According to onchain data, there’s now 69,836 synthetic bitcoin tokens (over $700 million) circulating on the Ethereum blockchain. Out of the six synthetic bitcoin token projects, wrapped bitcoin (WBTC) commands the largest number of coins with over 63% and 44,622 WBTC.

Synthetic bitcoin (BTC) has grown massively in recent weeks and since news.Bitcoin.com’s last report on the subject, there was 38,021 BTC circulating on the Ethereum chain.

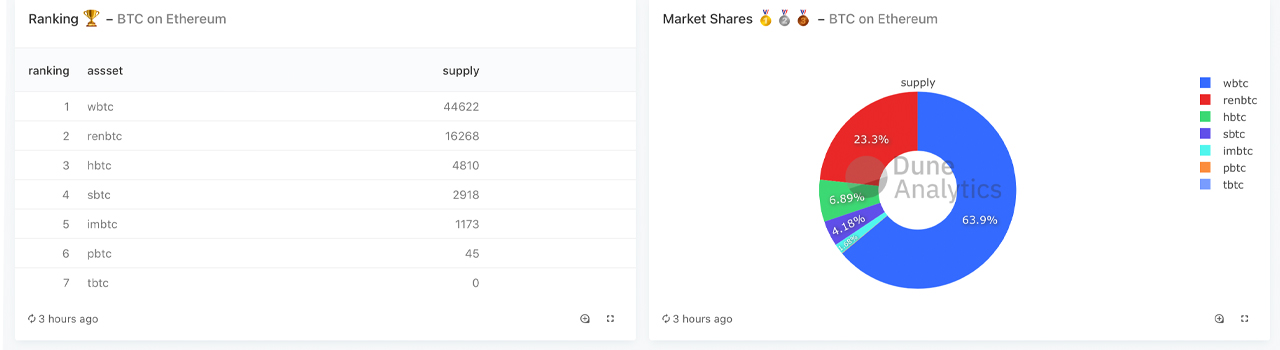

Since then, that metric has jumped more than 83% as there’s now 69,836 synthetic bitcoin tokens in the wild on September 7, 2020. Dune Analytics shows there are seven synthetic BTC projects but tBTC has zero coins minted, while the other six projects have between 45 BTC to over 40,000.

The top project minting the most synthetic BTC is the Wrapped Bitcoin (WBTC) protocol which commands roughly 44,622 BTC to-date or 63%. The Ren Protocol’s renBTC has over 23% of the aggregate total of synthetic BTC with 16,268 renBTC in circulation today.

The token hBTC has 4,810 and sBTC has a total of 2,918 at the time of publication. The two projects with the least amount of synthetic BTC is imBTC (1,173) and pBTC (45).

WBTC has gained a lot of traction, and on Monday reports detail that the organization Alameda Research obtained 70% of the WBTC minted in August. Alameda was cofounded by the FTX CEO Sam Bankman-Fried.

A great percentage of synthetic bitcoin is circulating among holders while the rest is used on platforms such as Compound, Balancer, Aave, and Uniswap.

Synthetic bitcoin trades take place on a few centralized exchanges like FTX and Binance has revealed listing WBTC this week. On decentralized exchange (dex) platforms, Synthetic bitcoin trades are happening on 0x, Bancor, Synthetix, Balance, Curve, and Uniswap.

Despite the massive growth and popularity, Ethereum cofounder Vitalik Buterin detailed that he has concerns about synthetic bitcoin projects.

“I continue to be worried about the fact that these wrapped BTC bridges are trusted,” Buterin wrote on August 16. “I hope they can all *at least* move to a decently sized multi-sig,” the developer added.

Following Buterin’s statements, the community discussed a research paper by the Wanchain project which claimed the Ren Protocol kept all the collateralized bitcoin in one address.

“Paradoxically, we found that the Bitcoin address provided by renBTC that users transfer their real BTC to for locking has not changed since the first day it went online,” the Wanchain report wrote.

Despite the trust issues, with 69,836 synthetic bitcoin tokens on the Ethereum blockchain, the ETH network continues to solidify itself as BTC’s most dominant offchain solution.

What do you think about the $700 million worth of BTC circulating on the ETH chain in synthetic form? Let us know in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.