An analyst has explained how a decline to $30,220 or below could happen for Bitcoin if the strong support range below the current price gets lost.

Bitcoin Has Strong Support Between $42,560 And $43,245 Right Now

In a new post on X, analyst Ali has discussed how Bitcoin is floating above a strong on-chain support wall currently. In on-chain analysis, the potential of any price level to act as support or resistance lies in the amount of Bitcoin that was last purchased at said level.

This is because the investors naturally treat their cost basis or acquisition price in a special way and are thus more prone to make moves when the spot price retests it.

Such a reaction from the investors isn’t relevant when only a few of them share their cost basis at a particular level, but if the level observed a large amount of buying, its retest could indeed end up imparting some effects on the price. This is why the strength of any support or resistance level lies in the density of coins that were acquired at the level.

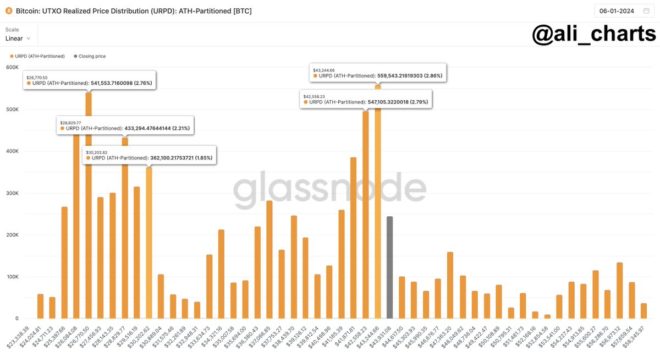

Now, to see the various price ranges in terms of the Bitcoin acquired at them, Ali has cited the “UTXO Realized Price Distribution” (URPD) from the on-chain analytics firm Glassnode.

This metric prices coins (or more precisely, UTXOs) based on the value at which they were last transferred on the BTC blockchain. Now, here is a chart that shows how this distribution is looking for the asset at the moment:

The distribution of the different UTXOs based on their realized price | Source: @ali_charts on X

As displayed in the above graph, the price levels between $42,560 and $43,245 hold the cost basis of a large amount of UTXOs. To be more specific, this range saw the investors acquire a total of 1.11 million BTC.

At present, Bitcoin is a decent distance above this range. This means that the holders who have their cost basis inside it would be in profit right now.

Usually, such holders are more likely to accumulate further when the price retests their cost basis, as they would feel confident that the same level could prove profitable again in the future.

Due to this reason, the retest of a major supply block from above can end up with the cryptocurrency feeling some support. Since the $42,650 to $43,245 range is quite heavy with investors currently, BTC should have a strong support base to fall back on, should things go wrong.

“If Bitcoin can hold above this level, there is not much significant resistance ahead that will prevent it from advancing further,” explains the analyst. This is because there aren’t any large supply blocks at the upcoming ranges.

Investors in losses (which those with cost basis at the prices ahead would be) can be desperate to exit at their break-even, so a retest of their cost basis can provide resistance. As such, BTC has no major resistance ahead.

“But if $42,560-$43,245 fails to hold, expect a downswing to the next critical area of interest between $26,770 and $30,220,” warns Ali. From the current spot price, a drop to the upper end of this range, $30,220, would mean a drawdown of more than 32% for Bitcoin.

BTC Price

Bitcoin has observed a strong surge during the past day and is now challenging the $45,000 level once more.

The price of the asset appears to have shot up over the past day | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.