- Zoom stock surged by 566% year-to-date, after a surprising 40% rally on September 1.

- While some traders expect the rally to slow in the near term, analysts are optimistic about renewed yearly revenue guidance.

- Hong Kong’s richest billionaire Li Ka-Shing holds 8.5% of Zoom stake and has not sold any of it yet.

Zoom stock has surged by 566% since January 2 as one of the best-performing tech stocks. Some traders are turning cautious in the short term. But over the longer-term, strategists say the prospect of Zoom remains strong.

Three catalysts buoy Zoom’s sentiment: growing demand for teleconference, high earnings, and a solid historical reputation.

Reason #1: Traders Worry a Slowing Rally, But Cannot Dismiss Clear Demand Growth

Zoom stock rose by over 40% on September 1 after its blockbuster quarterly revenue report.

The company posted revenues of $663.5 million in the second quarter, surpassing Wall Street estimates by 32%.

The strong quarterly earnings report immediately caused a “fear of missing out” (FOMO) rally. The company’s valuation soared past $125 billion, surpassing IMB.

Following its vertical rally, Some investors fear that Zoom stock has become “extraordinarily overbought.”

Newton Advisors founder Mark Newton said it is a “tough call” to justify buying the stock. He emphasized that Zoom has been the same company as it was three weeks ago.

The investor noted that he remains optimistic over the medium-term and would consider buying $227 to $275. At over $300, he said Zoom stock presents a “poor risk-reward technically.”

But with the U.S. stock market benefiting from low-interest rates and surging liquidity, tech stocks are continuing to spike.

The favorable macro backdrop of stocks strengthens the bull case for Zoom, which raised its full-year revenue guidance.

Morningstar’s Dan Romanoff called Zoom’s second quarter a “once-in-a-generation” result. The “tremendous encore” of the firm indicates consistently rising demand.

Zoom stock could have seen an overextended rally. But as it has been with Tesla stock, it is hard to fight technical momentum in this stock market landscape.

Zoom executives are positive about the growing demand for online communication. Watch the video below:

Reason #2: Hong Kong’s Richest Billionaire Remains Confident

Throughout the past year, escalating tension in Hong Kong around the national security law caused the local economy to slump.

Yet, Li Ka-Shing has solidified his position as Hong Kong’s wealthiest billionaire, all thanks to Zoom.

In 2013, Li invested in the video communications company through his venture capital firm.

As of 2020, Li holds 8.5% of Zoom Video Communications, a stake that values his holding at $11 billion.

The stake accounts for one-third of Li’s wealth, and so far, the billionaire has not taken profit on the early investment.

Reason #3: Pandemic is Lasting Longer Than Expected

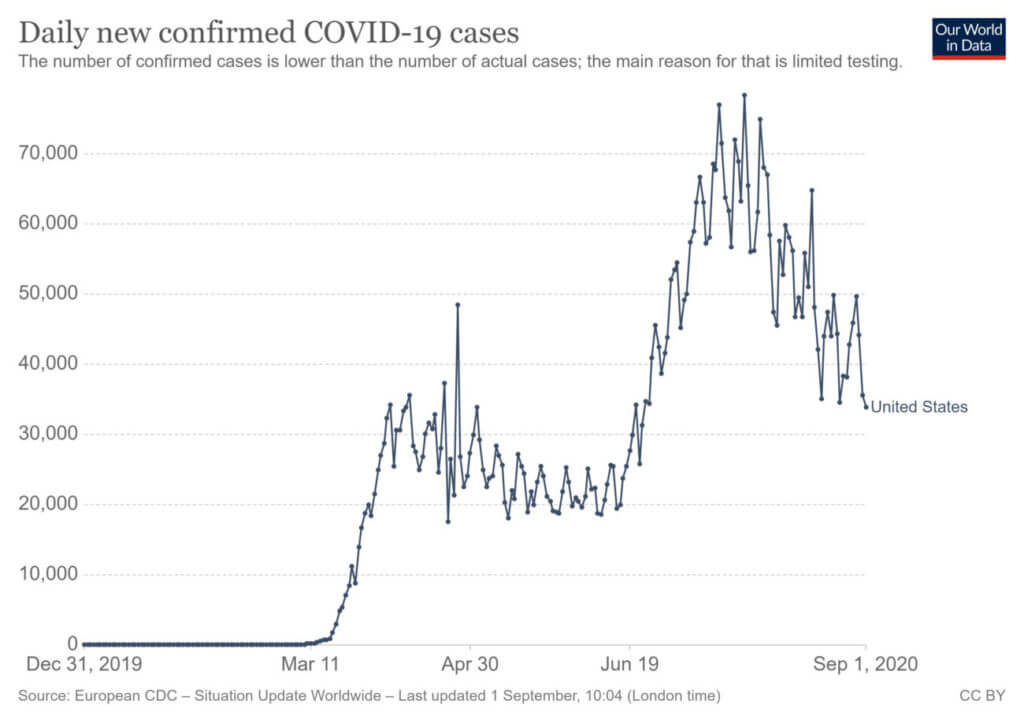

A new wave of COVID-19 cases is beginning to emerge throughout Europe and Asia.

Countries that handled the pandemic relatively well early on, like South Korea, have placed additional social distancing restrictions.

According to the official data from the U.S. Centers For Disease Control and Prevention (CDC), cases are plateauing. But the U.S. is still recording about 45,000 virus cases per day.

Until vaccines are mass-produced, companies will continue to run more operations and communication online. That bodes well for Zoom and other telecommunication platforms.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.