Bitcoin rallied continued during the European session Thursday as traders ignored Washington’s political unrest to focus instead on the potential for higher sovereign spending.

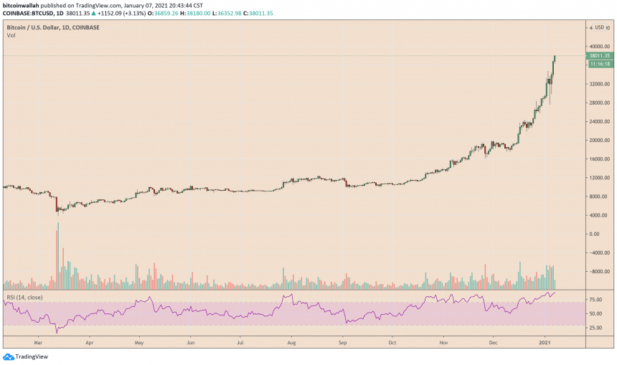

The BTC/USD exchange rate established a new record high of $38,180, adding 10 percent to what has been a relentless uptrend in the last four quarters. While the pair pared some of those gains later, the overall enthusiasm across the risk-on markets suggested it would continue posting gains in the US session ahead.

Bitcoin closes above $38,000 in the latest intraday rally. Source: BTCUSD on TradingView.com

Investors’ bullish outlook on Bitcoin improved further after Democrat Jon Ossoff’s victory in the second of two Senate run-off elections in Georgia. The seats handled control of the US senate to President-elect Joe Biden’s administration. That raised the hopes for additional stimulus for the US economy, beginning with a $2,000 worth of direct aid to deserving Americans.

A joint session of Congress Thursday morning also affirmed a clear win for Mr. Biden. Meanwhile, outgoing President Donald Trump agreed to an “orderly transition” of power after denying it since Biden’s lead in the US presidential race.

“The expectation is now we’ve avoided a gridlock, and more fiscal support will be available to the economy through this coming year, rather than less,” Christopher Smart, chief global strategist at Barings, told the Wall Street Journal.

Bitcoin To The Moon

So it appears, Bitcoin traders reacted optimistically to the overall political update.

The cryptocurrency surged by almost 900 percent after bottoming out in March 2020 at below $4,000. Its gains surfaced primarily after the Federal Reserve announced an open-ended government and corporate debts purchasing program and decided to cut benchmark lending rates to near-zero.

Meanwhile, the US government approved a $2.3 trillion stimulus package for American households and businesses suffering from the coronavirus pandemic’s economic aftermath. In December 2020, the White House passed another $900 billion worth of aid against the Democrats’ demand for “at least $2 trillion.”

“When it comes to the young people’s hands they are going right to their accounts,” said Mike Novogratz, CEO of Galaxy Investment Partners, on stimulus driving market gains. “One of the most unique things last time was seeing how many people bought Bitcoin with the exact amount of stimulus. Boom. Boom.”

Institutional investors are also gaining exposure in the Bitcoin market, believing that the strategy would protect their portfolio as their cash reserves lose value. Hedge fund veterans including Paul Tudor Jones and Stan Druckenmiller bought a small portion of Bitcoin in 2020.

Meanwhile, companies like MassMutual, MicroStrategy, Square, Ruffer Investments, also purchased Bitcoin against their fears of inflation.