- The stock market’s rally has made investing riskier than ever.

- Smart money appears cautious as stocks climb higher.

- All signs point to a correction in the coming weeks.

With the U.S. stock market trading at all-time highs, its only natural that traders are starting to get a little bit jittery. Not only is the coronavirus pandemic still hanging like a dark cloud over the economy, but the stock market’s rally has been driven by just a handful of big-name tech stocks. The rest of the market (roughly 60% of shares) is still showing losses compared to their February highs.

The Fed’s Role in the Stock Market

Many point to the Federal Reserve’s unprecedented intervention as a reason to believe the stock market can continue rising. But the belief that the Fed ultimately controls the stock market is a dangerous one that could end badly for the many retail traders who have flooded the market.

In 2019, retail investors made up roughly 10% of the overall stock market. The advent of low-cost brokerages has seen that figure jump to 25% over the past year. It’s up for debate whether the wave of novice traders is throwing the market out of whack, but the inexplicable rally among bankruptcy stocks suggests they’re having an impact.

Anecdotal evidence suggests these newly minted investors believe the Fed will keep this rally going at any cost. According to the CEO of AlphaOmega Advisors Peter Cecchini, that’s a dangerous assumption.

I regard uninformed WFH retail flows — emboldened by massive, temporary fiscal stimulus — as insufficient to sustain the rally. The equity markets are now like an old elevator way over capacity. It’s just a matter of time before the cable snaps and its passengers end up in the basement.

Cecchini isn’t alone in worrying that the Fed isn’t an all-powerful entity capable of keeping this rally alive.

Avi Gilburt, who authors the Market Pinball Wizard focused on predicting market movements, says investors need only look as far back as March for evidence that the Fed is powerless in controlling the will of the stock market.

So, despite this almost unanimous belief in the Fed’s omnipotence, consider how the Fed was unable to stem the tide of the negative market sentiment during the 35% market crash we experienced earlier this year notwithstanding all its attempts

Gilburt noted that instead, the stock market is a product of investor sentiment. The collective hive-mind of traders is what determines the direction equities will take.

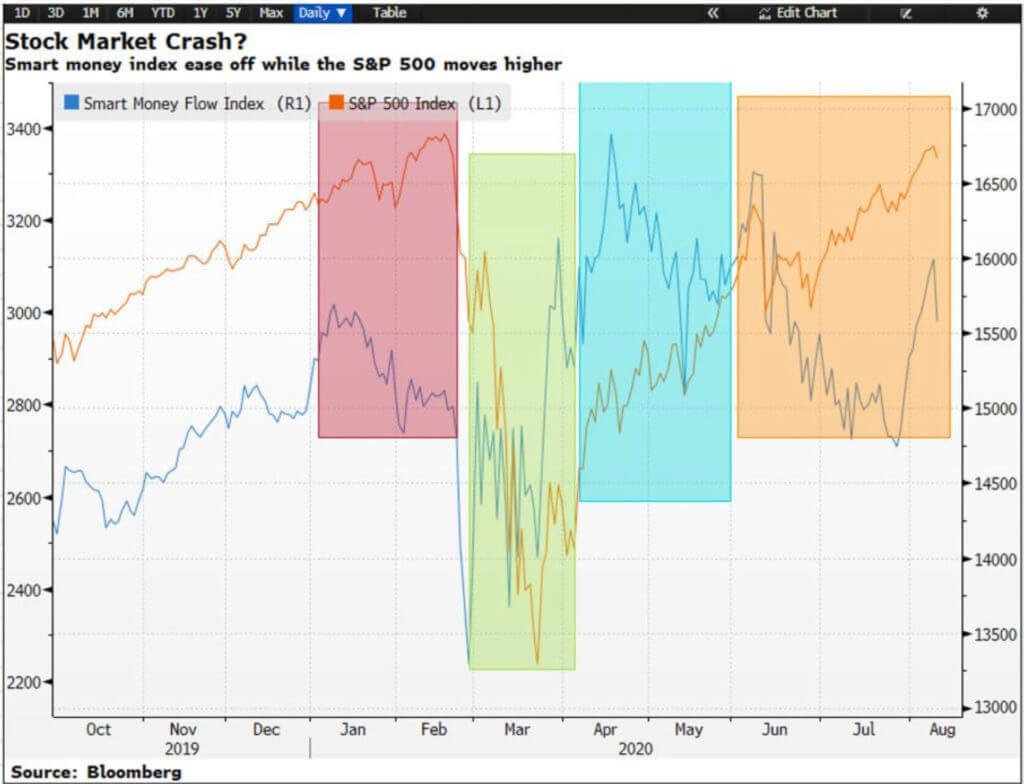

While it seems that the majority of retail investors see the market moving higher as the Fed continues to intervene, the other roughly 75% of the stock market—institutional investors—are beginning to look a bit more bearish.

Institutional investors, called the “smart money” because of their experience and access, appear to be pulling out of the stock market. As the S&P 500 approached its all-time highs, institutional investors began to withdraw from the market. End-of-the-day selloffs suggested mart money wasn’t convinced this rally could continue.

The Risks Far Outweigh the Rewards

The risk/reward scenario in today’s market isn’t worth participating in. Investors have to stomach high price-tags to eke out just a fraction of growth. Meanwhile, economic uncertainty and a murky path out of the pandemic is hanging over the future.

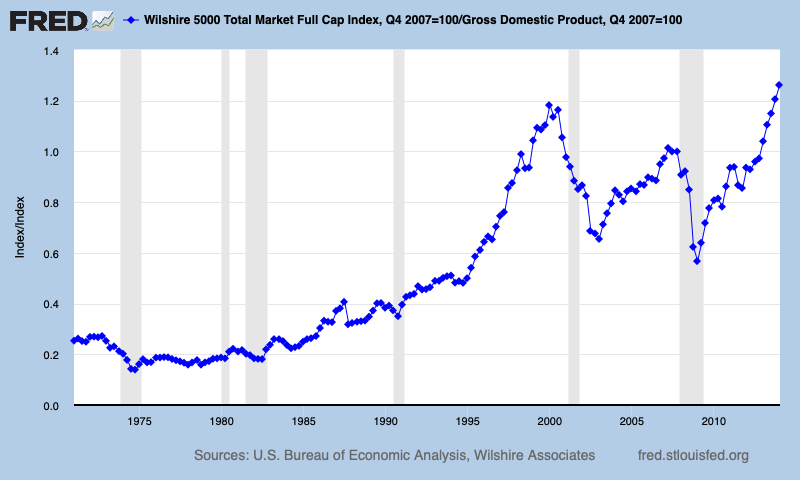

The Buffett index, which compares the equity valuations to U.S. GDP, has risen to levels above those seen during the dot-com bubble. It suggests that FOMO is keeping investors locked into the stock market despite its risks. In short, investors are getting greedy.

A stark note from Morgan Stanley this week noted that the market’s stunning rally has made it more vulnerable to shocks. The firm said that worries about growth would be a key downside catalyst that the market “is not prepared for.”

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author holds no investment position in the above-mentioned securities.