Bitcoin (BTC) held onto $5,000 support on March 14 as markets broadly steadied after many saw their worst week in over 30 years.

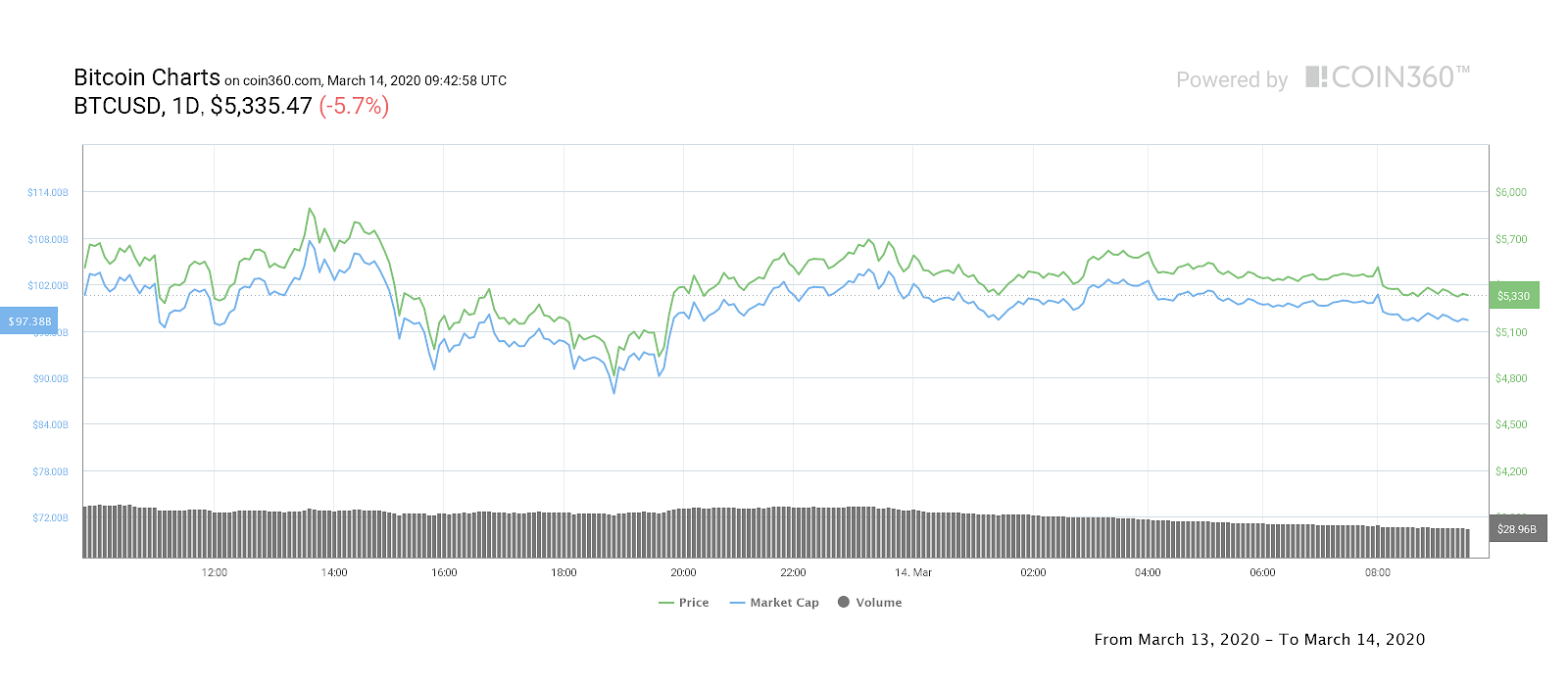

Cryptocurrency market daily overview. Source: Coin360

BTC price crash “did not break the model”

Data from Coin360 and Cointelegraph Markets showed BTC/USD circling $5,300 at press time on Saturday. Volatility remained high, with the pair’s 24-hour range close to $1,000.

Bitcoin was fresh from daily lows of $4,940, which came hours after trader Tone Vays predicted that the cryptocurrency would dip below $5,000 for a final time.

Trajectory remained uncertain, he said, but argued that in spite of this week’s huge losses, markets had not witnessed enough “pain” at Friday’s levels.

Bitcoin 1-day price chart. Source: Coin360

Similarly cautious was Cointelegraph Markets analyst filbfilb, who noted that while buying appetite was back on exchanges, there was little room to breathe a sigh of relief.

Late Friday, he told subscribers of his Telegram trading channel:

“Bid side of the orderbook has massively recovered. I certainly don’t think we are out of the woods but a squeeze up looks logical to me.”

So far, however, that squeeze has yet to occur.

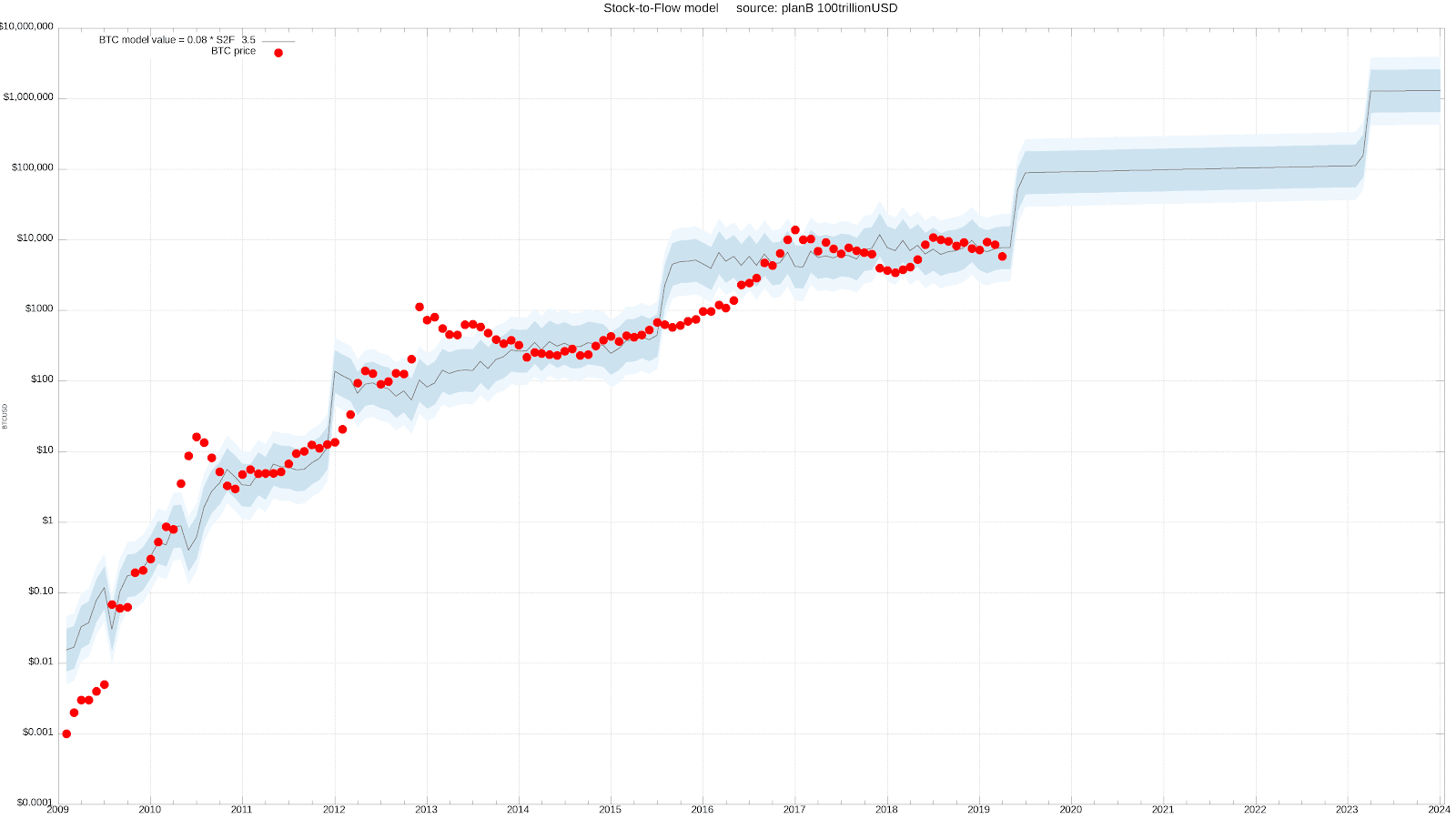

Even at current levels, however, Bitcoin was not disappointing everyone. PlanB, the creator of the stock-to-flow Bitcoin price model, noted that at around $5,000, BTC/USD was still well within its expected range.

“Some people think S2F model broke yesterday. Of course it did not,” he tweeted on Friday following Bitcoin’s crash to $3,700.

“#bitcoin oscillated nicely around model value and stayed well within model bands. The extreme volatility within the model bands shakes out the weak hands. No extreme returns without extreme risk (volatility).”

Bitcoin stock-to-flow model with $3,700 dip (most recent spot). Source: PlanB/ Twitter

CME Bitcoin futures volume down 80%

On derivatives markets, meanwhile, investor preferences were also being laid bare as the week closed.

Data from monitoring resource Bakkt Volume Bot showed a decline in open interest and volume for Bakkt’s Bitcoin futures product. Bakkt traded 1,386 contracts of 5 BTC each on Friday, down considerably from its all-time highs of 6,601 seen in December.

Bakkt Bitcoin futures volumes and open interest. Source: Bakkt/ Twitter

At the same time, as Cointelegraph reported, derivatives giant BitMEX saw some of its highest overall volumes ever, as huge waves of liquidations accompanied extreme volatility in Bitcoin.