Crypto taxation tool CoinTracker has released a report comparing the prevalence of cryptocurrency ownership across major cities in the United States. The report is based on user data that CoinTracker has been collecting since 2013.

CoinTracker found that the top four ranked cities by average crypto portfolio size are all in California’s San Francisco Bay Area, with San Francisco proper at approximately $55,000 followed by Palo Alto with $39,000, Oakland with $35,000 and San Mateo with $30,600.

Only four cities outside of California are home to investors whose average crypto holdings exceed $20,000 in the U.S. — with Seattle, New York, Tampa, and Pittsburgh investors holding between $27,000 and $21,000 on average.

Concentration of investors

The findings also show a significant concentration of crypto investors in the cities of San Francisco and New York — with their combined “crypto user index” roughly equating to that of the next four highest-ranked cities combined.

San Francisco is the top U.S. crypto city by the number of investors and thus scored a user index of 100.

New York ranks second for crypto investor density with a user index rating of 92, however, it ranks sixth by the average value of holdings at nearly $23,000.

Los Angeles has the third-largest density of crypto investors with a user index of 57.2, followed by Chicago with 48.8, and Seattle with 39.7.

Ashburn, Virginia tops per capita crypto holder rankings

Despite comprising a small town of 43,000 in Virginia, Ashburn tops the list for crypto ownership density when assessed on a per capita basis.

Despite its small population, Ashburn has been described as the “Center of the Internet,” with 70% of internet traffic passing through the city that also has the fourth-largest data center density in the United States.

Washington’s Redmond, a city outside of Seattle and the “bicycle capital of the northwest,” has the second-highest number of crypto investors per capita, followed by San Francisco.

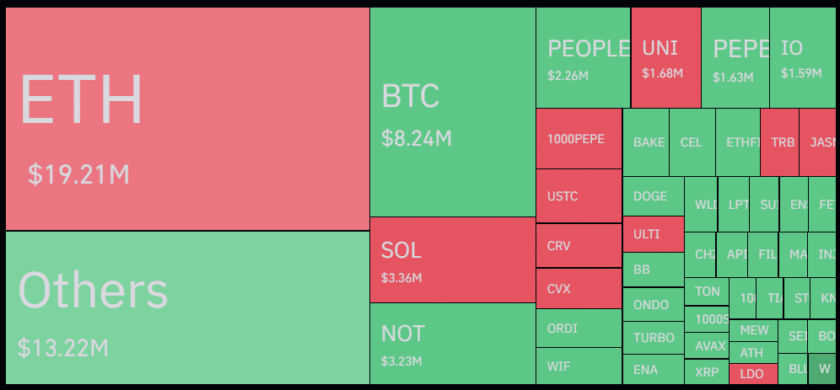

79% of U.S. crypto wealth is held in Bitcoin or Ether

Bitcoin (BTC) investments comprise 50.3% of CoinTracker users’ crypto portfolios, followed by Ether (ETH) at 28.7%.

Tether (USDT) ranks third at4.1%, followed by Litecoin (LTC) at 3.3%, Ripple (XRP) at 3.1%, Chainlink (LINK) at1.9%, and Bitcoin Cash (BCH) and Tezos (XTZ) with 1.7% each.

The eight-most popular crypto assets comprise 94.8% of U.S. virtual currency holdings combined, with all other crypto assets representing less than 1% of total capital in the cryptocurrency markets each.

Ether investments outweigh the Bitcoin holdings of investors in San Diego, Nashville, Seattle, Boston, San Francisco, and The Bronx — with Ether comprising more than 50% of crypto wealth in each city.

Investors based in Redmond, San Antonio, Atlanta, and Fremont have the majority of their crypto capital allocated to markets other than BTC or ETH.