Bitcoin’s price is starting to make gains after what turned out to be a rather dull halving event. With daily active bitcoin addresses at the highest level since 2018, interest in bitcoin could be heading even higher.

The world’s first cryptocurrency is now trading above its 10-day and 50-day moving averages, a bullish technical indicator. This reversal comes after a huge 10% drop in price on May 10 that led to bearish sentiment ahead of the bitcoin halving, which occurred May 11 at 19:23 UTC (3:23 p.m. ET). At press time, bitcoin (BTC) was trading up 1% over 24 hours at $8,829.

While the halving was pretty much a non-event for most traders, many are keeping an eye on various bitcoin-related statistics beyond price. Difficulty, which determines how demanding it is for mining machines to mine a bitcoin block, is one example.

“Definitely looking forward to seeing what the next difficulty adjustment is,” post-bitcoin halving, Ethan Vera, CFO of mining company Luxor, said during a Consensus:Distributed session Monday. The next difficulty adjustment, which occurs roughly every two weeks, is due May 19.

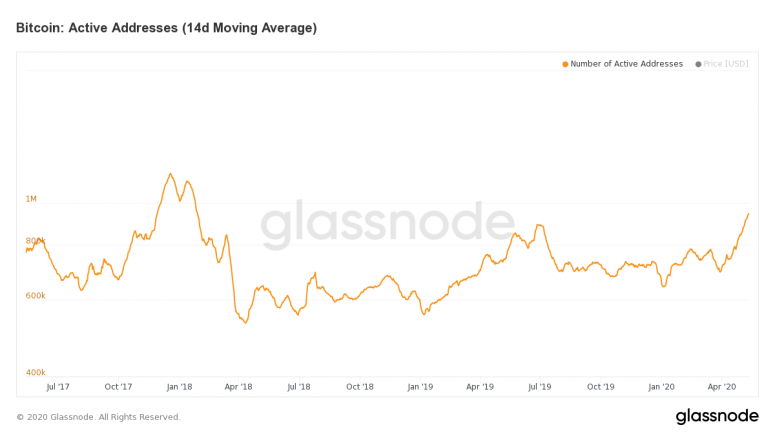

Another metric to watch is the number of active bitcoin addresses. On May 11, the number of active addresses on the bitcoin network totaled 943,869 – the highest number since Jan. 28, 2018, according to data from Glassnode. That was during bitcoin’s frothy 2017-2018 bubble, when prices went as high as $19,915 on spot exchanges like Coinbase.

“When you read that the halving is bullish for bitcoin, it has to be taken with a grain of salt,” said David Lifchitz, chief investment officer at ExoAlpha, a quantitative crypto trading firm. “It may be bullish, but only if interest for bitcoin remains over that long term.”

Those who became interested in bitcoin as a result of its halving might be tempted to stick around if the price increases.

“Just like the price surges in 2017 that really brought bitcoin to the wider consciousness, the halving could again see a new wave of ordinary investors who are not steeped in computer science or technology,” said Simon Peters, an analyst at multi-asset brokerage eToro.

Active addresses can’t be attributed to individual holders because exchanges and wallets often generate multiple keys for users. However, all those addresses do mean more activity is occurring on Bitcoin’s network.

Of course, some of that growing interest could have nefarious intent, said Constantin Kogan, a partner at crypto fund of funds BitBull Capital. The rise in active addresses could be due to things other than buying bitcoin, such as “money laundering and the need to obfuscate chain analysis,” he told CryptoX.

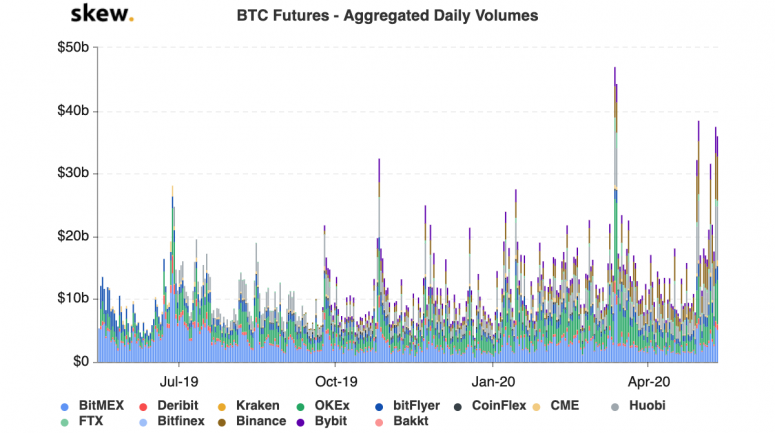

Although it is hard to pin down exactly what all these active addresses are doing, at least some of them have increased trading using more intricate strategies, said ExoAlpha’s Lifchitz. “In 2020, there are more sophisticated institutional traders in the market. They can use futures and options to build complex trades.”

Active addresses can be an indicator of increased usage and interest in bitcoin, but it doesn’t just necessarily mean “number go up,” added Lifchitz. “I don’t expect a straight line up for bitcoin in the days ahead. I don’t see a drastic 30% jump in price.”

Other markets

Digital assets on CryptoX’s big board are in the green on Tuesday. Ether (ETH), the second-largest cryptocurrency by market capitalization, gained 1.6% in 24 hours as of 20:00 UTC (4:00 p.m. EDT).

Cryptocurrency gainers include stellar (XLM) up a mouth-watering 11%, zcash (ZEC) in the green 6.7% and cardano (ADA) climbing 5.7%. All price changes were as of 20:00 UTC (4:00 p.m. ET) Tuesday.

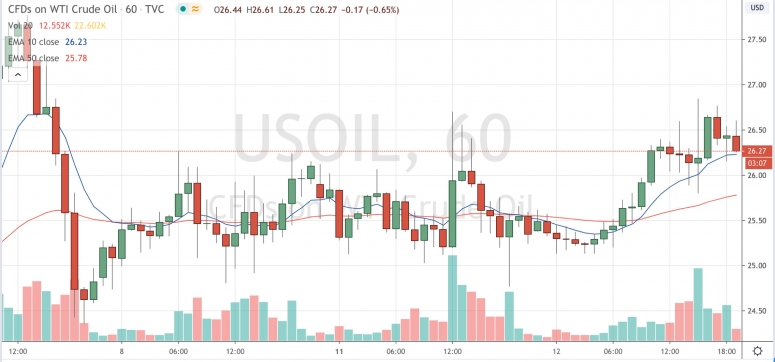

In the commodities markets, gold is trading flat, up less than a percent and the yellow metal closed the New York trading session at $1,702. Oil is trading in the green today, up 3% as Saudi Arabia announced Monday it plans to reduce production by 1 million barrels in June in addition to the April OPEC+ cuts that slashed crude supply by 20%.

In the United States the S&P 500 index of large-cap stocks was down 2% on investor uncertainty regarding reopening the economy amid the coronavirus pandemic. U.S. Treasury bonds all fell Tuesday. Yields, which move in the opposite direction as price, were down most on the two-year bond, in the red 8.4%.

In Europe the FTSE Eurotop 100 index closed flat, up less than a percent. A surge in mobile operator Vodaphone shares boosted stocks after the company denied it planned a dividend cut.

The Nikkei 225 of Japan’s largest companies ended trading flat, in the red less than 1 percent as transportation and real estate stocks dragged down the index.

Disclosure Read More

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.