Bitcoin’s intrinsic value has been heavily discussed in the crypto community this week following a remark by the governor of the Bank of England suggesting that the cryptocurrency may have no intrinsic value.

Does Bitcoin Have Intrinsic Value?

Bank of England Governor Andrew Bailey talked about bitcoin’s intrinsic value during a question and answer session with members of the public early this week. “I have to be honest, it is hard to see that bitcoin has what we tend to call intrinsic value,” he was quoted by Reuters as saying. “It may have extrinsic value in the sense that people want it.” Furthermore, the governor said people using bitcoin for payments makes him “very nervous” because the value of the cryptocurrency is uncertain.

Following Bailey’s remark, the crypto community began discussing bitcoin’s intrinsic value in some detail. Michael Saylor, the CEO of Nasdaq-listed company Microstrategy that recently bought $425 million worth of bitcoin for its treasury reserve, tweeted:

Bitcoin is the first digital monetary system capable of storing all the money in the world for every individual, corporation, and government in a fair & equitable manner, without losing any of it. If that’s not intrinsically valuable, what is?

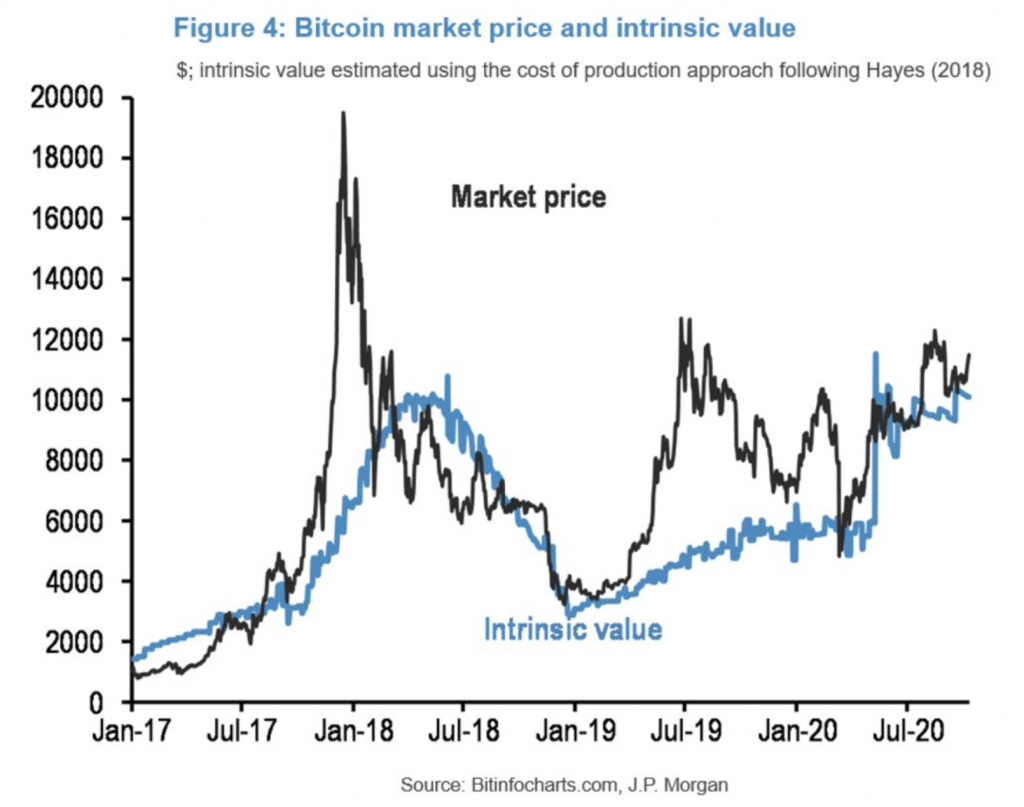

JPMorgan’s strategists, including Nikolaos Panigirtzoglou, wrote in a note on Tuesday about bitcoin’s intrinsic value approaching its market price. “Bitcoin faces a ‘modest headwind’ in the short term based on an analysis of bets in the futures market and an estimate of the cryptocurrency’s intrinsic value,” Bloomberg reported them explaining, adding that they said the price remains about 13% higher than an estimate of intrinsic value.

A number of people on Twitter were quick to point out that bitcoin may have no intrinsic value, but neither do fiat currencies. The Federal Reserve Bank of St. Louis published a report back in 2018 stating:

Bitcoin is not the only currency that has no intrinsic value. State monopoly currencies, such as the U.S. dollar, the euro, and the Swiss franc, have no intrinsic value either.

“They are fiat currencies created by government decree. The history of state monopoly currencies is a history of wild price swings and failures. This is why decentralized cryptocurrencies are a welcome addition to the existing currency system,” the report notes.

“There is no such thing as ‘intrinsic value,’” Shapeshift CEO Erik Voorhees opined. “Value is always subjective, in the eyes of the valuer … Gold, bitcoin, fiat, rice: none have ‘intrinsic value.’”

Twitter user Bob McElrath shared the sentiment. “Nothing has ‘intrinsic value,’ because the word ‘value’ is human sentiment, and changes with time and circumstance. Anyone who says otherwise is trying to sell you something,” he described. “Despite not having ‘intrinsic’ value, bitcoin has a sophisticated, market-based way to determine its value, not only on the demand side but on the supply side as well. Of course, this statement is true for any commodity.”

Cato’s Center for Monetary and Financial Alternatives director George Selgin chimed in:

Of course no goods have ‘intrinsic’ value. Some (like any fiat money) also lack ‘non-monetary use value’ … the Bank of England’s observation that bitcoin lacks intrinsic value is an instance of the pot calling the kettle black.

What do you think about bitcoin’s intrinsic value? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, JPMorgan, Bloomberg

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.