As the U.S. elections approach, Biden’s stance on cryptocurrencies appears to be softening. What is behind this decision, and what can the crypto community expect?

Cryptocurrency-related events in the U.S. may signal that President Joe Biden is entering the race for the attention of the crypto community. It is likely that in the near future Biden’s administration may change its aggressive rhetoric on crypto. How will it affect the crypto landscape in the United States?

Voting to repeal SEC directive

Last week, the Senate passed a resolution that repeals Staff Accounting Bulletin 121 (SAB 121) from the U.S. Securities and Exchange Commission (SEC). The SEC rule addressed accounting standards for financial institutions holding cryptocurrency.

SAB 121 sets accounting rules for companies that hold their clients’ crypto. The bill would require financial institutions to classify digital assets as liabilities and show them on their balance sheets.

The SEC says SAB 121 protects investors. However, the crypto industry disagrees with this. In their opinion, such rules may lead to banks and other financial institutions being less willing to work with crypto companies. And this, in turn, could slow down the growth of the crypto industry.

Digital asset industry supporters reacted extremely positively to the vote. Representatives of the Blockchain Association called the result “stunning.”

It is noteworthy that the Blockchain Association linked the Senate’s decision with the upcoming elections in the United States. Experts believe that in this way, the current administration wants to get the votes of young people:

“The threat of a presidential veto denies the fact that there is a growing awareness among the voting public, particularly young people, that crypto is something our elected officials should care about.”

Blockchain Association

FIT21

The House of Representatives is also set to vote on the Financial Innovation and Technology for the 21st Century Act, known as FIT21 or HR 4763. The legislation aims to establish a consistent regulatory framework for all digital assets in the United States.

One of the key aspects of the law is to clarify the regulatory responsibilities of the Futures Trading Commission (CFTC) and the SEC. The division is strictly necessary as this is what will determine whether digital assets are treated as securities or commodities.

Proponents of FIT21 argue that the bill will offer needed regulatory clarity while allowing the industry to continue operating in the U.S. They believe that clearer regulation will help crypto companies build public trust, develop valuable products, and ensure accountability for bad practices.

Spot Ethereum ETFs

The possibility of Biden changing his rhetoric is also fueled by rumors about the spot Ethereum ETFs approval. Barron previously reported, citing anonymous sources, that the SEC was inclined to approve spot Ethereum-ETFs.

The agency has asked potential issuers to update Form 19b-4 in filings to launch the funds.

Bloomberg analyst James Seyffart also noted that at least five companies sent updated documents to the SEC. These include Fidelity, VanEck, Invesco/Galaxy, ARK Invest/21Shares, and Franklin Templeton.

In parallel, VanEck’s proposed spot Ethereum ETF under the ticker ETHV appeared on the DTCC asset list. The Franklin Templeton fund — EZET — has also been added to the list.

Bloomberg ETF analyst Eric Balchunas also changed his forecast regarding the likelihood of approval of the spot Ethereum ETF, raising it to 75%.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they’d be denied).”

Eric Balchunas, Bloomberg ETF analyst

He and his colleague James Seyffart became one of the leading sources of information about spot Bitcoin ETFs and accurately predicted their approval and launch in January. Seyffart also wrote that he supports the analyst’s opinion, adding that the information comes from several sources.

VanEck’s 19b-4 filing deadline is May 23, and ARK Invest’s fund, managed by investor Cathie Wood, is May 24. For the most prominent companies vying to launch Ethereum ETFs, BlackRock, the deadline for filing Form 19b-4 is Aug. 7.

Biden’s main competitor began accepting payments in cryptocurrency

Another turning point in Biden’s policy shift could be the fact that Presidential Candidate Donald Trump will accept political donations in cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), USDC, XRP, Dogecoin (DOGE), Shiba Inu (SHIB), ApeCoin (APE), Bitcoin Cash (BCH), Dai (DAI), and Litecoin (LTC).

About two weeks ago, during an event to promote his NFT collection, the Republican candidate pledged support for the industry, contrasting it with the policies of incumbent President Joe Biden’s administration.

Now, Trump has once again called on the cryptocurrency community to support him amid heavy regulation from Biden supporters.

“Biden surrogate Elizabeth Warren said in an attack on cryptocurrency that she was building an “anti-crypto army” to restrict Americans’ right to make their own financial choices. Now, with a new cryptocurrency option, MAGA supporters will build a crypto army, moving the campaign to victory on November 5!”

Donald Trump’s election website

The number of cryptocurrency asset owners in the U.S. is growing, and the upcoming presidential election could significantly impact the crypto industry.

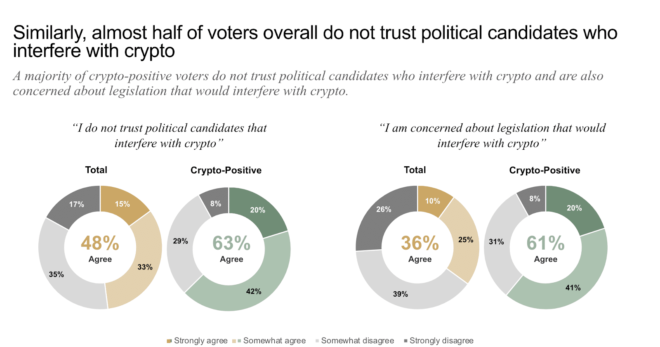

A recent Digital Currency Group poll also found that over 20% of respondents in several states consider cryptocurrency a vital issue in the upcoming U.S. elections.

According to the study, 40% of respondents want more discussions about digital assets by candidates. 20-25% would prefer that an elected politician focus on regulating the industry and protecting investors.

48% do not trust candidates who intervene in the digital asset sector. 30% are ready to support a cryptocurrency-friendly politician.

The results of a Paradigm survey indicate even greater distrust of Biden among the cryptocurrency community. Thus, about 48% of voters who own digital assets plan to vote for Donald Trump in the upcoming U.S. presidential election. However, only 38% prefer Biden.

What is behind the softening of the American authorities’ policy?

The cryptocurrency industry is stepping up its profile in Washington in hopes of influencing the upcoming U.S. election, spending unprecedented amounts of money to support crypto-friendly candidates and train lawmakers.

While the industry’s past efforts to shape national elections have been largely unsuccessful and, in the case of former FTX CEO Sam Bankman-Fried, criminal, the crypto industry’s growing political influence now appears to have greater staying power.

Thus, soon, the Biden administration may change its aggressive rhetoric toward cryptocurrencies to a friendly one to catch up with Trump in this direction, who has turned crypto into a campaign weapon.