Bitcoin has chosen violence with a sudden move to the downside resulting in a 5% loss in the daily chart. As of press time, the first crypto by market cap seems to be recovering as it moves back to the mid-zone of its current levels.

Related Reading | Bitcoin Maximalism – Crypto Survivors and OG’s Could Make a Case to Differ

Bitcoin trades at $65,442 still with a 3.6% profit in the daily chart. In the short term, BTC’s price has found support at these levels, but could see further downside if it dropps below $63,000.

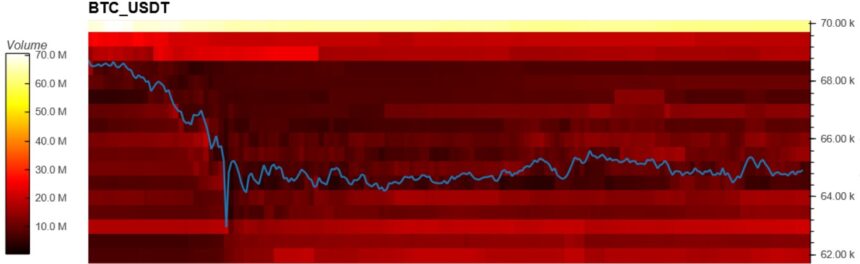

To the upside, much of the resistance has disappeared and BTC seems poised to, at least, attempt to take the high area near its next all-time high, $70,000. Above those levels, data from Material Indicators still records $62 million in potential ask orders around those levels.

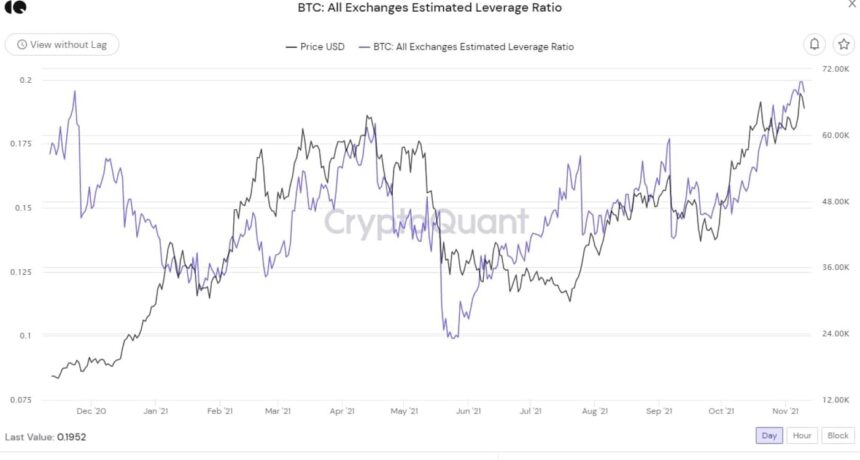

In the derivatives sector, Bitcoin’s flash crash resulted in some leverage positions being wipe-out. As seen below, the leverage ratio across exchanges took a dive after seeing an explosion in mid-October.

These levels are still much higher than it May, 2021, when Bitcoin saw one of its most severe corrections crashing from its previous all-time high to the yearly open, near $29,000.

Thus, as more traders turn bullish on BTC’s price recording more gains, the leverage ratio could increase. This leaves the market open for sudden moves as liquidation cascades forces the price to trend to the levels where most operators would sell, willingly or not, their positions.

Related Reading | Bitcoin Extends Correction, Why The Bulls Might Take Back Step

Analyst David Puell explored Bitcoin’s crash and recorded an increase in Open Interest with positive premiums on exchange platform Binance, one of the largest in the world. Puell Said:

OI acts as fuel to to the fire to the above as predictor of a liquidation event. Liquidity can be grabbed on the downside by smarter players. Binance holding the OI makes the bearish signal more reliable. Liquidation event is likelier given that CME (Chicago Mercantile Exchange) can only go 2x.

Why $100K Per Bitcoin Could See Some Obstacles

However, as the event unfolded Puell recorded a shift in the premium for derivatives to a discount. This has made the analyst flipped for a completely bearish bias to believe the moved to the downside could have been healthy for Bitcoin.

Still, the price of BTC must remain consistent as it seems to enter another consolidation phase. There are other factors that could bring volatility into the market, such as the activation of Taproot, Bitcoin’s upgrade, which should be activated during the week or at some point next week.

Related Reading | Bitcoin Supply Looks Illiquid As Long-Term Holders Keep From Selling

As this data shows, the path towards more gains in Q4, 2021, could prove difficult. In addition, the macro-outlook turns complexes. Yesterday, Bitcoin appeared to have reacted to a potential default from the Chinese real state company Evergrande.

While it looks like #Evergrande didn’t default as initially reported, these rumours have been affecting financial markets (S&P 500 shown here) and #Bitcoin negatively. Bitcoin’s price is now down by roughly 4% to around $64.5k pic.twitter.com/NEIK9QP1wB

— Jan Wuestenfeld (@JanWues) November 10, 2021