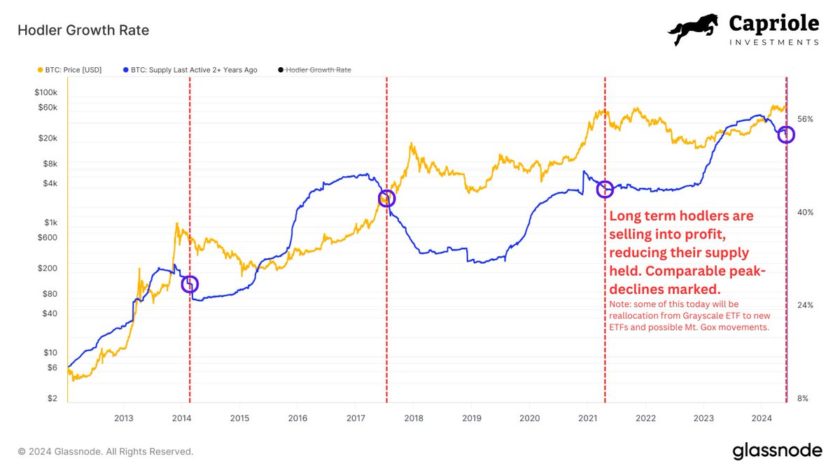

Publicly traded companies, large privately held companies and even national governments are stealing the crypto headlines nowadays thanks to their investment in crypto treasuries. MicroStrategy CEO Michael Saylor is the ultimate evangelist for the idea. His company holds over 121,000 of the 21 million bitcoins that will ever exist.

That said, substituting cash reserves with bitcoin or ethereum isn’t the only way for companies to get exposure to the crypto world. Plenty of alternatives exist for gaining exposure to this asset class: decentralized finance platforms, investment in non-fungible token (NFT) artwork and even deep dives right into the metaverse.

Let’s explore each of these alternative options and why corporations are pursuing them.

DeFi investing for institutions

SEBA, a Swiss-regulated crypto investment bank, now has products that allow its institutional clients to engage in decentralized finance (DeFi) protocols, and the lending and borrowing services they offer provide annual returns between 3% and 13%.

Research firm CryptoCompare suggests that the volume of smart contract loans on the Ethereum blockchain is now up to $26 billion. For that level of volume to be coming into loans, institutional investors have to be flocking towards it.

Staking is also being incorporated into institutional investing strategies. Further research shows that the total value of money invested in staking projects on the Ethereum blockchain moved from $65 million in January to a whopping $4 billion in October.

Companies buying into the exciting world of NFTs

Visa and MasterCard both have a vested interest in getting as big a piece of the cryptocurrency pie as they can. After all, public blockchains that allow users to exchange value from peer to peer are a direct threat to the two companies, which have dominated the payments industry for more than 50 years.

MasterCard plans to open its services to more crypto-based businesses heading into 2022, while Visa is getting involved in the NFT game directly. In August, the company spent $150,000 on a CryptoPunk NFT. Within an hour of the sale, 90 other NFTs were sold, generating more than $20 million in volume for the project.

The head of crypto for Visa, Cuy Sheffield, said the move is all about “gaining a firsthand understanding of the infrastructure requirements for a global brand to purchase, store and leverage an NFT.”

Facebook rebrands as Meta

NFTs, crypto gaming projects and virtual reality are converging to create monetary value, putting it back into the hands of participants rather than traditional gaming publishers or other centralized businesses.

That’s why it makes sense for Facebook to change its name to Meta. The company has a global reach and a golden opportunity to benefit as a metaverse onramp for the world.

For BVNK, the same opportunity exists. Gaming and NFT projects are turning into billion-dollar enterprises in a flash, and the companies running them will need access to a digital banking platform that can act as a chief financial services provider.

The next wave of institutional crypto investing is here

Exchanging cash reserves for crypto is arguably the first popular way to invest in digital assets, and it’s already been adopted by institutional investors on a large scale. DeFi, NFTs and staking clearly represent the next frontier for those same institutions who continue to look for ways to hedge their risks financially and also protect their brands from falling victim to decentralized platforms.

Things are even changing within the world of crypto treasuries. While MicroStrategy and Tesla stole headlines this year by making large investments in bitcoin, companies like Grayscale Investments are realizing they can get access to other categories of crypto investing through creating similar treasuries. The organization has 14 patents pending to create new treasuries for various projects, including the video streaming service Livepeer, smart contract platform Tezos and metaverse project Decentraland, to name a few. Grayscale is a subsidiary of Digital Currency Group (DCG), which also owns CoinDesk.

Small and medium-sized enterprises will make the move, too

As the adoption of cryptocurrencies and all their unique sectors continues to accelerate, more and more businesses are realizing they need to hedge, and they can’t be left behind. That’s why BVNK is helping small and medium-sized enterprises (SMEs) get in on the game, too.

BVNK is a digital asset financial services provider that serves SMEs.

Now is the time to explore alternative ways for institutions to get a piece of the ever-expanding crypto pie – DeFi, NFTs and the metaverse included.