Not a day goes by without someone shilling something related to Decentralized Finance (DeFi). It’s being touted as being bigger than the 2017 altcoin boom, and when you look at things like the monstrous Tether market cap, the recent surge in the price of Chainlink as well as DeFi platform Celsius recently exceeding $1 billion in crypto deposits, it’s clear that these are well-founded claims.

However, the one problem that this potentially presents for Bitcoin is the value proposition to high-net-worth-individuals and institutions considering entering the space.

Earn as much as 8% interest on USDT in a year or risk losing 11% on Bitcoin in a day?

Daily crypto market performance. Source: Coin360.com

Bitcoin is trading at the top

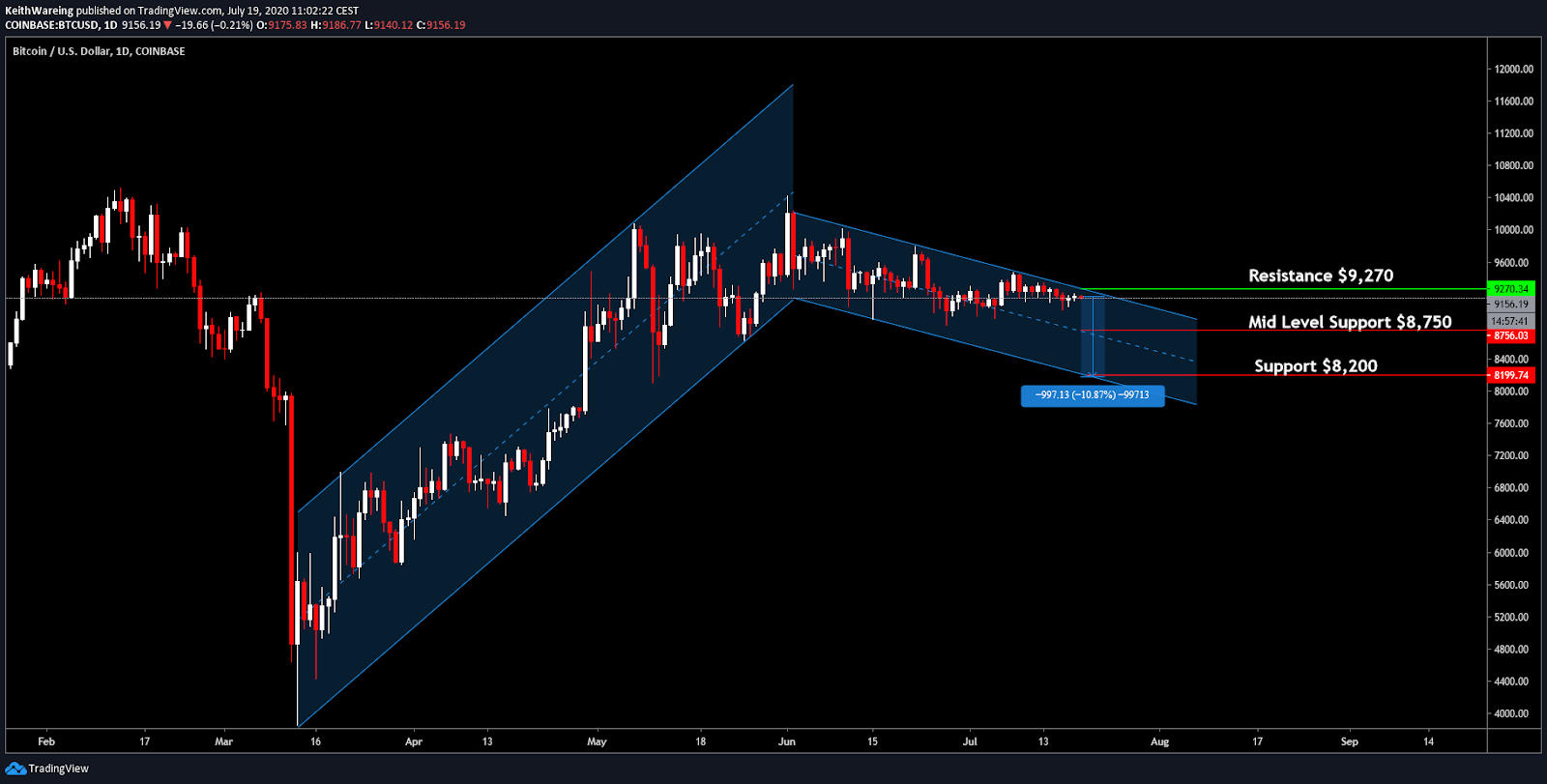

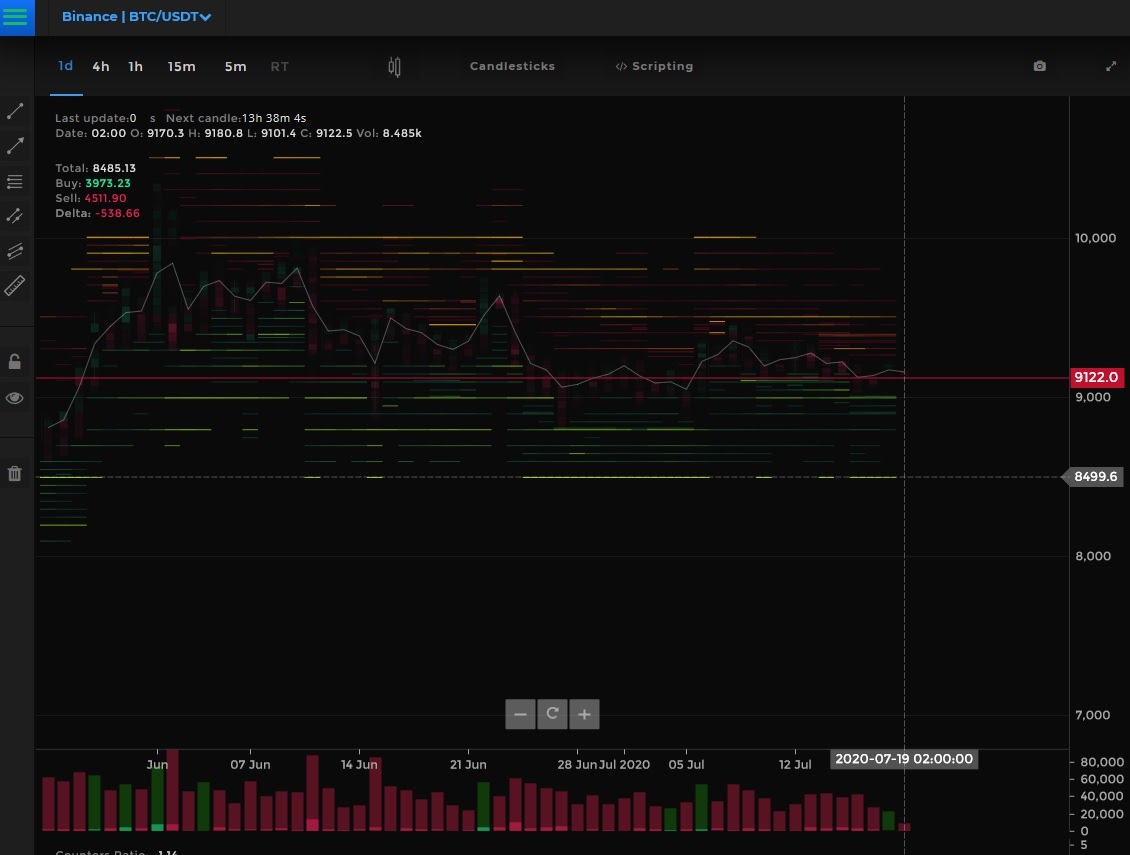

BTC/USD 1-day chart. Source: TradingView

Using the 1-day BTC chart, it’s clear that we’re still in a descending pattern dangerously close to the top of a channel. The current price is about $9,150 and the resistance is at $9,270.

This puts the mid-level support at $8,750 and the lower channel support at $8,200, which suggests to potential Bitcoin buyers that an 11% drop to the channel support is a potential scenario.

I don’t know about you, but when faced with potentially losing 11% in a day, compared to earning 8% in a year on a DeFi platform, the risk vs. reward, especially for institutions managing third-party portfolios, the latter certainly looks like the safest bet.

But what about the same view on the world’s number-two coin by market capitalization, namely Ether? Its Ethereum blockchain hosts many of these so-called DeFi projects that have been gaining a lot of attention lately.

The rise of the phoenix

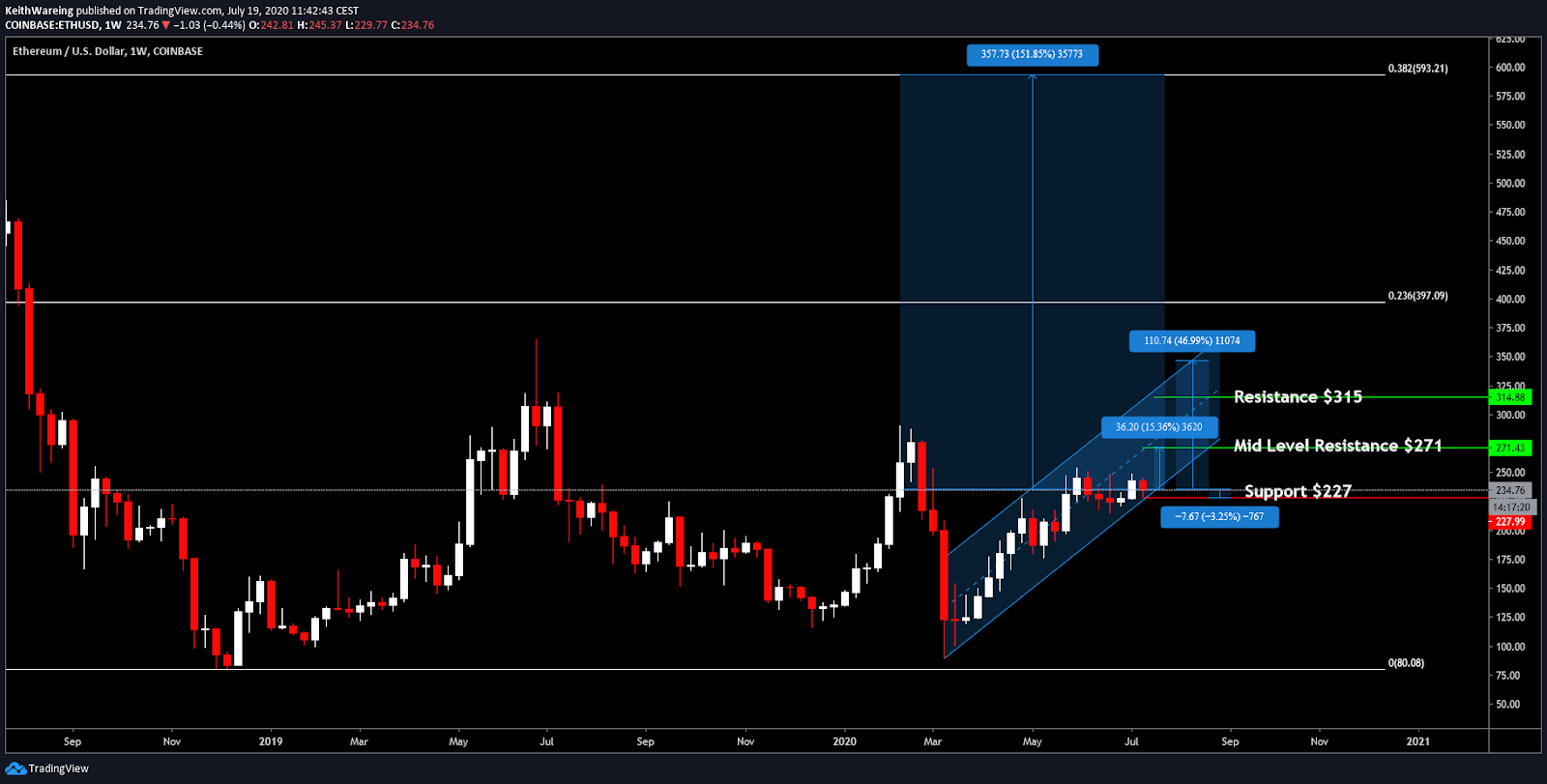

ETH/USD 1-Day chart. Source: TradingView

Comparatively, Ether (ETH) looks like it is trading at the bottom of its current ascending channel on the daily chart. In other words, it paints a picture of a 50% upside and a 3% downside.

While this is only one view, and by no means a guarantee of what will happen in the immediate future, it signals to me that Etheruem’s Ether token could potentially be staging its comeback.

Despite all the FUD and controversy, you can also read on Twitter about Ethereum 2.0 delays and one of its co-founders wishing to be disassociated with it. However, you cannot deny that Ethereum has cemented itself as being equally important as Bitcoin in the cryptocurrency space.

Without Ethereum, you wouldn’t have the majority of DeFi platforms, smart contracts, or altcoins that might give you insane returns if you pick the right one, including the marines’ beloved Chainlink (LINK).

The weekly Fibonacci for Ether

ETH/USD 1-week chart Source: TradingView

In last week’s technical analysis, I looked at the fib on Bitcoin. Not much has changed in the price of Bitcoin since with it still hovering around the 0.382 fib.

However, for Ether, all of the price action in its current channel occurs below 0.236, which would put ETH/USD close to $400 should it reach the first Fibonacci level.

What’s more, that doesn’t even bring Ether price close to Bitcoin’s current retracement levels. If ETH were to approach the 0.382 fib, we’re looking at a 150% gain on the second-largest cryptocurrency in the space.

The question is then, will Ethereum begin to outperform Bitcoin in the immediate future?

If so, what will happen to all of the alts paired with ETH and subsequent profits people start taking on ETH only pairs? What effect would you expect to happen across the space? It seems it would be 2017 all over again while also presenting a third option attractive for investors.

- DeFi interest growth

- Potential 11% loss buying Bitcoin

- 150% gains on the world computer that is Etheruem?

Bitcoin has long been touted as a safe-haven asset and store-of-value. But DeFi presents alternative investment opportunities, and while perhaps a token like Chainlink could lead the next bull run, don’t forget that paired assets are the ships that will rise with the tide, which puts Ether in prime position for a comeback.

The bullish scenario for Bitcoin

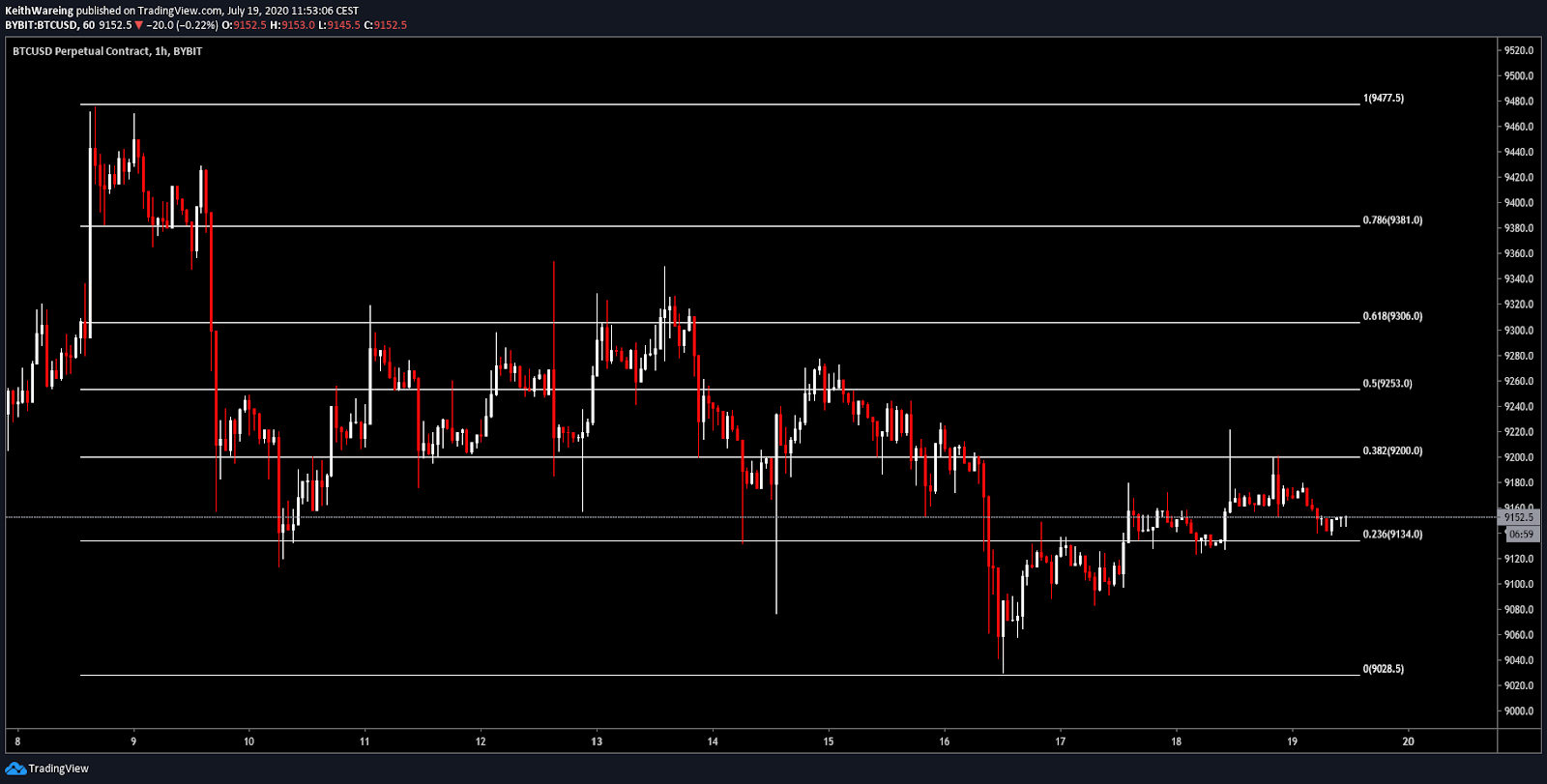

BTC/USD 1-hour chart. Source: TradingView

Looking at Bitcoin on the hourly chart, it’s important for Bitcoin bulls to break past the 0.618 fib of $9,300 to break out of the current downward slide. The price was rejected off the 0.382 of $9,200 in the last 24 hours, so right now all eyes are firmly on this tight range.

Once out of this range, breaking out of the current fib pattern of $9,500 would be key to once again see the multi-year resistance $10,500 being challenged again.

The bearish scenario for Bitcoin

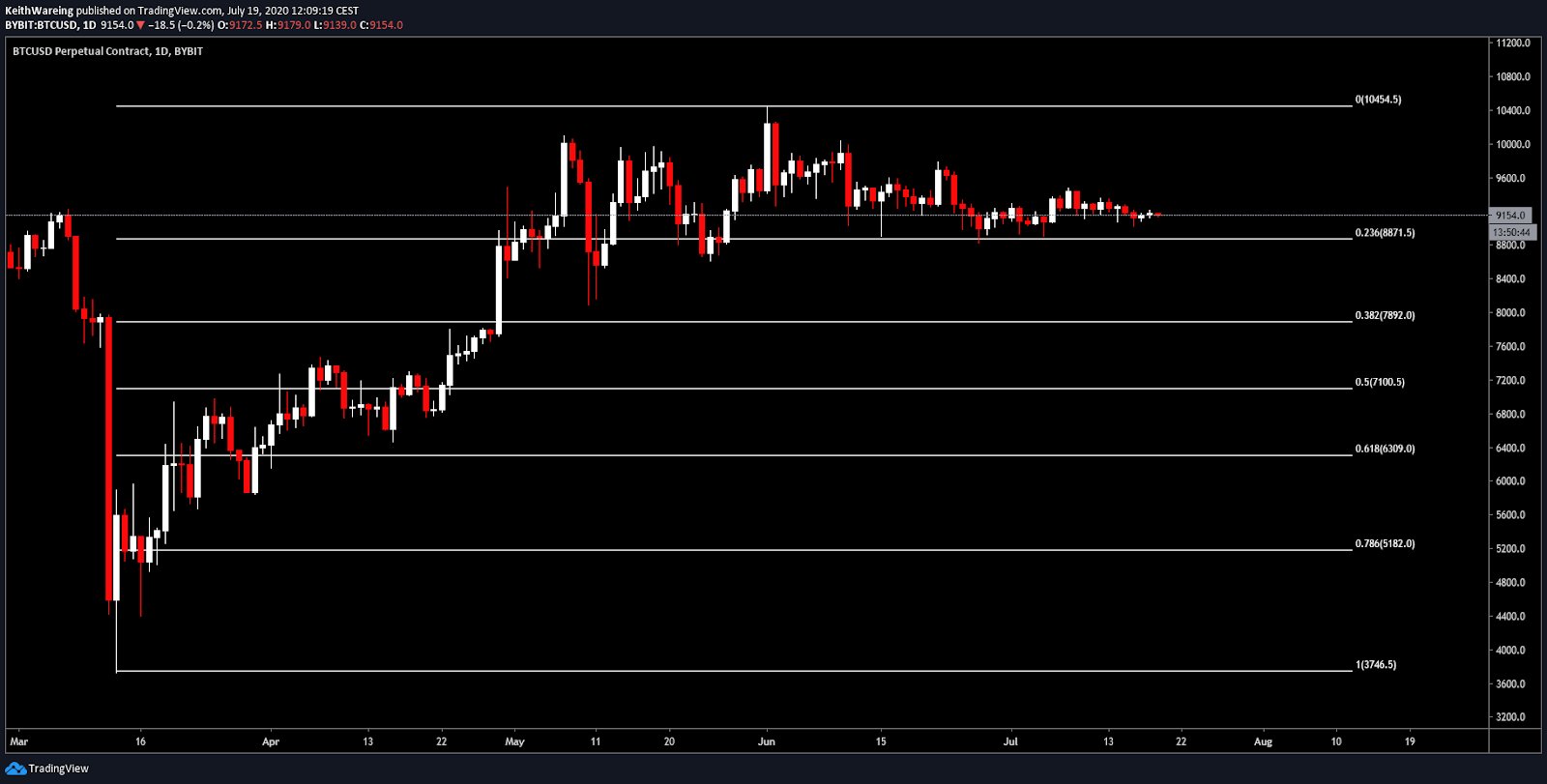

I see a lot of support around $8,900 on the daily chart. From here, it begins to open up $7,800 as the next potential Fibonacci target for support.

BTC/USD 1-daily chart. Source: TradingView

Support can be found along the way in the channel between $8,750 and $8,350 before considering these downside targets.

BTC/USD 1-daily chart. Source: Tensorcharts

However, if $8,200 is lost, I expect a very fast drop to the $7K levels as there are no significant buy-orders on the Binance orderbook heat map below $8,500.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.