Earlier this week, British-American entrepreneur John McAfee, who is currently living “in exile” due to tax-related charges filed against him by the United States authorities, launched his own decentralized exchange (DEX).

The expressive crypto advocate’s McAfeedex.com is running on the Ethereum (ETH) blockchain, and, in McAfee’s own words, it is a “Wild Wild West exchange” that purportedly cannot be seized by regulators. “There is nothing to shut down,” he wrote on Twitter, “Our technology is the smart contracts forever residing on the blockchain.”

According to the businessman, the DEX, currently in beta, is open source and imposes no Know Your Customer (KYC) or Anti-Money Laundering (AML) requirements on its customers.

But can a crypto trading platform be fully exempt from regulations in the current, post-ICO environment, where authorities are actively prosecuting bad actors and discussing the possibility of digital assets in Congress?

In the new Crypto Myths series, Cointelegraph will attempt to debunk various assumptions circling around the crypto space.

What’s a DEX?

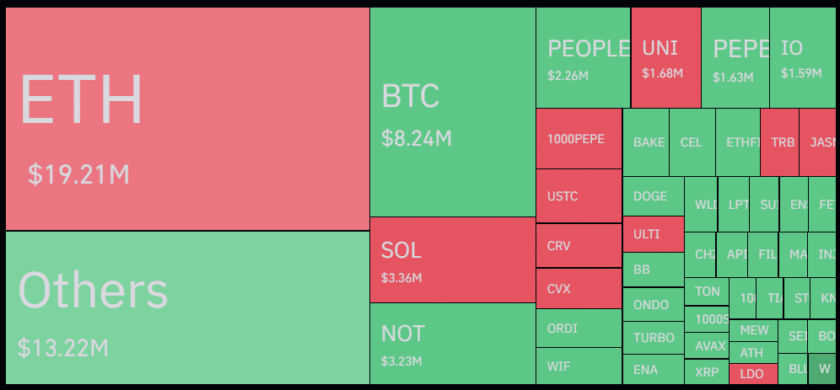

In the most basic sense, there are two kinds of cryptocurrency exchanges: centralized and decentralized. The former are much more popular, as they seem to account for more than 99% of the global cryptocurrency trade volume. As a testament to this fact, the largest and most well-known trading platforms — Coinbase, Kraken, Binance, Bittrex, etc. — are all centralized.

They act as middle men, connecting people willing to trade cryptocurrencies while holding their assets on company-owned wallets. As a result, once a trader deposits their coins onto a centralized exchange, he or she essentially hands over control of their private keys, trusting the platform with the safety of their assets.

This practice goes against the decentralized agenda prominent in the cryptocurrency space, namely the catchy, “Not your keys, not your Bitcoins” proverb. Last year, Vitalik Buterin, co-founder of Ethereum, went as far as to say that centralized exchanges should “burn in hell.”

Related: DEX, Explained

DEXs, therefore, are built in such a way that allows users to retain ownership of their cryptocurrencies and private keys. Specifically, they are peer-to-peer (P2P) services that allow direct transactions between two interested parties directly on the blockchain. Moreover, given that DEXs use smart contracts to facilitate trade, they require far less supervision compared to centralized platforms.

While some people still find it easier to trust a third party with their private keys, DEXs have other major benefits over centralized exchanges, namely anonymity and security. Indeed, decentralized platforms are much more difficult to hack, since they rely on smart contracts. This contrasts with the regular breaches experienced by centralized servers, resulting in multi-million losses every year. Additionally, lax KYC requirements are also a plus for the cryptocurrency enthusiasts who value anonymity.

DEXs are still lagging behind centralized platforms. Why?

DEXs remain a strongly alternative option, as proven by relatively low liquidity rates. There are a number of reasons for that, experts say, like cost and speed of trading. Andrej Cvoro, CEO and founder of R&D blockchain firm Decenter, explained to Cointelegraph, “Centralized exchanges are of course historically older and hence had more time to accumulate both users and liquidity, win users’ trust and tweak the user experience.” According to Cvoro, even some supposed advantages of DEXs come with certain drawbacks, while security is also an issue:

“DEXes are trustless systems where users keep their funds within their wallets and have them exchanged through smart contracts, but this does involve on-chain interactions, which then includes waiting for transactions to be mined and paying required fees for them. DEXes also expose all orders and the accounts making them, which some users want to avoid. Finally, DEXes could also have security issues and have known to struggle with issues such as front-running”

User experience and institutional involvement are other factors that should be taken into consideration, according to John Todaro, director of research at TradeBlock, a provider of institutional trading tools for digital currencies. The analyst told Cointelegraph that centralized exchanges, by nature, would have more institutions and market makers using them, adding that:

“Given institutions typically operate within a specific regulatory sandbox, they are more comfortable trading through centralized exchanges than DEXs. Further, the majority of retail flows are concentrated on centralized exchanges. Using a DEX requires a deeper understanding of wallets and exchange order books than using a centralized exchange such as Coinbase which can be accessed via a smartphone app, and thus has limited the customer pool for DEXs.”

Decentralization as a spectrum

Another crucial problem for DEXs lies within their name, as there is no clear definition that would fully explain what this kind of trading platform should entail. As the phenomenon became more popular last year, many well-known cryptocurrency exchanges like Binance and Huobi decided to use their brand to launch their own decentralized marketplaces while applying the same compliance principles. In fact, the majority of DEXs now follow regulatory standards like KYC and AML in much the same way as centralized platforms, Todaro said:

“Many DEXs have KYC/AML procedures in place and decide which tokens are added to their platforms. Regulators have shown in the past that DEXs are subject to existing exchange requirements, and if DEXs do not comply, DEX creators are subject to fines and other repercussions.”

Some experts are even reluctant to call those exchanges decentralized. “Today, most exchanges which call themselves decentralized exchanges are actually only non-custodial exchanges,” said Eyal Shani, a blockchain researcher at consulting firm Aykesubir. He elaborated:

“They do not own your digital assets, but the exchange operator is still much in control of everything regarding the platform. Any exchange that relies on a traditional web front to facilitate the order book, runs normal KYC/AML processes are not completely decentralized. But that’s a matter of definition.”

In Shani’s view, a true decentralized exchange would be the one that facilitates fee-free transactions between people without the need for KYC or AML, he noted:

“However, running such an operation is usually costly, and those who engage in that kind of business usually wishes to make a profit out of it. And this is where the law kicks in and dictates that if one is making profit out of the operation, he is de facto in charge of it, and requires that entity to run KYC/AML among other requirements”

Thus, to avoid potential confusion, decentralization should be seen as “a spectrum, rather than a binary, black and white classification,” Cvoro suggested, providing some specific examples:

“On one end, there are the least decentralized options, such as Binance DEX, that require KYC, have limited availability depending on the user’s country of residence and rely on centralized, server-based order matching, among other things. And on the other end there’s, for example, Uniswap that has no KYC whatsoever, has unlimited global availability and does everything on-chain without any accounts with admin privileges of any sort.”

So what about McAfee’s DEX, boldly marketed as an independent platform and backed by someone who is himself hiding from authorities in international waters? Shani said in an email to Cointelegraph, “To the best of my understanding, McAfee’s DEX does profit from running the operation, so I recommend him to ask the creator of EtherDelta what the SEC thinks of those kind of exchanges.”

Shani was referring to when U.S. authorities charged Zachary Coburn, the founder of decentralized crypto token trading platform EtherDelta, with operating an unregistered securities exchange.

Related: McAfee on BTC, Exile & the US: ‘No Way the Current System Can Survive’

Coburn neither admitted nor denied the allegations, but consented to pay the state over $300,000 in unlawful profits, along with other penalties. Although, McAfee is well-aware of the concerns of the Security and Exchange Commission (SEC) — at least according to his Twitter, where he wrote:

“SEC says as long as we follow AML and KYC procedures the http://McAfeedex.com exchange is OK. But we don’t follow either and why should we even if we could? We are just a window into the blockchain where people trade. This is for the people, not the Government. F*ck them.”

Thus, even though the McAfee DEX “does stand out as one of the more decentralized exchanges out there” due to having a decentralized listing process and self-custody on top of requiring no personal information for KYC and AML procedures, “there are still likely central points of failure on the back-end that regulators could target,” says Todaro.

Myth busted?

Theoretically, it is possible to run a fully decentralized exchange, Shani told Cointelegraph. However, it would certainly involve much less profit for the owners, especially considering the current trading volumes that DEXs are demonstrating. Shani added:

“There is a way to run a truly decentralized DEX. But it could potentially be so expensive that it would scare away the small traders. For that to happen, in addition to having no KYC/AML, running the orderbook and saving all data on replicating systems. But even then the government could block those services, fine whoever is involved etc.. So we would need a decentralized DNS servers, decentralized ISPs and many more services which are great solutions. Yet, based on the current volume on the so called DEXes, it seems like a solution looking for a problem, rather than a true product-market fit.”

Indeed, based on the current trading history displayed on the McAfee DEX, it seems that the service has yet to experience a massive influx of traders. Todaro explained that generally, cryptocurrency traders tend to value other features besides anonymity and decentralization:

“There is a demand for fully decentralized exchanges, but I would expect the vast majority of traders and exchange users to prioritize liquidity, token availability (i.e. access to more tokens than just ERC-20s), and ease of use over a platform that ‘no one can block.’”

Therefore, it is still unclear whether the market is ready for a fully decentralized exchange, even if there is one. Given that the top-three trading platforms are calculating their each and every step (namely in the U.S. market) to avoid facing large fines from regulators, it would seem unlikely that a “true” DEX could perform that well in the current landscape — in terms of profit, at least.