sponsored

CoinFLEX, a leading derivatives exchange and yield platform, has announced the second iteration of their innovative AMM+ (Automated Market Maker) platform—making the yield-earning product more accessible to everyday investors.

AMM+: Leveling up the AMM model on a CeFi platform

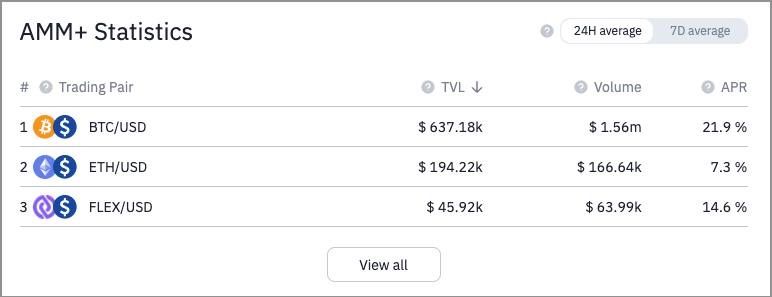

AMM+ Statistics

The revamped AMM+ page now offers users a statistical summary they can easily reference to access relevant information when selecting a market pair. This includes key figures such as average TVL (total value locked), volume, and APR across both 24-hour and 7-day time periods.

Tips and Guidance

AMM+ emphasizes an educational user experience, equipping users with the necessary skills and tools to navigate around both the product and relevant markets. The ‘Tips and Guidance’ toggle is turned on by default to provide users with simple explanations for different AMM+ features.

Setting Your Price Range

The live price chart offers users the ability to set their price range while directly referencing live, real-time prices from the CoinFLEX platform. For those who choose to use the ‘Capital Boost’ feature, an associated liquidation price can be seen on the chart in the form of a dotted red line. The more Capital Boost used, the closer the liquidation price will be to the limits of the chosen price range.

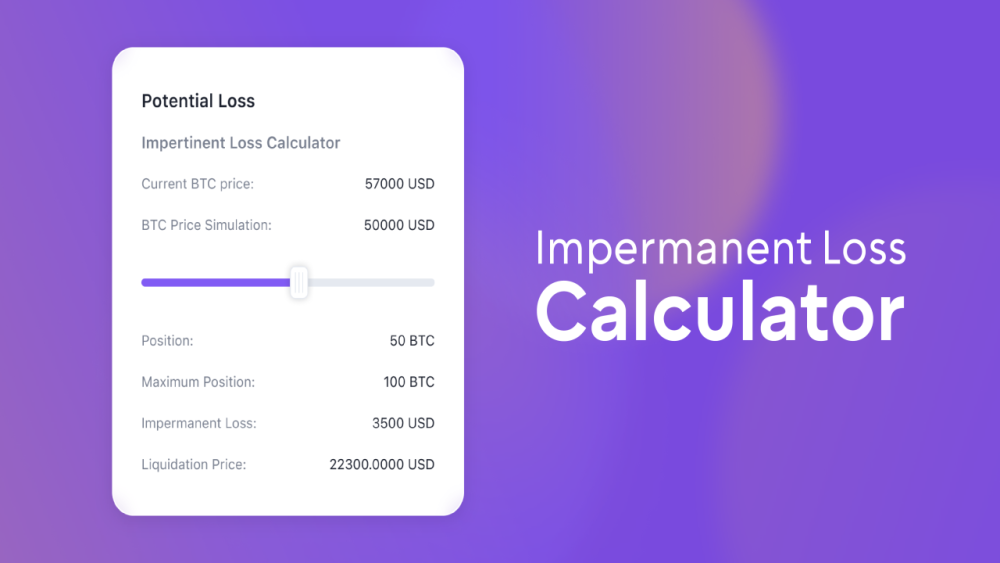

Impermanent Loss Calculator

Calculating impermanent loss (IL) has long been a headache for AMM users across the DeFi space. The AMM+ platform includes an innovative built-in IL calculator, so that users can simulate impermanent loss at specific prices—and the prices at which impermanent loss is eliminated. Providing this information upfront is key to making informed decisions when deploying capital through AMM+, and highlights the company’s commitment to accessibility and ease-of-use.

Yield

Below the IL calculator, users can see a simulated yield on their particular AMM+ position based on information such as the selected trading pair, price range, deposit amount, and for those utilizing leverage—the amount of Capital Boost. This gives traders a chance to estimate their returns before deploying any capital, and incorporate this information into their decision-making.

At the Forefront of Crypto Yield 2.0

Crypto yield opportunities are quickly evolving and expanding. Crypto Yield 2.0 is an indication of the shift from yield opportunities sourced through centralized intermediaries to those accessed “direct-from-market” across CeFi and DeFi. These opportunities are becoming more accessible to the mainstream through improved platform tools, dApps, and education. CoinFLEX remains at the forefront of this transition, building out the next generation of Crypto Yield 2.0 opportunities.

What is Crypto Yield 1.0?

- Staking assets through third-party lending platforms and earning fixed or variable interest.

- DeFi yield-farming and (often unsustainable) liquidity incentivization.

- Farming-as-a-service products through clunky CeFi integrations.

What are some issues with Crypto Yield 1.0?

- Higher double- or triple-digit rates of return are associated with smaller low-cap coins, while on AMM+ these numbers can be achieved on ‘blue-chip’ coins such as BTC, ETH, or XRP.

- DeFi risks such as impermanent loss are more easily mitigated on AMM+ as impermanent loss only exists in one direction, i.e. for users who choose a price direction that is “overall increasing” or “overall decreasing”.

What is Crypto Yield 2.0 about?

- Allowing users to source yield directly from the crypto futures market versus centralized intermediaries, resulting in higher yields for end-users.

- Accessing transparent, market-based, sustainable yields.

How will AMM+ drive forward Crypto Yield 2.0?

- Generating yield directly from futures market activity, allowing users to earn continuous yield over the long-term without relying on arbitrary liquidity incentives that can change at any time.

- Offering higher APRs compared to standard DEXes due to higher trading volumes on futures orderbooks vs. lower volumes on blockchain-based spot DEXes.

- Enabling users to be more capital-efficient with the use of leverage.

About CoinFLEX

Founded in 2019, CoinFLEX is the Home of Crypto Yield and is committed to provide passive investors and active traders an accessible platform to earn and trade crypto. CoinFLEX creates innovative solutions to bring investors and crypto markets together through intuitive yield products such as flexUSD, the world’s first interest-earning stablecoin, and AMM+, the most capital-efficient automated market maker in the world.

CoinFLEX is backed by crypto heavyweights, including Roger Ver, Mike Komaransky, Polychain Capital, and Dragonfly Capital. In 2021, the platform achieved $9 billion in daily trading volume.

Telegram | Twitter | Discord | LinkedIn | Facebook | Youtube | Reddit

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.