Weak volumes and rotations into other cryptocurrencies are likely impeding bitcoin’s price movement from going higher. Meanwhile, ether has been more volatile than bitcoin in 2020 and could remain that way.

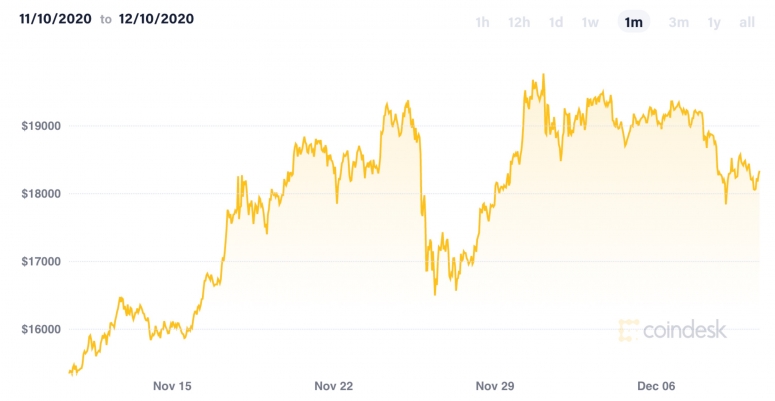

- Bitcoin (BTC) trading around $18,349 as of 21:00 UTC (4 p.m. ET). Gaining 0.14% over the previous 24 hours.

- Bitcoin’s 24-hour range: $17,904-$18,652 (CoinDesk 20)

- BTC slightly above its 10-day and 50-day moving averages, a bullish trending signal for market technicians.

The price of bitcoin once again fell below $18,000 Thursday, going as low as $17,904 according to the CoinDesk 20. The price was able to reverse course, with higher volume pushing it back up to $18,349 as of press time.

Constantin Kogan, partner at crypto investment firm Wave Financial, pegs $17,900 as a “support” level whereby if traders don’t start scooping up bitcoin to push price back up, there may be a larger fall. “The trend is weakening,” Kogan told CoinDesk. “If we dip further then I will consider that as a start of a downtrend.”

Chris Thomas, head of digital assets for Swissquote Bank, has noticed a lull in the market this week but sees it as a buying opportunity for those who have a longer time frame. “I’m not scared by this. It’s just providing a better entry point for those who want to invest mid-long term,” said Thomas to CoinDesk. “I haven’t seen much [over-the-counter] or larger activity this week, though.”

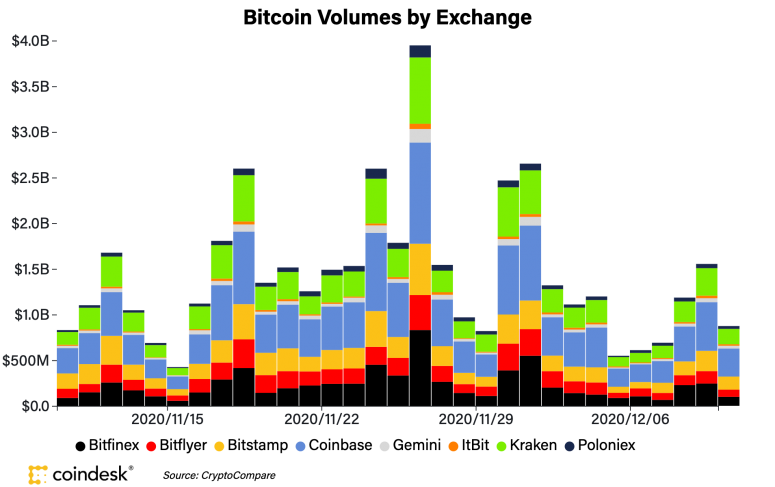

At a combined $1.1 billion as of Wednesday’s close, average weekday spot volume on major CoinDesk 20 exchanges is lighter this week than last week’s $1.7 billion. As of press time, combined volumes were at $873 million Thursday.

Henrik Kugelberg, an over-the-counter (OTC) crypto trader, is not dismayed by the doldrums in the crypto market this week. “It’s a moderate dip on the way up,” Kugelberg told CoinDesk. “Nothing to see here.”

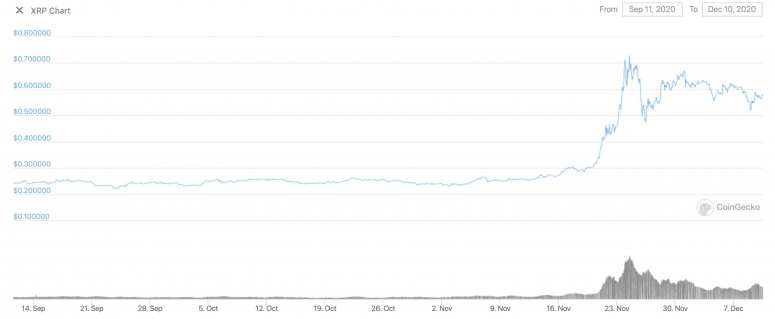

Rotation into alternative cryptocurrencies has been a popular theme in the crypto market as of late, and Swissquote’s Thomas pointed to XRP as one example of this dynamic. “Our data shows that in the last four weeks the volume of XRP has increased substantially at the detriment to ether and a little bit bitcoin,” Thomas said.

Indeed, XRP, the third-largest cryptocurrency by market capitalization, has seen a bump in volume over the past month, according to data from aggregator CoinGecko.

An airdrop in collaboration with Coinbase is likely accelerating a hype cycle on XRP, leading to volume jumping along with price, noted Thomas.“I think XRP volumes continue to outperform BTC and ETH ahead of tomorrow night’s flare token snapshot,“ said Thomas.

Ether more volatile than bitcoin this year

Ether, the second-largest cryptocurrency by market capitalization, was down Thursday, trading around $566 and slipping 1.1% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

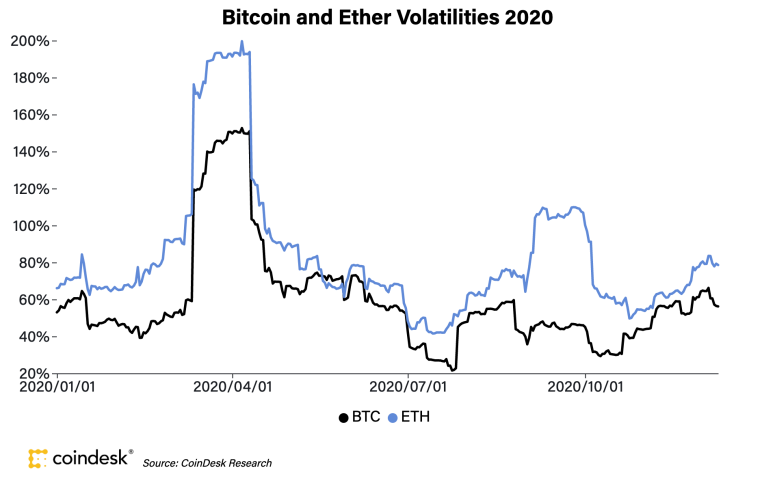

The 30-day volatility for ether for the most part has been higher than for bitcoin in 2020, according to data collected by CoinDesk Research.

Vishal Shah, a crypto options trader and founder of derivatives venue Alpha5, says Ethereum’s ambitious “2.0” upgrade provides totally different fundamentals for ETH compared to BTC, giving it wilder gyrations.

“ETH should have a higher volatility given that it’s a less established protocol than bitcoin; it is materially smaller in market cap and has more uncertainties on the immediate horizon,” Shah told CoinDesk. “The largest uncertainty would be the settling of [the Beacon Chain] and the transition to 2.0, it’s all a bit uncharted.“

Other markets

Digital assets on the CoinDesk 20 are mixed Thursday, mostly red. One winner as of 21:00 UTC (4:00 p.m. ET):

- Oil was up 2.5%. Price per barrel of West Texas Intermediate crude: $46.86.

- Gold was in the red 0.14% and at $1,836 as of press time.

- The 10-year U.S. Treasury bond yield fell Thursday dipping to 0.915 and in the red 2.1%.