Bitcoin observes a few different bearish signals going off despite strong recovery above $44k, could it be a dead cat’s bounce?

On-Chain Data Shows Bitcoin Miners Have Started Selling, Funding Rates Have Turned Negative

As explained by a CryptoQuant post, a bunch of bearish Bitcoin signals have gone off despite some fresh movement up.

First, the miners reserve has started to decline. This indicator shows the total number of coins that miners are holding in their wallets.

A downtrend in the metric’s value suggests miners have started sending their Bitcoin to exchanges for selling purposes.

Second is the Long-Term Holder SOPR (LTHSOPR) that shows the degree of realized profits and loss for those coins that haven’t moved on the chain since at least 155 days (which means these coins belong to long-term holders).

Related Reading | Will Fear And Greed Keep Bitcoin Buyers From The Halloween Effect?

This metric has also been showing low values, implying these long-term holders are more likely to sell their coins right now.

Here is a chart showing the trend in both these indicators for Bitcoin:

The BTC miners reserve and the LTH SOPR | Source: CryptoQuant

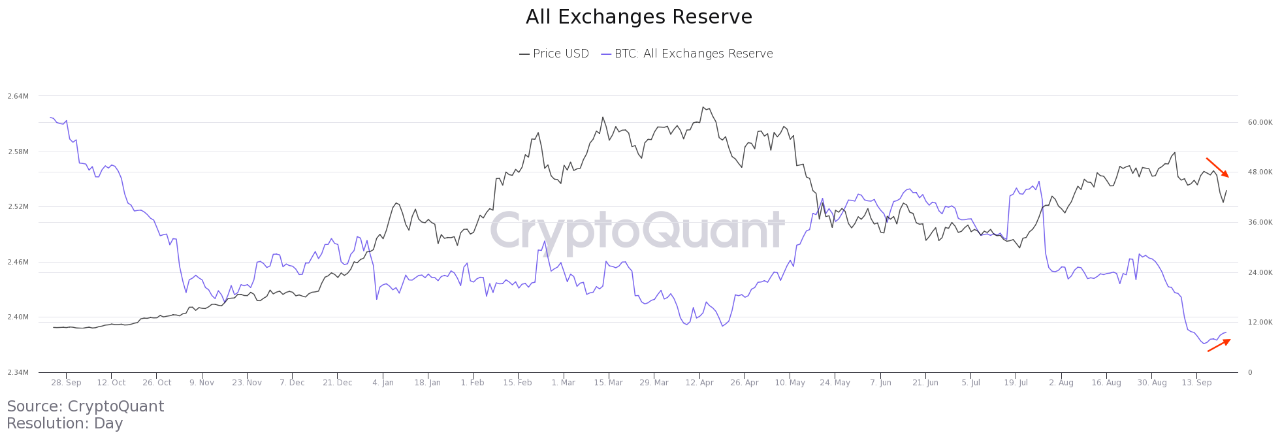

Next is the Bitcoin exchange reserve, an indicator that measures the total number of coins present on wallets of all centralized exchanges.

The below chart shows how the reserve’s value has changed recently:

The indicator seems to showing some uptrend | Source: CryptoQuant

As the graph shows, the Bitcoin exchange reserve has started trending up after a long period of constant decline. When the metric’s value goes up, it means investors are starting to send their coins to exchanges for withdrawing to fiat or purchasing altcoins.

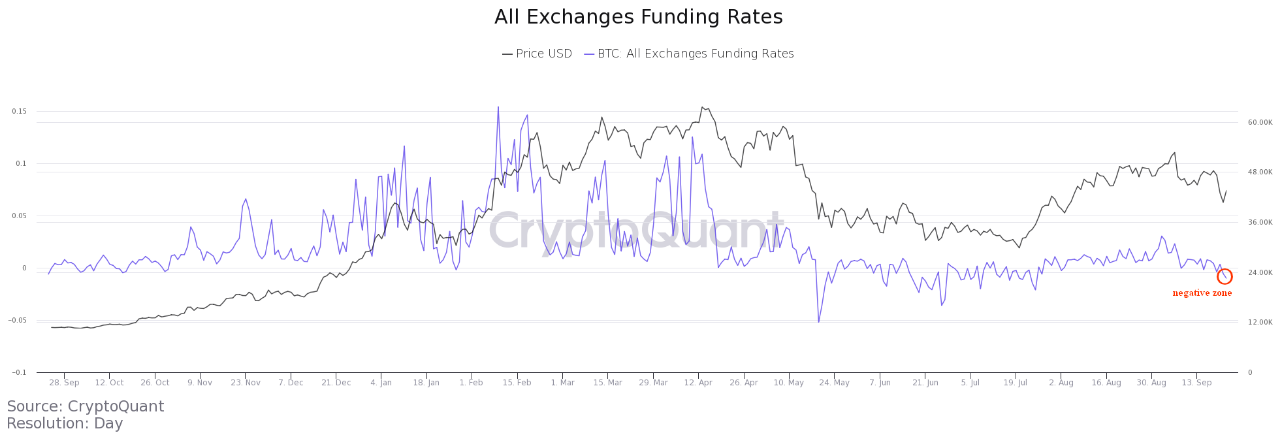

Finally, there is the funding rate, which highlights whether investors are finding long positions better or short ones.

funding rates look to be moving negative again | Source: CryptoQuant

As the above chart shows, the BTC funding rates have dipped below zero, signifying that short positions are more hot right now.

Related Reading | Mid-Cap Altcoins Hold Onto Highs Better Than Bitcoin And Ethereum

What Do These Indicators Mean For BTC’s Price?

All of these signals show a bearish outcome in the short term at least. However, the price has started moving up for now nonetheless.

It’s possible this recovery above $44k is just a dead cat’s jump, and that the price would move down soon as these indicators suggest, but there is still some chance this recovery holds.

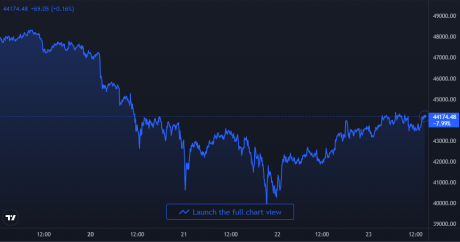

At the time of writing, Bitcoin’s price floats around $44k, down 7% in the last 7 days. The below chart shows the trend in the price of the coin over the last five days.

BTC's price has started moving up after making a touch of $39.6k | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com