Bitcoin’s parabolic ascent looks unstoppable. Recently, every correction has been seen as an opportunity to buy heavily on dips. This week, the number one cryptocurrency is up by as much as 15 percent and it looks like bulls are gunning for the 2019 high of $13,868.44.

The atmosphere is so bullish that CryptoTwitter is starting to feel euphoric. One cryptocurrency trader and investor that goes by the name Josh Rager shared an image of a majestic bull with a caption “$13k $BTC” to illustrate the strength of the uptrend.

$13k $BTC pic.twitter.com/XvQcjtqUHG

— Josh Rager 📈 (@Josh_Rager) July 10, 2019

While bulls are celebrating, an examination of bitcoin in both the short-term and long-term timeframe reveals that bulls are running out of steam. Indicators look overheated, which makes a retracement down to $9,000 a very likely scenario.

Bitcoin Flashes Classic Bullish Exhaustion Signals on the Weekly Chart

The first cryptocurrency soared from $4,000 levels in March 2019 to close to $14,000 last month. That’s an astronomical ascent of around 245 percent in three months. The steep rise came with very little correction. Without a significant retracement, the long-term health of the uptrend is at risk.

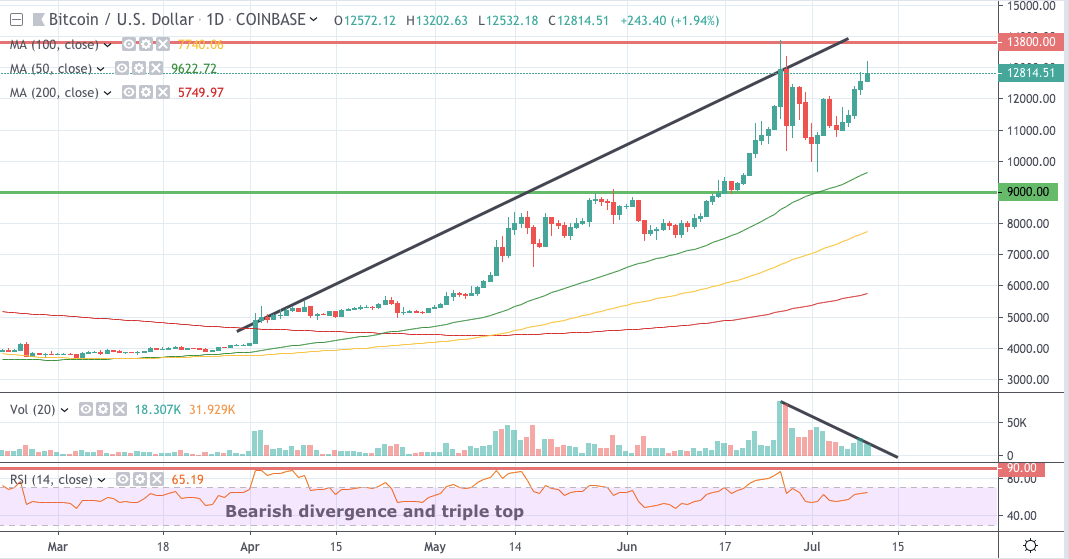

This risk may come into play in the next few days as the market shows signs of bullish exhaustion. First, bitcoin’s price continues to rise, yet volume has significantly declined over the past two weeks. This divergence tells us that demand is beginning to dwindle and sellers are just biding their time before they dump their positions.

In addition to that, the weekly RSI indicates that the cryptocurrency is massively overbought. It is approaching RSI resistance of 90. This is a level that has never been breached. In other words, bitcoin has always retraced after tapping this RSI resistance.

Short-term Timeframe Looks Even Worse

Bitcoin’s daily chart paints an uglier image. In addition to the slumping volume, the daily RSI has printed a triple top pattern. This bearish structure is coupled with a large bearish divergence. The price may continue to rise but momentum is visibly waning.

Also, the daily candles over the last two days have wicks on top of their bodies. This is an indication that sellers are emerging.

As demand and momentum show signs of weakness, it won’t take long before more sellers take notice. When they do, bitcoin will likely correct to $9,000.

Bottom Line

It’s likely that market participants are holding on their positions as they anticipate more upside potential. This explains why the price keeps rising even though volume has been anemic.

However, the failure to breach or even touch the 2019 high of $13,868.44 may likely ignite a waterfall event. Sellers would realize that the top is in and they would dump positions in a hurry. If this happens, bitcoin could be trading around $9,000 levels.

Click here for a real-time bitcoin price chart.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.