Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana has experienced bearish momentum this week as it retraces by 7%. But the move has sparked fears of further downside after breaking below $100. Will SOL recover to continue its rally, or are new lows imminent?

Traders back Solana

Market participants are notably bullish on the upcoming weeks and months for crypto, with this sentiment spilling over into Solana despite its recent pullback.

Currently, Solana is trading at $97.23 with a $42 billion market cap and a $1.6 billion 24-hour trading volume.

Its recent sell-off comes after a three-month-long rally where SOL hit $121, its highest price since April 2022.

However, Solana fell after this and continued to tumble following the spot Bitcoin ETF approvals.

Another factor driving Solana lower is the liquidation of long positions in derivatives exchanges. According to CoinGlass data, over $4.73 million of SOL long positions were liquidated on Jan. 12.

SOL tumbled to $91.23 in the aftermath but has begun a steady recovery, now priced at $97.36.

Prominent analyst Jelle recently noted that Solana is trading below a trend line resistance but anticipates a move to $169 following a breakout.

Meanwhile, World Of Charts expects Solana to recover, forecasting an uptick to $140-$145 after breaking its current resistance level.

Analyst Reetika also remains bullish on Solana, stating it is “still holding daily trend and looks solid.”

Ultimately, traders are bullish on SOL based on broader optimism that altcoins will flourish in the coming months.

One of the biggest proponents of this narrative is Michael van de Poppe. He opines that Bitcoin dominance has peaked, providing an opportunity for altcoins to see significant gains.

In a follow-up tweet, the trader predicted the altcoin market cap to increase by approximately 50% from $796 million to $1-$1.25 trillion.

However, the incoming liquidity would benefit some coins more than others.

Analysts are already backing Bitcoin Minetrix to ride the upcoming altcoin rally.

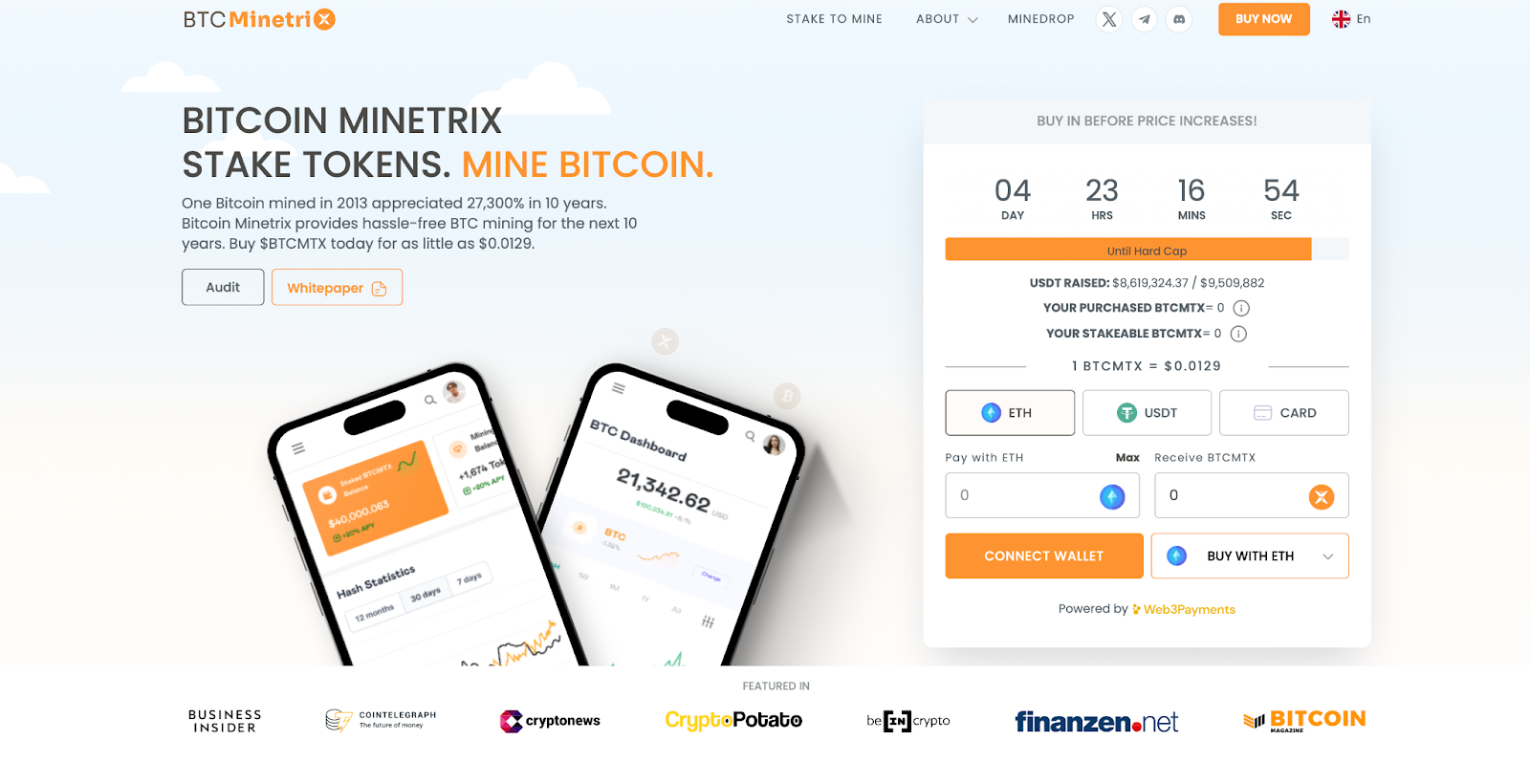

Bitcoin Minetrix hits $8.5 million in presale

Bitcoin Minetrix is a stake-to-mine project where users can stake BTCMTX on its Ethereum-based platform in exchange for Bitcoin mining credits. They can then burn these credits for cloud mining power, receiving BTC.

Bitcoin Minetrix has gained widespread attention due to its innovative approach to Bitcoin mining. The platform eliminates several common barriers to entry, such as the need for expensive hardware or technical expertise.

Additionally, it eliminates location-based restrictions, allowing users to mine Bitcoin remotely without concerns about noise pollution.

Furthermore, Bitcoin Minetrix’s decentralized and transparent nature minimizes the risk of cloud mining scams, making it a more secure alternative to existing solutions.

These advantages are expected to drive significant demand for the platform, which analysts believe will support BTCMTX prices.

Already, analyst Jacob Bury backs the project to rally.

Bitcoin Minetrix has a well-structured tokenomics model that enhances its appeal.

Users need BTCMTX to stake, ensuring a consistent demand for the token.

Moreover, a significant portion of tokens will be locked in the staking contract, further reducing circulating supply. Rewards are primarily distributed in mining credits, not BTCMTX.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.