After the release of Uniswap v2 in May 2020, several competitors for the DEX emerged, forking its codebase, launching new incentives, and their own governance model to attract users. Sushiswap is perhaps the most important.

To prevent something similar, the third iteration of the automated market maker will be released with a Business Source License 1.1. The license will expire after two years unless the community decides to accelerate its expiration. It will then adopt a GPL 2.0 open-source license.

With a tentative deployment date of May 5, General Counsel for Compound Finance, Jake Chervisnsky, believes it is possible that Uniswap v3 could prevent further forks, for a trade-off.

1/ One interesting piece of Uniswap v3 is its use of Business Source License (BSL) 1.1, which restricts production use for two years.

I see people asking if @Uniswap can really use BSL 1.1 against v3 forks. Answer: yes, mostly, at a cost.

The DeFi + copyright situation 👇 pic.twitter.com/KYQZTl58Ht

— Jake Chervinsky (@jchervinsky) March 24, 2021

Chervinsky señala que es importante que los protocolos de finanzas descentralizadas operen con licencias de código abierto. Sin embargo, indica que la licencia de negocio de Uniswap no será “inútil” como muchos piensan. El experto afirmó:

This is where people say “good luck enforcing copyright against anon devs,” as if Uniswap’s BSL 1.1 license is useless. Wrong, for a few reasons. First, most dev teams aren’t fully anonymous. Like it or not, anonymity is tough to maintain, especially when a project succeeds.

In addition, Chervinsky said that the developers of a successful project have a difficult time remaining anonymous and indicated that they may not be the only targets in a potential lawsuit based on U.S. law.

The Uniswap Labs team could go after a third party that violates the license by choosing to integrate the fork. This includes exchanges, decentralized exchange aggregators, investors, liquidity providers, market makers, among others. The possibilities for lawsuits are broad and “It just depends how aggressive they want to be,” the lawyer said.

Adding that the “threat” of a lawsuit could be enough to enforce the license and prevent a fork of the code, the lawyer believes that litigation could be just part of Uniswap Labs’ defense arsenal without ever having to pursue it. Chervinsky cited the opinion of his colleague Collins Belton:

Ultimately, suing someone isn’t only way for legal remedies to have force. It’s also why I have to unfortunately highlight to some people that just because you *can* sue someone and win doesn’t mean it’s smart to do so (e.g. getting buried in costs and bankrupt before winning).

In conclusion, the value of the license could go beyond suing everyone who attempts to fork the decentralized exchange. Chervinsky predicts a future in which other protocols adopt a similar strategy.

The trade-off for this action could be increased centralization and reputational damage to the DEX. However, The lawyer believes that a “well-calibrated” legal strategy could be beneficial. He also highlighted that one of the license best aspects is the ability for UNI token holders to revoke it. Chervinsky added:

Given all this, I think it’s premature to say BSL 1.1 should be the new standard for every DeFi project in every circumstance. “Uniswap did it, so we should too” may seem tempting, but the reality is every project is different & very few are positioned as well as Uniswap.

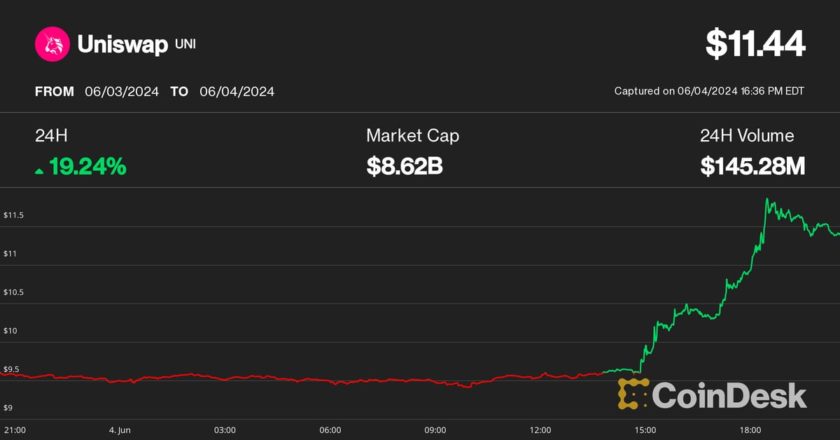

UNI follows a bearish trend

UNI trades at $26.91 with a 12.2% correction on the 24-hour chart. In the last weeks, UNI’s losses stand at $14.8%.