The total crypto market cap added $78.1 billion to its value for the last seven-days and now stands at $637.4 billion. The top 10 currencies were mostly in green for the same time period with Litecoin (LTC) adding 27.6 percent to its value while ChainLink (LINK) lost 4.7 percent. By the time of writing bitcoin (BTC) is trading at $22,860, ether (ETH) is hovering around $616. XRP dropped further to $0.532.

BTC/USD

Bitcoin closed the trading day on Sunday, December 13 at $19,155 after successfully rebounding from the weekly support situated around $18,100 a day earlier. It closed the seven-day period 1.1 percent lower.

Bulls successfully re-initiated the uptrend and did not allow further decline even when the price of BTC was pushed below the psychological level of $18,000.

The new trading period started positively for buyers. On Monday, the BTC/USD pair continued to climb and reached $19,279, which was followed by another green day on Tuesday. This time, the leading cryptocurrency hit $19,420 and surpassed the next major resistance line on the weekly/daily timeframe.

The mid-week session on Wednesday was one to remember. Bitcoin formed its fifth consecutive green candle on the daily chart and skyrocketed all the way up to $21,368 registering a new all-time high. This resulted in a 10 percent jump. Naturally, the coin also reached its highest market cap ever at $383.5 billion.

The rally continued on Thursday, December 17 and the BTC/USD pair climbed further to $22,819 and grew by another 6.7 percent. The biggest crypto entered a price discovery mode with no defined resistance in its way.

The Friday trading was no different and BTC achieved a new major milestone – breaking above $23k ($23,140).

The cryptocurrency market seemed unstoppable now and the fearing-of-missing-out or FOMO started to kick in with retail interest going through the roof.

On the first day of the weekend, bitcoin hit $24,170 before closing at $23,870 in the evening. Then on Sunday, it made a small pullback to $23,464.

The 24-hour trading volumes were hovering in the $22-$23 billion area for the first three days of the workweek then started to pick up the pace and peaked at $61 billion on Thursday. They dropped to $31 billion on Friday and Saturday morning and increased back to $36 billion late on Saturday and on Sunday.

ETH/USD

The Ethereum project token ETH successfully regained position above the weekly support at $560 on Saturday, December 12. It made another step forward on the next day and closed the week at $591, still 1.8 percent down compared to the previous seven-day period.

On Monday, the ETH/USD pair stabilized around the above-mentioned level in what seemed to be a consolidation before the continuation of the uptrend.

The trading day on Tuesday, December 15 was a quiet one, with low price volatility. The ether remained at $590.

The third day of the workweek brought a wave of optimism to the cryptocurrency market and the altcoins surged following the example of BTC. The ETH token climbed up to $638 for the first time since May 2018, adding 8.1 percent to its value.

On Thursday, December 17, it hit $677 during intraday, moving above the next monthly resistance line, but the momentum was not strong enough for such a big step and ETH registered a small green candle to $642.

The coin made another step up on Friday and reached $655 as the upward movement was not showing any signs of exhaustion. The move resulted in another 2 percent being added to the value of ETH.

The weekend of December 19-20 began with another attempt to break the mentioned horizontal level. Buyers again failed but were already closing the gap.

On Sunday, December 20 it made a healthy retrace down to $638, but not before hitting the weekly support at $620.

XRP/USD

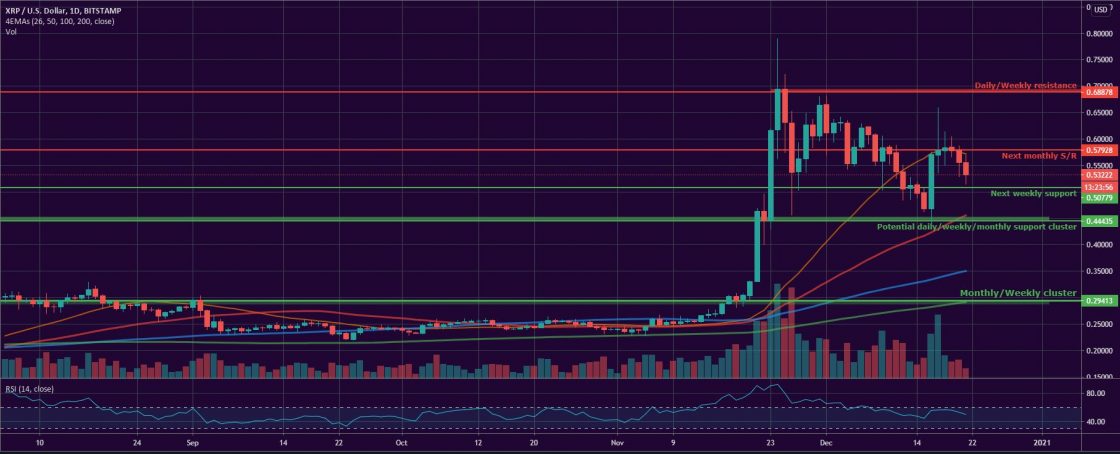

The Ripple company token XRP closed the session on Sunday, December 13 at $0.513 after trading in the wide-area between $0.458 and 0.53 throughout the day. Bulls were fighting hard to defend the weekly support line at $0.50 after losing 17.5 percent for the seven-day period.

On Monday, the XRP/USD pair broke below the mentioned horizontal support and formed a short red candle to $0.496. It continued to slide on Tuesday, December 15, and hit $0.468, already threatening to breach the monthly/weekly support cluster at $0.445.

The mid-week session on Wednesday brought some relief for buyers. The “ripple” fell as low as $0.435 in the early hours of trading then managed to recover later in the evening by skyrocketing all the way up to $0.57, reaching the short 27-day EMA. The coin added 21.8 percent to its value and kept the uptrend intact, at least temporarily.

Thursday, December 17 was an extremely volatile day for the crypto markets and especially for XRP. It was moving up and down in the $0.536 – $0.661 range before closing with a short green candle to $0.58, the next major monthly line on the chart.

The last day of the workweek did not bring any major changes in the price of the altcoin and it continued to hover around the mentioned zone.

The weekend of December 19-20 started with a small drop to $0.576 on Saturday as neither bulls nor bears could trigger a trend.

The coin continued to slide on Sunday by closing at $0.556, still below the monthly resistance.

Altcoin of the Week

Our altcoin of the week is SwissBorg (CHSB). Another relatively unknown altcoin, SwissBorg stormed into CoinGecko’s top 100 list and is now ranked at #73 with a market capitalization of approximately $248 million.

CHSB is a blockchain-based wealth management system from Switzerland. According to the official webpage, the project enables users to manage their funds by utilizing it app features including yield and arbitrage instruments.

The coin grew by 132 percent for the last seven days, peaking at $0.279 on Sunday. December 20.

As of the time of writing, it is trading at 0.0000098 against BTC on HitBTC.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4