strong bullish signs and it could continue to rise in the near term.

- Bitcoin started a strong surge after it cleared the $19,800 and $20,000 resistance levels.

- The price is currently well above the $21,500 level and the 100 hourly simple moving average.

- There was a break above a couple of bullish continuation patters near $19,754 and $20,900 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could correct lower, but downsides might find support near $21,600 or $21,250.

Bitcoin Price is Surging

Yesterday, there was a clear break in bitcoin price above the $19,500 and $19,800 resistance levels. As a result, BTC broke the $20,000 barrier to start a strong upward move.

The price traded to a new all-time high and settled above the 100 hourly simple moving average. The bulls are clearly in action, as they managed to pump the price above $21,000 and $22,000. During the rise, there was a break above a couple of bullish continuation patters near $19,754 and $20,900 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

The pair gained pace and it traded as high as $22,182 recently. It is currently consolidating gains and trading near $22,000. On the downside, an initial support is near the $21,700 level. It is close to the 50% Fib retracement level of the recent surge from the $21,251 swing low to $22,182 high.

On the upside, bitcoin price might face resistance near $22,200 and $22,450 levels. Any more upsides could lead the price towards the $23,500 level in the near term.

Downsides Supported in BTC?

If bitcoin starts a short-term downside correction, it could find support near the $21,700 level. The first key support is near the $21,600 level.

The 61.8% Fib retracement level of the recent surge from the $21,251 swing low to $22,182 high is near $21,600 to provide support. Any more losses may possibly call for a test of the $21,000 zone in the near term.

Technical indicators:

Hourly MACD – The MACD is showing many positive signs in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently well in the overbought zone.

Major Support Levels – $21,700, followed by $21,600.

Major Resistance Levels – $22,200, $22,450 and $23,500.