The U.S. Securities and Exchange Commission delayed multiple decisions on proposed spot Bitcoin (BTC) ETFs ahead of a possible government shutdown. Pending applications from VanEck, WisdomTree and Fidelity were all delayed on Sept. 28, per The Block. The regulator said it was instituting additional proceedings to determine whether the proposed ETFs should be approved or disapproved. The SEC asked for input from commentators, who have 21 days to submit written data, views, and arguments. There’s another 35-day rebuttal period, which suggests the approval process will drag on for at least…

Month: September 2023

Expect new crypto regulations to follow Bitcoin ETFs

Aside from liquidity, what do institutions bring to crypto? What precisely is their value added? This is an instructive question to ponder, because there is little consensus on what deeper institutional participation means for an industry that is riven with contradictions. The long-running wait for Bitcoin ETF approval, giving pensions and funds exposure to BTC, may well prove to be a positive catalyst for industry growth. But in focusing on price action, observers are missing out on the real benefit of broadscale institutional adoption. The greatest benefit of deepening institutional…

nChain CEO resigns, claims Craig Wright is not Satoshi

Venture capitalist Christen Ager-Hanssen announced his departure from web3 solutions provider nChain, citing a conspiracy to defraud shareholders. The Norwegian internet entrepreneur stated on social media that he was stepping down from his position as CEO “with immediate effect.” I can confirm I have departed from @nChainGlobal as its Group CEO with immediate effect after reporting several serious issues to the board of nChain Group including what I believe is a conspiracy to defraud nChain shareholders orchestrated by a significant shareholder. I also… pic.twitter.com/F6rNJfRxnl — Christen Ager-Hanssen (@agerhanssen) September 29,…

Flood of Ethereum Futures Exchange-Traded Funds Could Launch on Monday, According to Bloomberg ETF Analyst

A Bloomberg exchange-traded fund (ETF) analyst says that the market could be inundated by Ethereum (ETH) futures ETFs starting on October 2nd. In a new thread on the social media platform X, Bloomberg ETF analyst James Seyffart notes that nine different ETH-based futures ETFs are set to potentially launch on Monday, adding that it will be a “crazy day.” The financial firms on Seyffart’s list that are gearing up to issue Ethereum futures ETFs include VanEck, Bitwise, Proshares, Vol Shares, Hashdex and Valkyrie. Source: James Seyffart/X The analyst goes on…

FTX Exploiter Transfers 5,000 ETH Ahead of Ether Futures ETF Launch

Some 5,000 ETH, worth over $8.2 million, have been moved from a wallet address associated with the FTX hacker. This development marks the first time assets have been transferred out of the hacker’s wallet following the exploit about a year ago. FTX Hacker Moves 5,000 ETH, Spot On Chain Reveals Marked as one the biggest crypto heists ever, the now-defunct FTX exchange suffered a loss of over $600 million through an hack in November 2022, a few hours after filing for bankruptcy. According to the on-chain analytics platform Spot On…

VanEck to donate 10% profits from Ether ETF to core developers

Global asset manager VanEck will donate 10% of all profits from its upcoming Ether futures exchange-traded fund (ETF) to Ethereum core developers for ten years, the company announced on X (formerly Twitter) on Sept. 29. The beneficiary will be The Protocol Guild, a group of over 150 developers maintaining Ethereum’s core technology. According to VanEck, it’s only fair for asset managers to return part of their proceeds to the community building the crypto protocol. It stated: “If TradFi stands to gain from the efforts of Ethereum’s core contributors, it makes…

Crypto CEO Very Bullish On XRP Price, Sets Make Or Break Point

Following its victory against the US Securities and Exchange Commission, the XRP price has been displaying bullish sentiments, effectively gaining the attention of long-term investors seeking to buy and hold to gain more profits. In light of this, a crypto CEO has disclosed his insights on XRP’s bullish outlook, acknowledging the prospects of a bull run in the future. Crypto CEO Concedes Possible XRP Bull Run The market sentiment surrounding Ripple Labs’ native token, XRP has taken a bullish trajectory, increasing investors’ confidence and expectations of a possible bull run. …

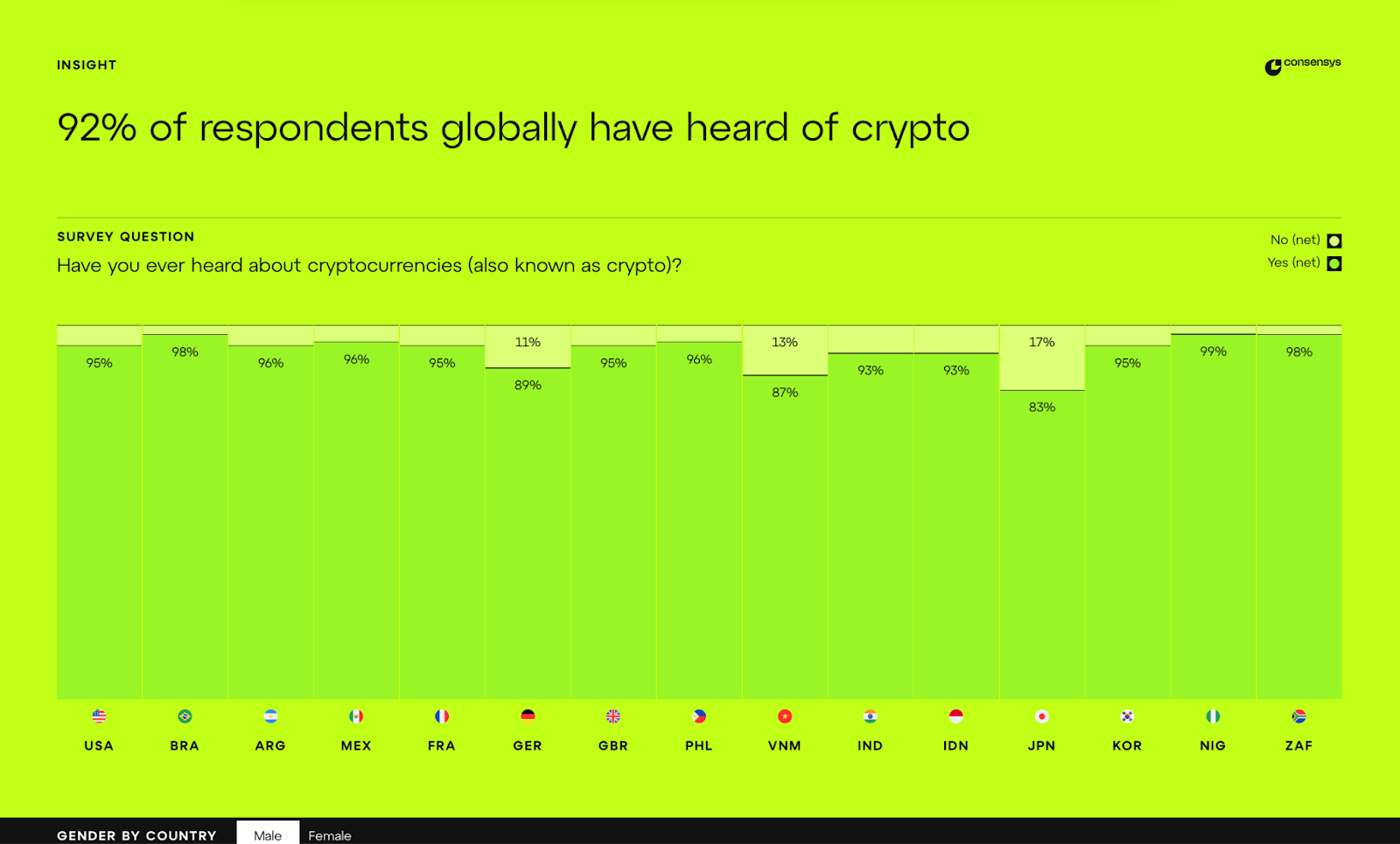

Cryptocurrency awareness vs knowledge: To educate to empower

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial. Consensys surveyed around 15,000 people worldwide, and 92% said they ‘heard about’ crypto. What’s more: 50% of respondents ‘understand’ the asset class. Such understanding was especially high among people from emerging economies like Nigeria, Brazil, India, etc. Crypto awareness | Source: Consensys These data points highlight the rising interest in crypto and related technologies. But there’s still much to do in terms of educating the masses about…

Valkyrie Halts Purchase Of ETH Futures Contracts

Asset management firm Valkyrie, one of the frontrunners for the first Ethereum ETF (exchange-traded fund) in the United States, has decided to pause its purchase of Ether futures contracts until the US Securities and Exchange Commission approves an Ether futures ETF. This comes barely a day after the asset manager reportedly secured approval to offer investors exposure to Ether futures under its existing strategy ETF (BTF). SEC Might Be Behind This Action, Bloomberg Expert Speculates On Friday, September 29, Valkyrie filed a 497 with the SEC, saying that it would…

Is the artificial intelligence market already saturated?

From voice assistants to algorithms predicting global market trends, artificial intelligence (AI) is seeing explosive growth. But as with any emerging technology, there comes a point where innovation risks giving way to oversaturation. The rapid proliferation of AI tools and solutions in recent months has ignited discussions among industry experts and investors alike. Are we witnessing the zenith of AI’s golden age, or are we on the precipice of a market saturated beyond capacity? The tech landscape has always been dynamic, with innovations often outpacing the market’s ability to adapt.…