As a bitcoin skeptic, I don’t think it is a good idea for anyone to be trading or holding bitcoin or any other cryptocurrencies.

However, I recognize that many investors are watching the bitcoin action and want to get involved.

While I think this is a terrible idea, there are trading strategies utilized by the so-called “whales” that you should avail yourselves of. The idea behind these trading strategies is to reduce the risk involved in trading bitcoin.

Bitcoin Pricing is Random

The first thing you must recognize about bitcoin is there is no rhyme or reason as to its price at any given moment. There are no earnings reports, discounted cash flow models, income generating potential, or correlation to hard assets to rely upon.

What you are doing is engaging in speculation that is based entirely on subjective perception.

Thus, in order to take advantage of other people’s subjective perception, you need to look at everything objectively.

There are two approaches to this objective analysis.

The first is a longer-term approach that involves the least amount of risk.

The Long-Term Approach

You’ll recall that after the massive bitcoin run at the end of 2017, when bitcoin’s price approached $20,000, it cascaded down to around $3,100 by the end of 2018.

The run up to $20,000 was a classic parabolic rise. We’ve seen this many times in many different kinds of assets, and what goes up always comes down.

If you have the ability to short bitcoin, perhaps by getting shares of the Grayscale Bitcoin Trust to short, the play would have been to wait for bitcoin to fall about 10%, and then short it in increments as it fell. This is a standard approach based entirely on investor psychology.

You might then choose to have scaled out of the trade by covering your short and for increments that suit your need.

After the crash from $20,000, bitcoin then spent a few weeks bouncing around $3,000 in early 2019. That kind of stability after a big move might suggest that a second move is on the way. That would be a time to establish a new long position. After bitcoin moved above $6,000 in May 2019, you could have added your position.

The time to exit was around the $12,000 mark in late June 2019.

The key to this entire long-term strategy is to have a stop loss order in place. Decide how much you’re willing to lose on your investment, usually around 7%, and then make sure to trigger a sale if you experience that loss.

This is how the whales trade.

The Short Term Approach

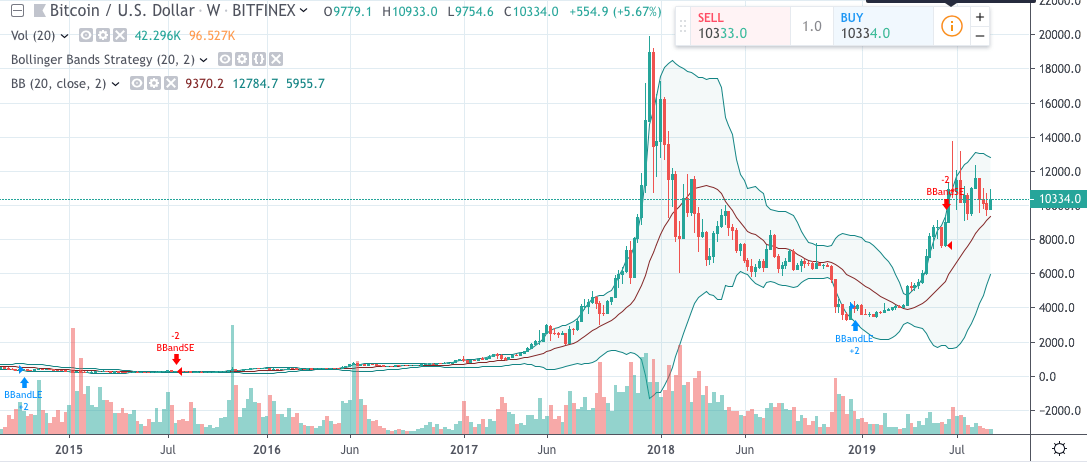

A shorter-term strategy, which carries higher risk because you have to be much more nimble with your entry and exit points, is to use Bollinger Bands, just as the whales do.

According to Ed Butowsky, Managing Partner at Chapwood Capital Investment Management:

“Bollinger Bands are very useful in these situations. They are two sets of bands that are both above and below a moving average, and represent two standard deviations, meaning bitcoin has a 95% chance of remaining within these bands.”

With situations like this, Butowsky says that traders should enter or exit the trade when the price of bitcoin breaks away from the Bollinger Band itself. It may mean that you miss an initial big move, but you should be able to capture the majority of it.

One final reminder: Trading like this is really nothing more than gambling. Stock traders use the same techniques to trade stocks. However, the only reason I would buy a stock using these techniques is if it were undervalued at the price I was purchasing.

Last modified (UTC): September 12, 2019 8:37 PM