Since January, there have been over 10 million inscriptions on the largest blockchain in the world, and this number continues to grow exponentially.

To provide some context, the Ordinals Protocol allows for the ordered identification of satoshis, the smallest subdivision of a Bitcoin (BTC), enabling each of them to have an individual identity. From that people can inscribe sats with arbitrary content, creating Bitcoin-native digital artifacts, more commonly known as nonfungible tokens (NFTs).

Among the various narratives resulting from this technique, the existence of an extremely underground group of individuals who identify, track and trade high-value historical satoshis has come to light. They are known as “sat hunters.”

There is no denying that the Bitcoin ecosystem is undergoing a period of tremendous innovation since the advent of the Ordinals Protocol in early 2023.

Their main activity involves transacting millions of BTC in search of satoshis that were present in historical moments of the crypto world.

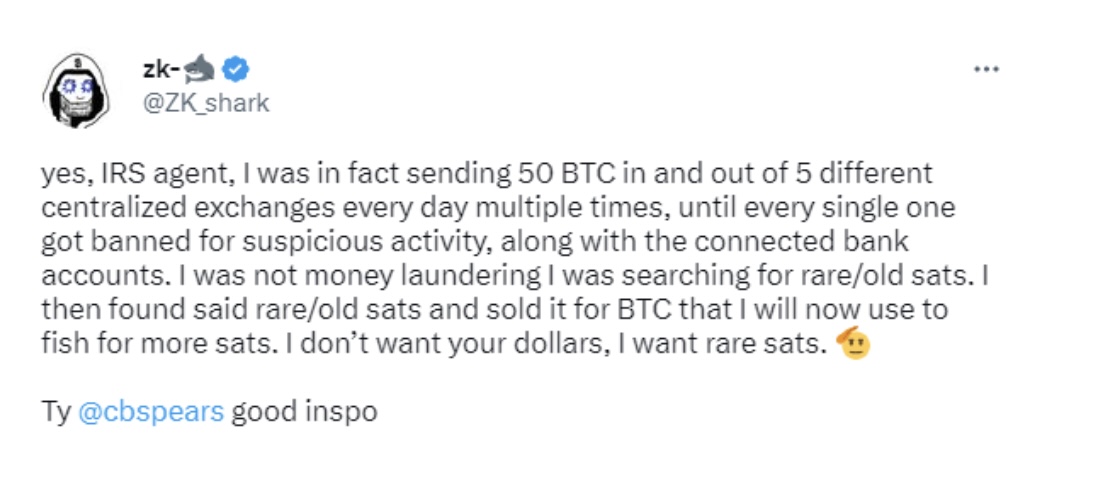

This practice is known as “sat hunting” and can be compared to continuously withdrawing money from a bank in search of rare coins: You withdraw $10,000, keep $1 of rare coins, deposit the remaining $9,999, and repeat the process of withdrawing another $10,000 in a continuous cycle.

Related: Users will decide if they can still trust Ledger with their seed phrases

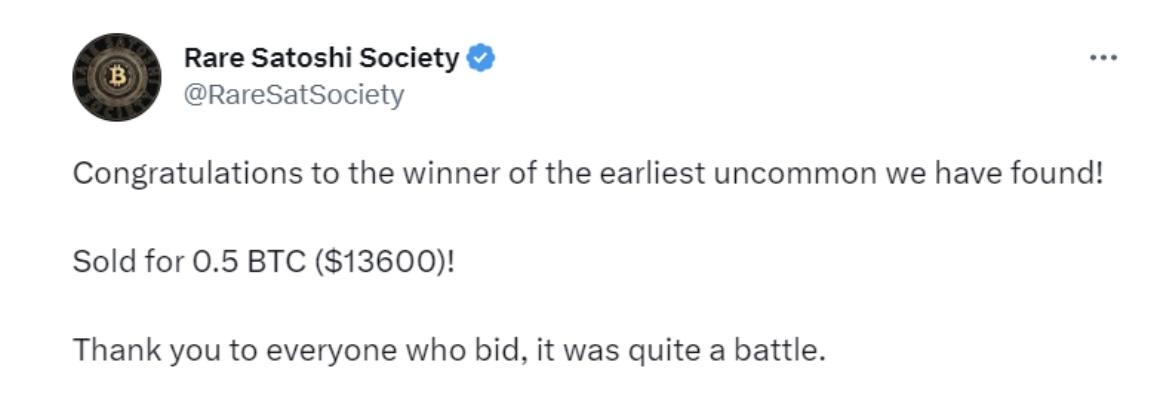

The group that holds the largest amount of rare satoshis is the Rare Satoshi Society, which has already traded more than $1 billion in Bitcoin volume in pursuit of these historical sats.

They are becoming well-known for providing rare satoshis for the majority of Ordinals experiments and even sold a single satoshi for 0.5 BTC.

And it’s fascinating to observe how some Ordinals projects are adopting this narrative. One example is the Nakamoto Whales project, which minted a portion of its collection into rare satoshis from the first thousand mined blocks, including one mined by Satoshi Nakamoto.

Alongside the deployment of NFTs in rare satoshis, there is also an emerging trend of historically inscribed fungible tokens (BRC-20). DAnTer, a member of the Rare Satoshi Society, recently inscribed a collection, FHAL, onto a satoshi that was mined by the legendary Hal Finney on block 78 with the purpose of democratizing access to such a historical asset for more individuals.

Now, according to DAnTer, we have entered an era where one Bitcoin is no longer equal to one Bitcoin — and a satoshi becomes equal to infinity.

Related: Pepe would be ashamed of PEPE investors

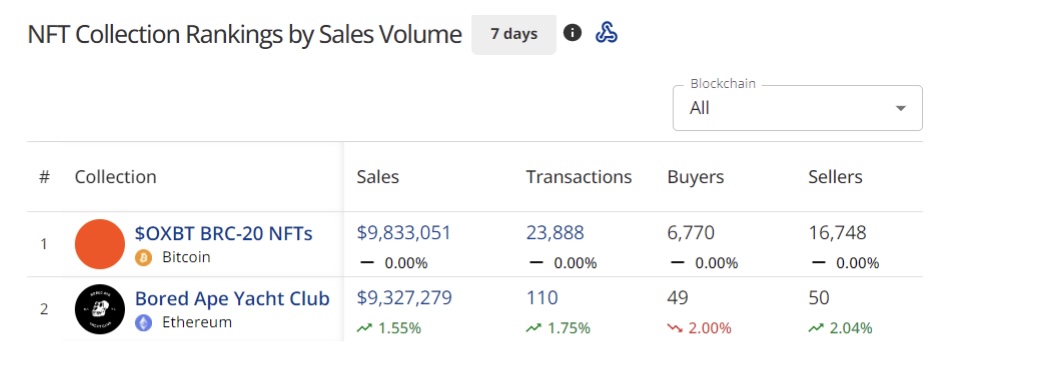

And although the narrative of historical satoshis still remains underground, fungible tokens on the Bitcoin network are hotter than ever. OKX, one of the largest exchanges in the world, just announced the listing of ORDI, the largest BRC-20 token in terms of market capitalization, while OXBT, one of the most popular BRC-20 tokens, has surpassed Bored Ape Yacht Club in the seven-day volume chart — just after its launch.

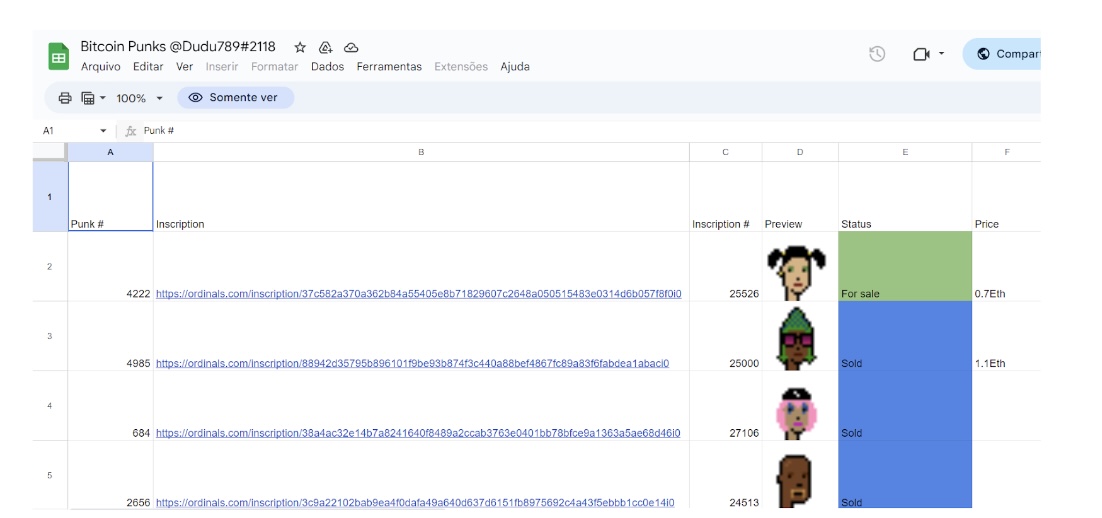

In February, people were trading Ordinals using Excel spreadsheets due to the lack of infrastructure. Today, just a few months later, major exchanges are joining this movement. Big brands like Bugatti have shown interest in the rare sats narrative, and there is even discussion about smart contracts on the Bitcoin network.

Could this be the phase of the greatest innovation and onboarding in the history of Bitcoin?

Lugui Tillier is the chief commercial officer of Lumx Studios, a leading Web3 studio that counts BTG Pactual Bank, the largest investment bank in Latin America, among its investors. Lumx Studios has previous Web3 cases with Coca-Cola, AB InBev, Nestlé and Meta.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.