This past week, Bitcoin (BTC) price had many investors biting their nails as the top crypto asset turned bearish and is currently fighting to stay above crucial support at $8,300.

Meanwhile, altcoin investors are growing increasingly bullish sentiment wise and a number of lesser-known altcoins rallied impressively throughout the week. Ether price (ETH) is also heating up and the ETH/BTC pair is continuing to flash bullish signals.

Crypto market data daily view. Source: Coin360

The Nov. 15 drop from $186.59 brought Ether price below the ascending trendline and below the $177.57 area where the altcoin has bounced on 3 previous occasions. Ether price eventually found support at $176.79 and has since reversed course and begun to recover lost territory.

ETH USD daily chart. Source: TradingView

The Bollinger Bands and underlying support at $177.57 and $176.79 suggest that Ether has temporarily bottomed and the price is likely to make an attempt to return to the middle Bollinger Band moving average, which is directly aligned with the ascending trendline at $185.28

ETH USD 6-hour chart. Source: TradingView

Based on Ether’s price action since Oct. 27, the current bounce off support appears to be a good entry point for 3.5% to 3.94% gain. Risk-averse traders will probably wait for the price to break above the ascending trendline at $185.28 before considering an entry.

Aggressive traders may have concluded that if Ether price returns to its most recent range an entry at $179.50 represents a 7.08% profit opportunity.

The moving average confluence divergence (MACD) on the 6-hour timeframe shows the MACD line beginning to curve up toward the signal line and the histogram bars have shortened and flipped from red to pink as buying volume increases.

As mentioned earlier, a move to $185.28 would place Ether back above the 50-DMA and the ascending trendline. The volume profile visible range shows a lot of selling pressure at $180 to $186.93. But if the price can clear this node, Ether could run to the upper Bollinger Band arm at $191.33 followed by the 200-DMA at $197.25.

Reclaiming the 200-DMA restores the previously discussed profit-taking estimates starting at $204.

ETH-BTC grows increasingly bullish

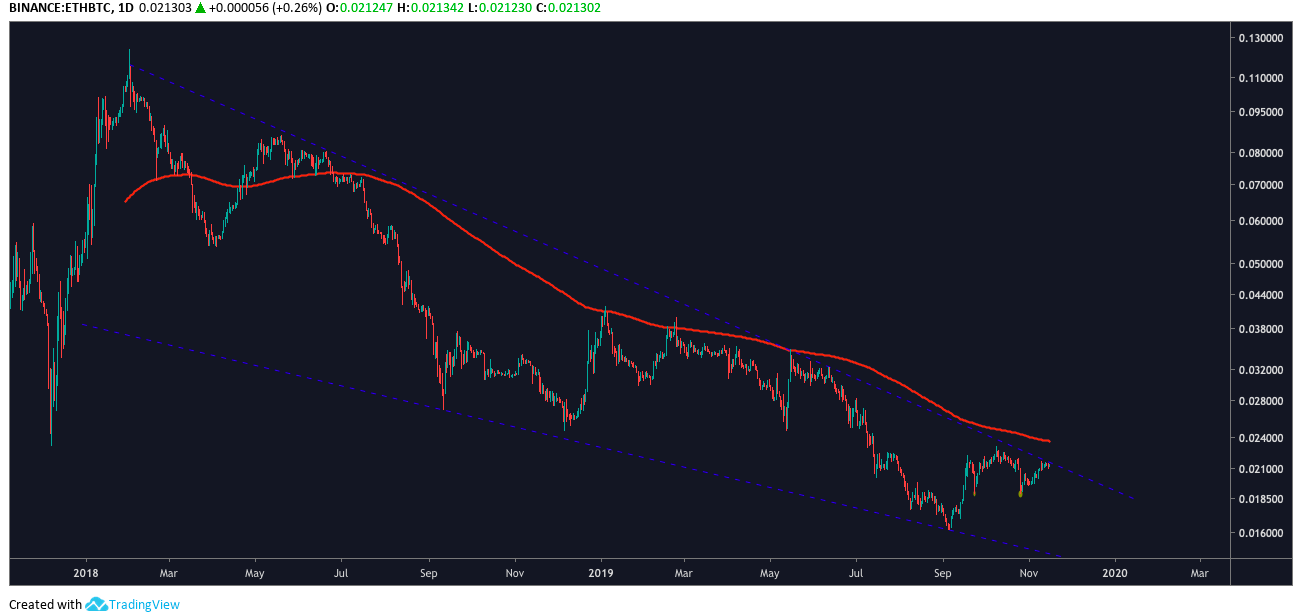

ETH BTC daily chart. Source: TradingView

As suggested last week, Ether continues to flash bullish signals on its ETH/BTC pairing. In the daily timeframe, one can clearly see that Ether price continues to press against the descending trendline. The daily MACD on the pair is also bullish and the RSI is currently pushing above 57.

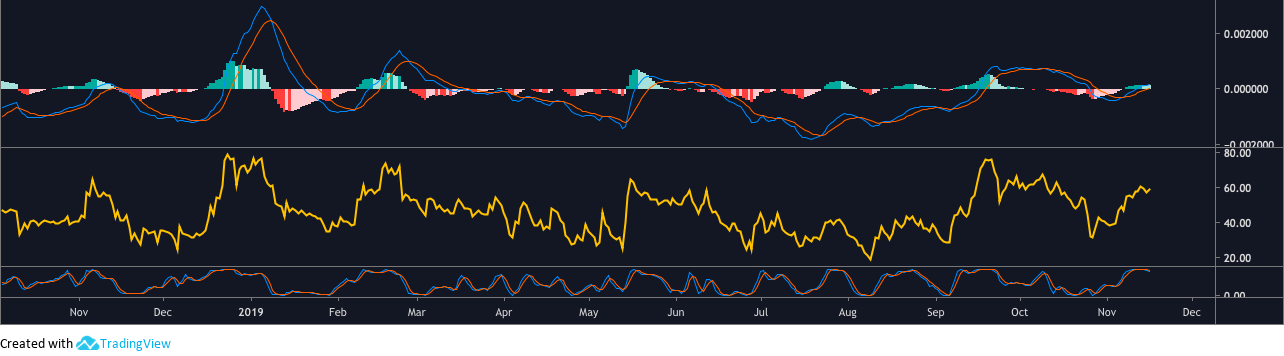

ETH BTC daily MACD and RSI. Source: TradingView

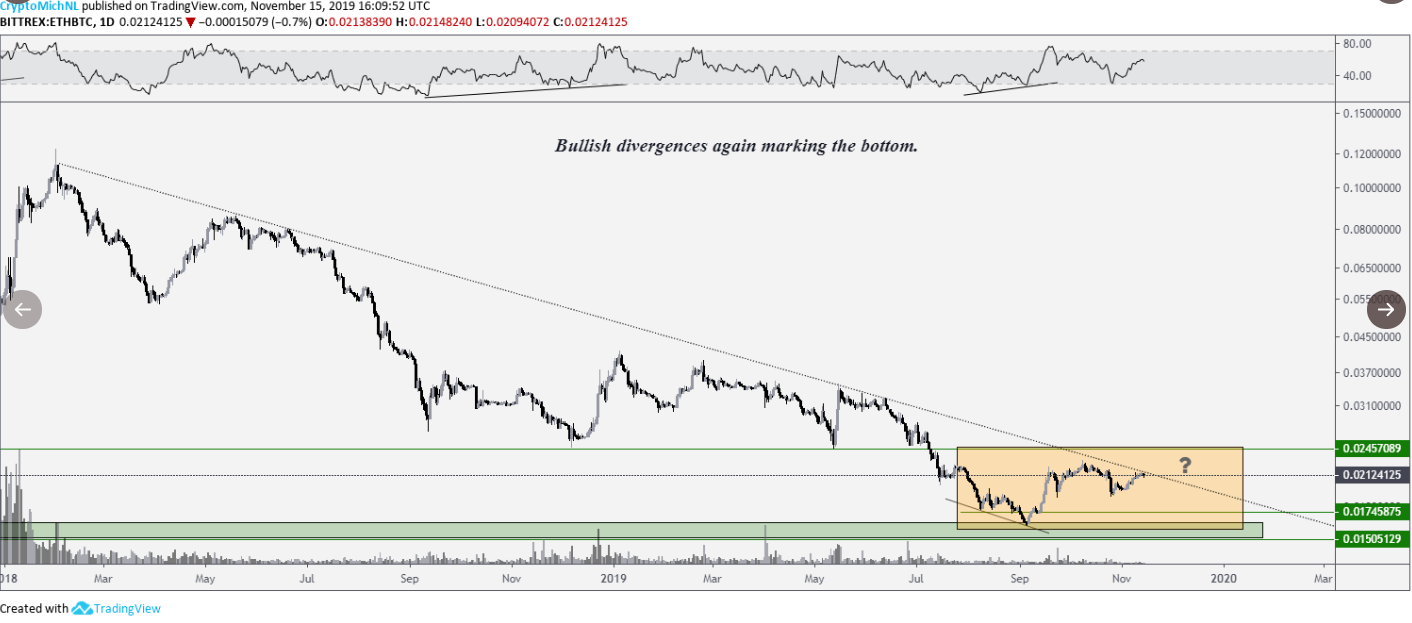

Furthermore, crypto analyst Michaël van de Poppe spotted a series of bullish divergences on the daily RSI, possibly hinting that ETH/BTC has bottomed.

ETH BTC daily chart. Source: TradingView

ETH BTC daily chart. Source: TradingView

Despite Friday’s pullback, Ether price remains in an ascending channel with the 12 exponential moving average (EMA) above the 26-EMA.

Breaking above the descending trendline would be notable as Ether price has been trapped below the trendline for 22-months. Although, traders will certainly remember Ether’s December 2018 rally from $80 to $364 on the ETH/USD pair.

Bullish scenario

Traders will be closely watching to see if Ether can cross above the descending trendline. This would be significant as Ether leads altcoins by market capitalization and at the moment handfuls of altcoins are showing identical chart setups or have already crossed above the 200-DMA and the descending trendline.

Over the weekend and the coming week, traders will be looking for Ether price to continue climbing in the ascending channel. A move above 0.021581 (sats) would clear the high volume node shown on the volume profile visible range (VPVR) and bring Ether price right to the long-term resistance at 0.021999 (sats).

This point has served as resistance since July 14, 2019, and moving above it would position Ether to set a monthly higher high at 0.023063 (sats).

More importantly, the VPVR shows that there is minimal selling pressure above this level and Ether would be en-route to take out the 200-DMA. Assuming Ether is able to remain in the ascending channel and overcome the resistance levels mentioned above, the altcoin could be potentially gain 18.15% before encountering resistance at 0.025346 (sats).

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.