There’s a chasm between the fast-developing world of decentralized finance (DeFi) and the old-school world of regulated TradFi, or traditional finance. The core rationale of DeFi is that there is no central entity in charge of authorizing or overseeing transactions. And as more DeFi products come to market, that chasm grows wider, like a centrifugal force pulling the two worlds apart.

Luckily, decentralized stablecoins can bridge the divide between DeFi and TradFi. The very idea may sound contradictory, but it’s made possible by using a parallel system. Parallel stablecoins are synthetic assets that are decentralized, non-custodial, collateral-backed, fully redeemable and pegged to a fiat currency. They maintain stability through collateral locked in smart contract vaults.

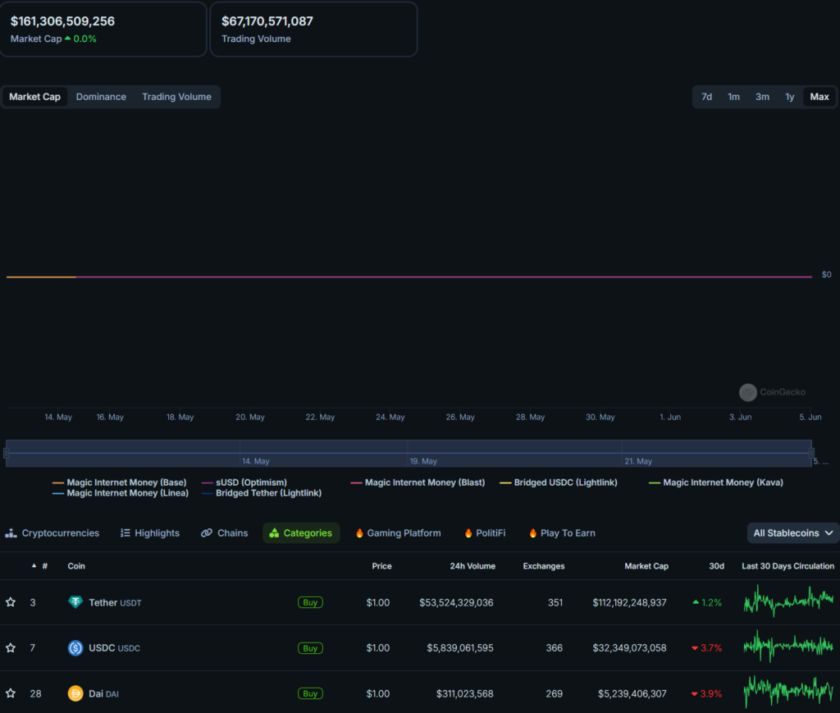

The problem is today’s stablecoin market is dominated exclusively by U.S. dollar-denominated stablecoins including tether, USDC, maker and paxos standard. In general, stablecoins promise to shield users from the volatility that besets other crypto coins and assets.

But this isn’t the case for anyone not living with the U.S. dollar (or any currency pegged to it), since they’re exposed to the inherent currency risk posed by foreign exchange rates. For instance, Europeans who held onto U.S. dollar stablecoins over the course of 2020 lost about a tenth of their buying power in the eurozone. Such movements have slowed down the adoption of crypto assets in Europe.

Now, there’s a solution: Individuals and enterprises in Europe can transact in the first euro stablecoin, PAR, brought by Mimo Capital. Users mint PAR by depositing collateral such as ether (ETH) into the vault smart contract.

The existence of two different ratios – a minimum collateralization ratio (MCR) for borrowing and the liquidation ratio (LR) used to calculate for liquidations – in the parallel protocol helps to prevent the system from falling below the safe collateralization threshold. Initially, the MCR is set at 150%, and LR is set at a lower 130%.

And because there are no counterparties involved in the minting and burning of PAR tokens, the actors in the network transact directly with the PAR smart contracts. Vaults are non-custodial, with each borrower having full control over their collateral and borrowed PAR balances.

Enter Polygon

Adding a new dimension to the availability and utility of PAR, Mimo is now live on the Polygon Network. Mimo users can continue mining and minting, but with the lower gas fees and faster transactions that Polygon enables. With a layer 2 solution implemented, long-time followers can open a vault and access their wealth without selling any crypto.

Polygon is one of Ethereum’s layer 2 sidechains with its own native token, MATIC. This is a new type of collateral for Mimo vaults. MATIC has proven to be a promising asset and transactions have increased rapidly. It costs less than a cent, paid in MATIC, to process a transaction.

“Polygon changes the game for Mimo DeFi,”said Claude Eguienta, CEO of Mimo Capital. “Lower gas fees for our users and faster blocks allowing for the development of new products on the top of our platform, thanks to a smoother liquidation market. We’ve always wanted to make Mimo DeFi accessible to more people, and Polygon makes it possible.”

Mimo has a unique opportunity to bridge the existing chasm between the DeFi world and the trusted world of regulated financial institutions by offering a fully decentralized stablecoin platform with features including savings and loans. For the first time, users can participate in a euro-denominated, decentralized, stable crypto ecosystem.