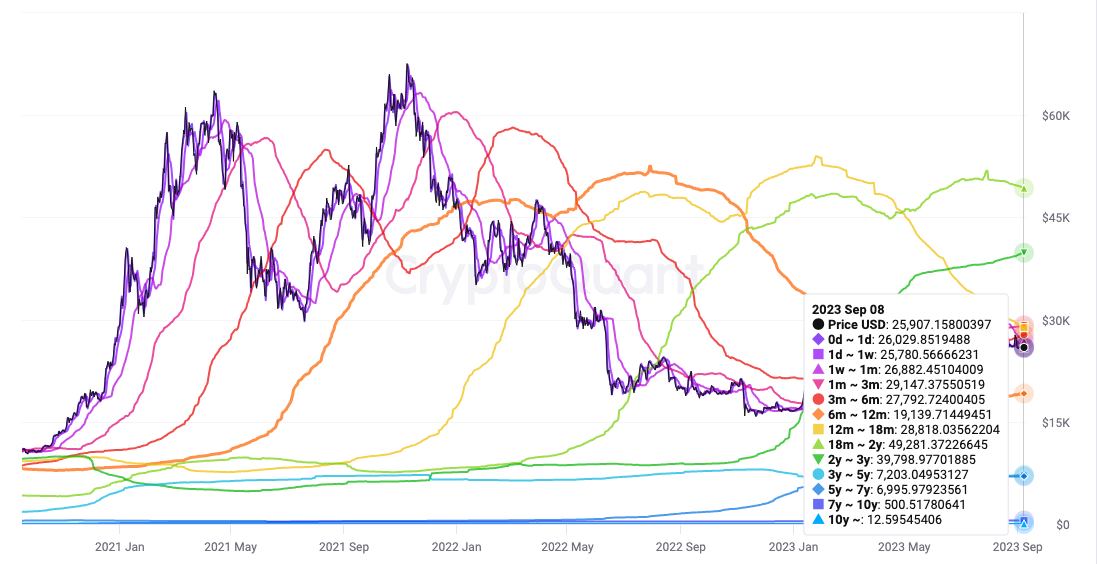

Bitcoin (BTC) is recovering from a “black swan” event last rivaled by the March 2020 COVID-19 crash, data suggests. In one of its Quicktake posts on Sept. 7, on-chain analytics platform CryptoQuant revealed a major spike in loss-making unspent transaction outputs (UTXOs). CryptoQuant: Bitcoin UTXOs in loss “mirror” March 2020 Bitcoin may be worrying market participants with current BTC price weakness, but on-chain data paints an intriguing picture of activity “under the hood.” UTXOs represent BTC left over after an on-chain transaction is executed. CryptoQuant’s UTXOs in Loss metric tracks…

Day: September 10, 2023

Bitcoin UTXOs echoing March 2020 ‘black swan’ crash — New research

Bitcoin (BTC) is recovering from a “black swan” event last rivaled by the March 2020 COVID-19 crash, data suggests. In one of its Quicktake posts on Sep. 7, on-chain analytics platform CryptoQuant revealed a major spike in loss-making unspent transaction outputs (UTXOs). CryptoQuant: Bitcoin UTXOs in Loss “mirror” March 2020 Bitcoin may be worrying market participants with current BTC price weakness, but on-chain data paints an intriguing picture of activity “under the hood.” UTXOs represent BTC left over after an on-chain transaction is executed. CryptoQuant’s UTXOs in Loss metric tracks…

From compliance to complicity: How Binance’s Russian connection undermines sanctions

Binance, a renowned cryptocurrency exchange, is embroiled in controversy as recent reports suggest a possible helping hand to Russia amidst Western sanctions. The story unravels with connections to blacklisted Russian lenders, contradicting public statements, and the shifting regulatory landscape. As dawn breaks over the world of crypto, murmurs seep into daylight, revealing stories that could shape the industry’s narrative. And as it happens, Binance, one of the juggernauts of the crypto world, finds itself at the heart of a contentious debate. According to a Wall Street Journal report from Aug.…

Robinhood adds 1.25T SHIB, Borroe.Finance’s user base growing, Maker follows

Shiba Inu (SHIB) supply in Robinhood increased after Shibarium. Meanwhile, the market is fawning over Borroe. Finance’s (ROE) presale following its token price increment. Maker (MKR) is also firm after talks of a new blockchain. Although SHIB, ROE, and MKR are rising, investors are bullish, expecting Borroe.Finance to be among the top altcoins in 2023. $280 million SHIB purchase highlights growing demand Following the launch of Shibarium, SHIB’s supply in Robinhood rose by nearly 70%. Data from Arkham Intelligence shows that the trading platform’s supply has rose to 14 trillion SHIB over…

AI token trading volume stagnant despite Worldcoin buzz – Kaiko data

While the debut of Worldcoin drew attention to artificial intelligence-powered tokens(AI-tokens), recent trading data from Kaiko indicates that these AI tokens have shown resilience despite the controversy surrounding Worldcoin’s launch. According to recent Kaiko data, the trading volume of AI-related tokens remained stagnant during the past month. The examination revealed a moderate increase in the trading volume of AI tokens last month, reaching approximately $870 million, up from $570 million at the close of July. Nevertheless, when compared to the volume at the beginning of the year, there was a…

3 reasons why Pepe price will continue to fall in September

Pepecoin (PEPE) price has crashed nearly 85% from its record high of $0.00000448 in May 2023. What’s more, its bearish momentum is likely to continue in September. Back-to-back Pepecoin security breaches Pepecoin has suffered two concerning security breaches in the last two weeks. First, on Aug. 24, Pepecoin’s rogue founding team members transferred $16 million worth of PEPE tokens to exchanges to potentially sell them. That created concerns across the community about a potential “rug pull scam,” causing a 30% decline in the PEPE market. Then, on Sep. 9, Pepecoin’s…

Terra Luna Classic contemplates deposit hike to curb spam proposals

The Terra Luna Classic is presently voting on multiple proposals, with concerns raised about an uptick in “spam” proposals following a decline in LUNA prices. A new proposal seeks to raise the minimum deposit requirement from 1 million LUNA to 5 million LUNA, with expectations of a potential price increase ahead of the upgrade. The proposal 11780, titled “Initiative to Address Spam Proposals by Raising Minimum Deposit to 5M LUNC,” is under consideration. Its objective is to elevate the minimum deposit requirement from 1 million LUNC to 5 million LUNC,…

1 in 4 investment firms assign senior execs to digital assets: Report

An increasing number of investment firms in the United States and Europe are appointing senior executives to lead digital asset investment strategies, based on the findings of a market intelligence firm. According to a recent Amberdata report titled ‘Digital Assets: Managers’ Data Infrastructure Fuel,’ 24% of asset management firms have adopted a digital assets strategy, with an extra 13% planning to do so in the next two years. “These roles are being staffed up, with almost a quarter of firms with a senior role dedicated to digital assets, reflecting seriousness…

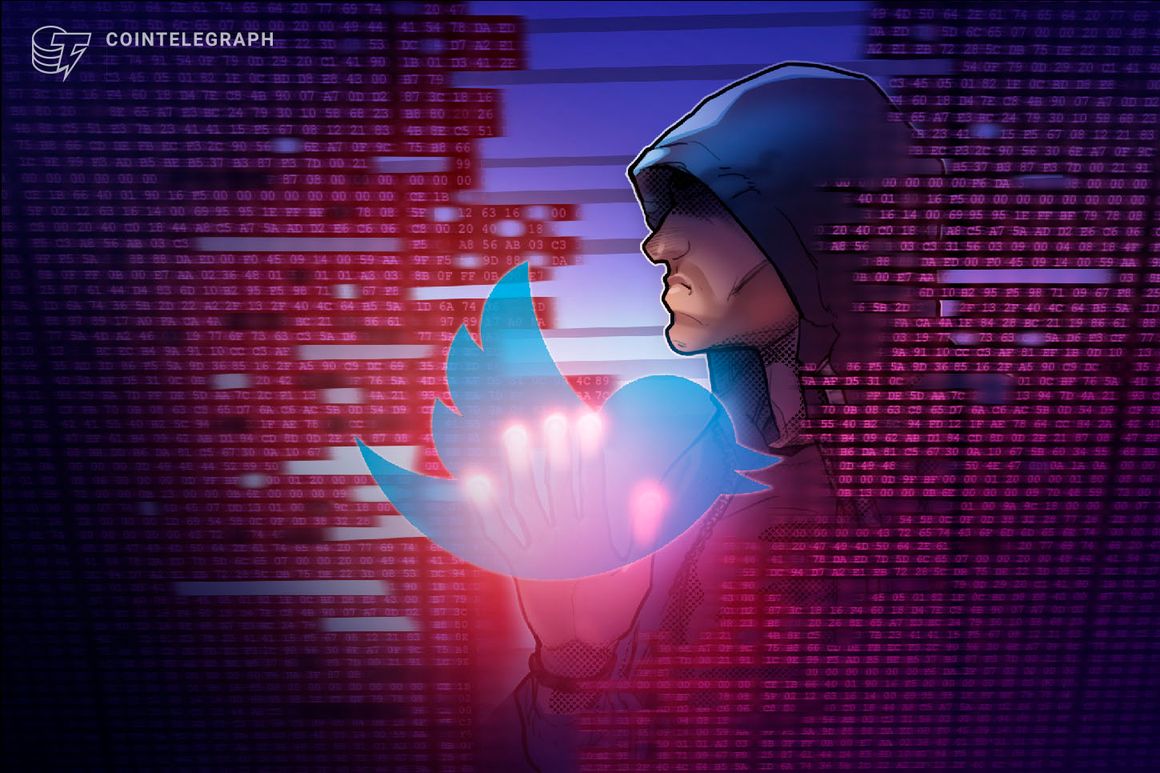

Vitalik Buterin’s X account hacked, draining $691K+ from victims : Report

Vitalik Buterin, co-founder of Ethereum (ETH) had his X (formerly Twitter) account compromised, which, according to social media reports, resulted in victims losing over $691,000 through malicious links. In a Sept. 10 post on X, Dmitry Buterin, the father of Vitalik Buterin, announced that his son’s account has been compromised: “Disregard this post, apparently Vitalik has been hacked. He is working on restoring access.” The post to which he was referring has since been deleted. It was allegedly made by the hackers on Buterin’s account to celebrate the arrival of “Proto-Danksharding on…

Vitalik Buterin’s X account hacked, drains $691K+ from victims : Report

Vitalik Buterin, co-founder of Ethereum, had his X (formerly Twitter) account compromised, which, according to social media reports, resulted in victims losing over $691,000 through malicious links. In a Sept. 10 post on X, Dmitry Buterin, the father of Vitalik Buterin, announced that his son’s account has been compromised: “Disregard this post, apparently Vitalik has been hacked. He is working on restoring access.” Blockchain investigator ZachXBT has been actively informing his 438,200 followers about the hacker’s actions, which have led to the illicit draining of $691,000 from Buterin’s followers through malicious links.…