How to trade crypto – a question that resonates with many in the rapidly evolving digital asset space. Whether you’re a novice eager to learn how to crypto trade or an experienced crypto trader looking to refine your strategies, this guide is your comprehensive resource. From understanding the best time to trade crypto to exploring the best cryptos to day trade, we’ll delve into every aspect you need to know.

What Makes A Crypto Trader?

A successful crypto trader is not just someone who knows how to trade crypto, but an individual equipped with a unique set of skills, especially in technical analysis. Technical analysis is the cornerstone of crypto trade decisions. It involves interpreting market data and price charts to forecast future price movements. This skill is particularly crucial for those who day trade crypto or engage in short-term trading strategies like crypto scalping.

Technical analysis in crypto trading often involves understanding and utilizing various tools and indicators. For instance, a proficient crypto trader should be adept at reading candlestick charts, which are fundamental in identifying market trends and potential reversals. Knowledge of trend lines, chart patterns, indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) as well as moving averages is also vital in making informed decisions about when to enter or exit a trade.

Apart from technical skills, a crypto trader must also have a strong psychological makeup. The ability to remain calm under pressure and maintain discipline, especially in volatile market conditions, is what separates seasoned traders from novices. This mental fortitude is especially important in high-stakes trading scenarios, such as when one is learning how to leverage trade crypto or engage in crypto futures trading.

Why Trade Crypto?

Trading cryptocurrency offers unique advantages that make it an appealing market for many investors and traders. Here are some key reasons why people choose to trade crypto:

- Market Volatility: While volatility is often viewed as a risk, for the savvy crypto trader, it presents numerous opportunities for profit. The rapid price fluctuations in the crypto market can result in significant gains, especially for those skilled in crypto trade strategies like day trading or swing trading.

- Accessibility And Liquidity: The crypto market operates 24/7, offering unmatched accessibility compared to traditional financial markets. This around-the-clock trading capability allows crypto traders to react instantly to market news and events. Additionally, the increasing adoption of cryptocurrencies has led to higher liquidity, making it easier to execute trades quickly and at desired prices.

- Potential For High Returns: Cryptocurrencies have been known for their potential to yield high returns. Though high returns come with high risks, traders who have learned how to trade crypto effectively, particularly those who engage in strategies like day trade crypto, can capitalize on these opportunities.

- Diversification: For investors looking to diversify their portfolio, cryptocurrencies offer an alternative asset class that is not directly correlated with traditional financial markets. This diversification can be a hedge against inflation or market downturns in other sectors.

- Democratization Of Finance: Crypto trading provides a level of inclusivity and democratization not always present in traditional financial markets.

Getting Started: How To Trade Crypto

When it comes to crypto trading , the initial steps involve laying a strong foundation and acquiring the necessary tools and mindset. Here’s a fundamental guide to getting started:

- Understanding The Market Dynamics: Before any actual trading, it’s crucial to grasp the unique dynamics of the crypto market. This includes understanding the factors that influence cryptocurrency prices, such as market demand, technological developments, regulatory news, and broader economic factors.

- Developing A Crypto Trader’s Mindset: Trading crypto requires a particular mindset. It involves patience, discipline, and a willingness to learn continuously. Developing a mindset that can handle the ups and downs of the market is as important as any technical skill.

- Basic Risk Management Principles: Before executing your first trade, understand the basic principles of risk management. This includes only investing what you can afford to lose, understanding the volatility of the market, and knowledge about the different order types.

- Exploring Different Cryptocurrencies: While many beginners start with well-known cryptocurrencies like Bitcoin or Ethereum, there’s a wide array of cryptocurrencies to explore. The smaller the market cap of an alternative cryptocurrency (“altcoin“), the more volatile it tends to be. Mid and small caps often have even greater profit potential, but also greater risks.

- Staying Informed And Updated: The crypto market is fast-paced and constantly evolving. Keeping yourself updated with the latest news and trends is crucial. This involves following crypto news, joining online communities, and possibly using social media to track real-time updates.

Crypto Trade Strategies (With Pros And Cons)

Choosing a crypto trade is one of the first challenges for potential crypto traders. You need to align your strategy with your goals, risk tolerance, and time commitment. Each strategy comes with its own set of advantages and challenges.

Day-Trade Crypto

Day trading in crypto involves buying and selling cryptocurrencies within the same trading day. Traders capitalize on short-term market movements to make profits.

Pros: The primary advantage of day trading is the potential for quick profits due to the high volatility of the crypto market. It also limits exposure to overnight market risks since positions aren’t held beyond a day. Day trading is highly engaging and can be very rewarding for those who have the time to monitor the market constantly.

Cons: However, day trading is time-consuming and requires constant market analysis, which can be stressful. It also demands a good understanding of market trends and technical analysis. The high frequency of trades can lead to significant transaction fees, and the fast-paced nature of this strategy can amplify losses just as quickly as gains.

Crypto Scalping

Scalping is a strategy where crypto traders make profits from small price changes, often entering and exiting positions within minutes.

Pros: Scalping allows traders to profit from even the smallest market movements, making it a good strategy in both volatile and stable market conditions. It also reduces exposure to long-term market risks.

Cons: Scalping requires immense discipline and a strict exit strategy to prevent significant losses. It’s a high-intensity strategy, demanding constant attention and quick decision-making. Scalping also typically involves a large number of trades, which can result in high transaction costs.

Crypto Swing Trading

Swing trading involves holding onto cryptocurrencies for several days or weeks to capitalize on expected upward or downward market shifts.

Pros: This strategy is less time-consuming than day trading or scalping, allowing traders more time to analyze the market. Swing traders can capture more significant price shifts than day traders, potentially leading to higher profits.

Cons: Swing trading involves the risk of holding positions overnight or longer, exposing the trader to unforeseen market changes. It also requires a good understanding of market trends and the patience to wait for the right moment to enter or exit a trade.

Position Trading

Position trading is a long-term strategy where traders hold their positions for months or even years, based on their analysis of long-term market trends.

Pros: This strategy requires less time to monitor daily market fluctuations and can yield substantial returns if the long-term market trend predictions are accurate. Position traders are less affected by short-term volatility.

Cons: The main downside is that capital is tied up for a long time, making it unavailable for other investment opportunities. It also requires a deep understanding of the market and strong conviction in one’s predictions, as holding positions through market ups and downs can be challenging.

How To Trade Crypto: Step-By-Step Guide

Trading crypto can seem daunting at first, but by following a structured approach, you can navigate the process with greater ease. Here’s a step-by-step guide to help you get started:

Preparation: How To Become A Good Crypto Trader

- Choose A Cryptocurrency Exchange: The first step is selecting a cryptocurrency exchange. Look for platforms known for their security, user-friendly interface, and the range of cryptocurrencies they offer. Popular exchanges like Binance, Coinbase, and Kraken are a good starting point.

- Set Up Your Trading Account: Once you’ve chosen an exchange, set up your trading account. This process will typically require you to provide personal information and complete a verification process to comply with regulatory requirements.

- Deposit Funds: After your account is set up, you’ll need to deposit funds. You can do this either by transferring fiat currency (like USD, EUR) into your account or by depositing cryptocurrencies from a digital wallet.

- Develop A Trading Plan: Before you start trading, it’s crucial to have a plan. This should include your investment goals, risk tolerance, and the trading strategy you intend to use (like day trade crypto, swing trading, etc.).

- Start With A Demo Account (If Available): Many platforms offer demo accounts where you can practice trading with virtual money. This is a great way to get a feel for the market dynamics and test your trading strategy without risking real money.

Start Crypto Trading

- Begin Trading: Once you’re comfortable, start trading. This involves placing buy or sell orders on your chosen exchange. Start with smaller amounts to get a feel for the market and gradually increase your trading size as you gain more confidence and experience.

- Monitor Your Trades And Adjust Your Strategy: Continuously monitor your trades and the market. Be prepared to adjust your strategy if the market conditions change. It’s important to stay flexible and responsive to market dynamics.

- Practice Risk Management And Learn: Always keep an eye on your risk exposure and use tools like stop-loss orders to protect your investments. After each trading session, reflect on what you’ve learned, what worked, and what didn’t. Continuous learning and adaptation are key to becoming a successful crypto trader.

Securing Your Cryptocurrencies

Securing your cryptocurrencies is a crucial aspect of trading and investing in the digital currency space. Here’s how you can ensure the security of your assets:

- Use Trusted Wallets: There are two main types of wallets: hot wallets (online wallets) and cold wallets (offline or hardware wallets). While hot wallets are convenient for frequent traders, cold wallets provide better security for long-term storage.

- Enable Two-Factor Authentication (2FA): Always enable 2FA on your trading accounts and wallets. This adds an extra layer of security. If your password is compromised, the attacker cannot access your funds without the second authentication factor.

- Be Wary Of Phishing Attempts: Be vigilant about phishing attempts. These usually come in the form of emails or messages that try to trick you into revealing your security credentials.

- Use Strong And Unique Passwords: For each account and wallet, use strong, unique passwords. Avoid reusing passwords across different platforms.

- Keep Your Software Updated: Ensure that your wallet software, as well as your computer’s or smartphone’s operating system, is regularly updated.

- Backup Your Wallet: Regularly backup your wallet, especially if you’re using a desktop or mobile wallet. This ensures that you can recover your cryptocurrencies in case your device is lost, stolen, or damaged.

- Be Cautious With Public Wi-Fi: Avoid accessing your crypto wallets or trading accounts over public Wi-Fi networks. These networks are often not secure!

Best Cryptos To Day Trade

Selecting the best cryptos to day trade is a nuanced process that hinges on several key factors. As a day trader, your focus should be on finding cryptocurrencies that not only exhibit high volatility but also possess substantial liquidity and trading volume. This ensures that you can enter and exit positions quickly and at desirable prices.

Factors To Consider:

Liquidity is paramount in day trading. Highly liquid cryptocurrencies allow for smoother transactions without causing significant price shifts upon entry or exit. Larger, well-established cryptocurrencies like Bitcoin and Ethereum typically offer higher liquidity, making them reliable choices for day trading.

Trading volume is another critical aspect. In general, cryptos with high daily trading volumes are preferred as they indicate active trading activity, which in turn suggests more opportunities for price movements that day traders can exploit. On the other, a strategy can involve trading altcoins with low liquidity, making it vulnerable for larger price swings.

Beyond liquidity and volume, a crypto trader should also look at the technical aspects like chart patterns and indicators. Cryptocurrencies that show clear and predictable patterns can be more manageable for crypto traders who rely on technical analysis. Indicators such as moving averages, RSI, and MACD are tools often used to analyze and predict short-term price movements in these volatile markets.

Furthermore, being cognizant of the current trends in the crypto market can provide an edge. For instance, if there’s growing interest in specific sectors like GameFi or AI altcoins, these could present unique trading opportunities. These sectors might exhibit increased volatility and trading volume, creating favorable conditions for day trading.

Overall, it’s crucial to balance technical considerations with a sense of market sentiment and news.

Best Platform To Trade Crypto

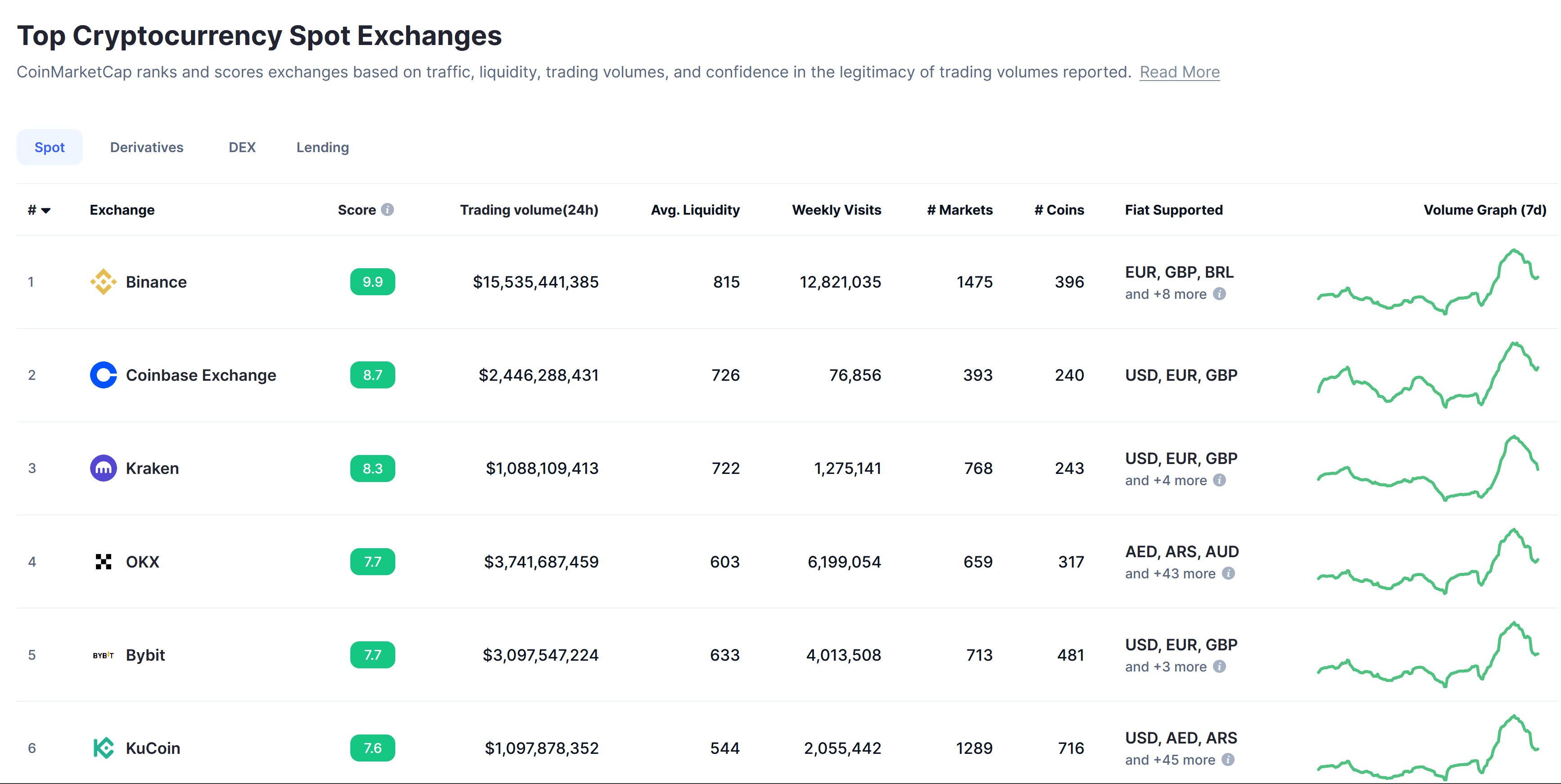

Selecting the best platform to trade crypto is a critical decision for any trader. Based on spot trading volume, here are the top platforms:

- Binance: Binance leads with a spot trading volume of approximately $15.48 billion in the last 24 hours. Known for its vast range of cryptocurrencies (over 1,475 markets), it supports multiple fiat currencies like EUR, GBP, and BRL. Binance is favored for its comprehensive tools, features, and relatively low fees.

- Coinbase Exchange: With a trading volume of around $2.51 billion in the last 24 hours, Coinbase is renowned for its user-friendly interface, making it ideal for beginners. It supports major currencies like USD, EUR, and GBP and offers a balance between accessibility and comprehensive trading features.

- Kraken: with a trading volume of $1.08 billion, is praised for its security and extensive range of cryptocurrencies (over 768 markets). It supports various fiat currencies, including USD, EUR, and GBP, and is known for its robust security measures.

- OKX: has a significant trading volume of about $3.72 billion. It offers a wide range of cryptocurrencies (over 659 markets) and supports diverse fiat options including AED, ARS, AUD, and 43 more. OKX is recognized for its variety of trading options and comprehensive platform.

- Bybit: with a trading volume of $3.08 billion, stands out for its advanced trading features and support for USD, EUR, GBP, among others. It is particularly popular among crypto traders looking for derivatives trading options.

Where To Trade Crypto?

Choosing where to trade crypto involves careful consideration of various factors. Here’s a guide to help you make an informed decision:

- Security: Prioritize platforms with robust security measures. Look for features like two-factor authentication, cold storage options, and a track record of handling security breaches, if any.

- Fees: Compare the fee structures of different platforms. Lower transaction fees can make a significant difference, especially for frequent traders.

- User Interface And Experience: For beginners, a user-friendly interface is key. For experienced crypto traders, advanced trading tools and features are important.

- Range Of Cryptocurrencies: Consider platforms that offer a wide range of cryptocurrencies. This allows for diversification and the ability to trade in lesser-known, potentially more volatile coins.

- Liquidity: High liquidity ensures that you can buy and sell cryptocurrencies quickly and at prices close to the market rate.

- Regulatory Compliance: Opt for platforms that adhere to regulatory standards. This can offer a level of protection and legitimacy.

- Customer Support: Good customer support can be crucial, especially in resolving issues swiftly.

- Community And Reputation: A platform’s reputation within the crypto community and its overall track record can provide insights into its reliability and performance.

- Additional Features: Some platforms offer additional features like staking, margin trading, or crypto savings accounts, which might align with your trading goals.

- Geographical Restrictions: Ensure the platform is available and legal in your region.

Crypto Trade 101: Technical Analysis

Candlestick Charts

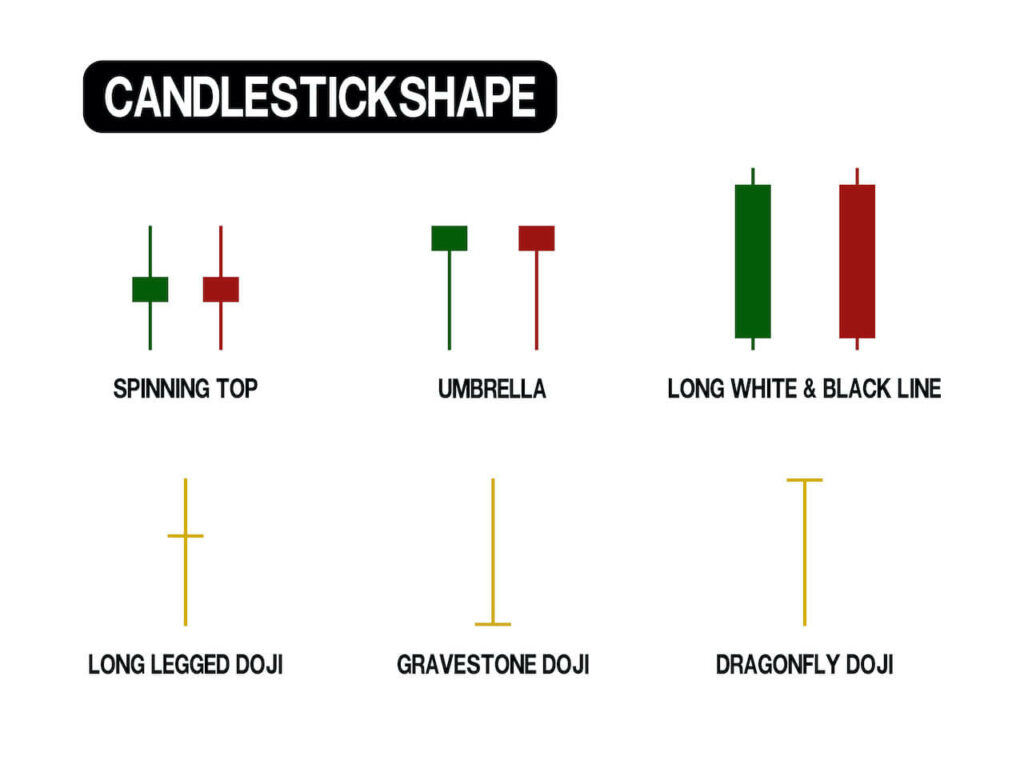

Candlestick charts are essential for understanding market movements in crypto trading. Each candlestick represents price movements within a specific timeframe. The ‘body’ shows the opening and closing prices, while ‘wicks’ indicate the high and low. Crypto traders look for patterns like ‘Doji’ (indicating indecision) or ‘Bullish Engulfing’ (signaling a potential upward trend) to predict future price movements.

Trend Lines And Triangle Patterns

Both patterns are vital tools in technical analysis for crypto traders.

Trend Lines:

You draw straight lines on price charts that connect a series of highs or lows. In an uptrend, an upward trend line connects the higher lows, indicating support levels where the price gains strength and bounces upwards. In contrast, a downward trend line in a downtrend connects lower highs, marking resistance levels. Breaking through a trend line often signals a potential change in the market trend.

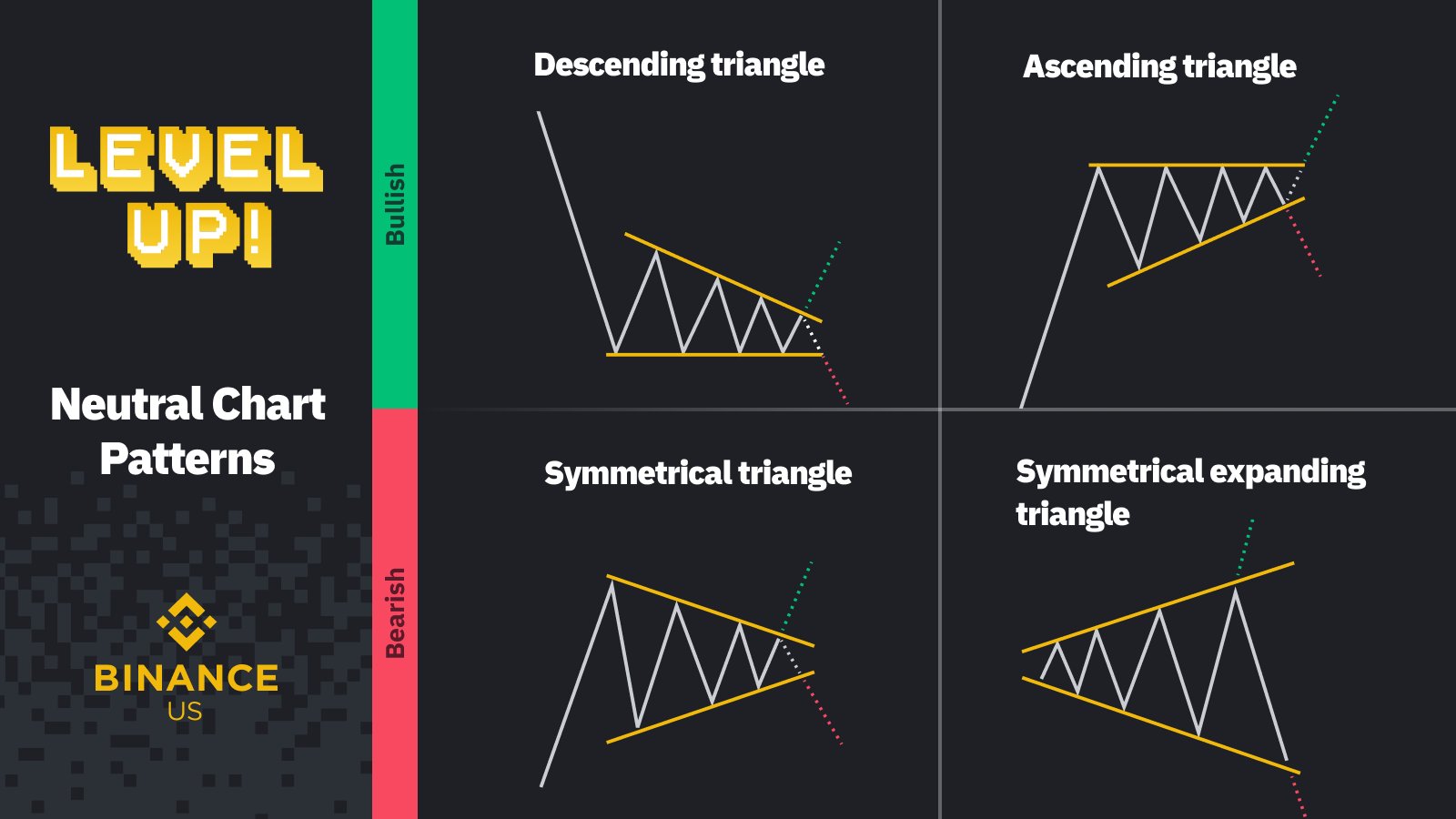

Triangle Patterns:

These are formed by drawing two converging trend lines as prices move in a narrowing range. There are three types:

- Ascending Triangle: Formed by a horizontal resistance line and an upward sloping trend line. It often indicates a continuation of an uptrend, especially if the price breaks above the resistance line.

- Descending Triangle: Characterized by a horizontal support line and a downward sloping trend line. This pattern typically signals a continuation of a downtrend, particularly if the price breaks below the support line.

- Symmetrical Triangle: Created when the slope of the price’s highs and the slope of the price’s lows converge to a point. This pattern indicates that a breakout is imminent, but it does not predict the direction. The breakout direction of the price out of the triangle can signal the continuation of the trend or a reversal.

Crypto traders use these patterns to make predictions about future price movements. A breakout above or below a triangle pattern often signals a strong move in the direction of the breakout. However, it’s crucial to confirm these signals with other indicators and market factors.

Moving Averages

Moving Averages (MAs) are crucial indicators in crypto trading, used to smooth out price fluctuations and identify trends. The two most common types are:

- Simple Moving Average (SMA): This is the average price over a specific number of time periods. It’s calculated by adding up the closing prices over a set period and then dividing by the number of periods. SMA gives equal weight to all prices in the period.

- Exponential Moving Average (EMA): EMA gives more weight to recent prices, making it more responsive to new information. It is calculated similarly to SMA but incorporates a weighting multiplier that exponentially decreases the weight of older prices.

Crypto traders use MAs to identify support and resistance levels. For example, a rising MA indicates support, suggesting an uptrend, while a falling MA indicates resistance, suggesting a downtrend. MAs also serve in crossover strategies: A short-term MA crossing above a long-term MA signals a potential upward trend (bullish crossover), while crossing below indicates a potential downward trend (bearish crossover).

Relative Strength Index (RSI)

RSI is a momentum indicator, ranging from 0 to 100, that assesses whether a crypto is overbought (above 70) or oversold (below 30). Crypto traders use it to spot potential reversal points. For instance, if RSI rises above 70, it signals that the market is red hot, while a value above 90 is almost a guarantee for a near term price pullback.

MACD (Moving Average Convergence Divergence)

The MACD consists of two lines – the MACD line (the difference between two EMAs) and a signal line. When the MACD crosses above the signal line, it suggests a bullish trend, and a cross below indicates a bearish trend. Divergences between MACD and price can also indicate potential market reversals.

For Advanced Crypto Traders

Advanced crypto trading, such as day trading and options trading, requires a sophisticated understanding of the market and specific strategies.

How To Day Trade Crypto

Day trading crypto is about exploiting short-term market fluctuations. It’s not just about buying low and selling high within a day but also involves nuanced strategies like playing on news-based volatility or using specific technical indicators for quick entry and exit points. An example is a day trader focusing on a particular cryptocurrency that has announced a major partnership. The crypto trader uses tools like RSI and MACD to determine the optimal entry and exit points within the day, capitalizing on the news-induced volatility.

How To Trade Crypto Options

Crypto options trading involves more complex strategies compared to regular trading. For instance, a crypto trader might buy a ‘call option’ if they anticipate the price of a cryptocurrency to rise before a specific date. Conversely, a ‘put option’ might be purchased if they expect the price to fall. This method requires a deep understanding of market sentiment and potential triggers for price movements. A practical example would be a crypto trader buying options ahead of a significant event, like a blockchain upgrade, betting that this event will cause substantial price movement.

Two major styles of options exist: European-style, which can only be exercised on the expiration date, and American-style, which can be exercised any time before expiration. For trading crypto options, some of the most renowned platforms include Binance, Deribit (known for being the most liquid crypto options trading platform), OKX, Bybit, Delta Exchange, and CME (a regulated exchange in the United States).

Risk Management in Crypto Trading

Effective risk management is vital in crypto trading to protect your investments and ensure long-term success.

Setting Stop-Loss Orders: Stop-loss orders are an essential tool. They automatically sell an asset when it reaches a certain price, limiting potential losses. If you buy a cryptocurrency at $100 and set a stop-loss order at $90, the asset will automatically sell if its price drops to $90, thereby limiting your loss to 10%.

Diversifying Your Portfolio: Diversification involves spreading your investments across various assets to reduce risk. Instead of putting all your capital into a single cryptocurrency, diversify across different coins, sectors, or even different asset classes.

Avoiding Emotional Trading: Emotional trading often leads to impulsive decisions, like chasing losses or making overconfident trades. To combat this, develop a trading plan and stick to it, making decisions based on logic and analysis rather than emotion. It’s also helpful to set predetermined entry and exit points for trades to avoid emotional biases.

Implementing these risk management strategies can significantly improve your trading outcomes and help in maintaining a more stable and sustainable trading career in the volatile crypto market.

FAQ: How To Trade Crypto

How To Trade Crypto?

Begin by choosing a reliable crypto trading platform, set up and fund your account, and educate yourself on the basics of cryptocurrencies and market trends. Develop a trading strategy based on your risk tolerance and goals, and start trading by making informed buy and sell decisions.

How To Day Trade Crypto?

Day trading involves buying and selling cryptocurrencies within the same day. Focus on understanding market trends, use technical analysis to make informed decisions, and always manage risks with stop-loss orders and disciplined trading practices.

When Is The Best Time To Trade Crypto In US?

Cryptocurrency markets operate 24/7, but the best time to trade can depend on market liquidity and volatility. Generally, overlapping hours between major financial markets (like the New York and London stock exchanges) can see increased activity.

What Is The Best Way To Trade Crypto?

The best way to trade crypto varies based on individual goals and risk tolerance. Options include day trading, swing trading, and long-term investing. Using a combination of technical and fundamental analysis is generally advised.

How To Leverage Trade Crypto?

Leverage trading in crypto involves borrowing funds to increase potential returns. Start by selecting a platform that offers leverage, understand the risks involved, use stop-loss orders to manage potential losses, and start with lower leverage to mitigate risk.

How To Trade Crypto Coins?

Trading crypto coins involves buying and selling different cryptocurrencies. Use a crypto exchange, stay informed about market trends and news, analyze price charts, and execute trades based on your analysis and strategy.

How Old Do You Have To Be To Trade Crypto?

The minimum age requirement to trade crypto varies by platform, but typically, you must be at least 18 years old.

How To Become A Crypto Trader?

Gain a thorough understanding of the crypto market, trading principles, and risk management. Practice with a demo account, stay updated with market news, and gradually build your trading experience and portfolio.

How To Trade Crypto And Make Money?

Profitable crypto trading requires in-depth market knowledge, a well-thought-out strategy, disciplined risk management, and continuous learning. Focus on understanding market trends and technical analysis to make informed trading decisions.

How To Be A Crypto Trader?

Educate yourself about cryptocurrencies, trading strategies, and market analysis. Start with a demo account (or small amounts) to practice, choose a reliable trading platform, develop a risk management strategy, and continuously update your knowledge and skills.

How To Day Trade Crypto For Beginners?

Start with understanding the basics of the market and technical analysis. Practice with a demo account, develop a disciplined trading routine, use risk management tools like stop-loss orders, and stay informed about market news.

How To Margin Trade Crypto?

Margin trading involves borrowing funds to trade. Choose a platform that offers margin trading, understand the risks of amplified losses, use stop-loss orders, and start with small trades to gain experience.

How To Swing Trade Crypto?

Swing trading involves holding assets for several days to capitalize on expected directional moves. Study market trends (crypto bull runs vs. crypto bear markets). Also, use technical analysis to identify entry and exit points, and maintain a disciplined approach to trading.

How To Trade Crypto Futures In US?

Select a platform that offers crypto futures trading in the US. Understand the basics of futures contracts, the associated risks, and legal requirements. Use risk management strategies and stay updated with market and regulatory developments.

Can You Day Trade Crypto?

Yes, you can day trade crypto. It requires a deep understanding of the market, quick decision-making, and strong risk management strategies.

What Is The Best Time To Trade Crypto?

The best time to trade crypto can depend on individual trading strategies and market conditions. Generally, periods of high market activity, such as during overlapping trading hours of major financial markets, can offer increased opportunities.

Featured images from iStock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.