Despite a week of price consolidation for Bitcoin (BTC), emerging digital asset legislation may provide the next significant catalyst for the world’s first cryptocurrency. Upcoming stablecoin rules, such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, may lay the foundation for a Bitcoin cycle top of over $150,000, according to Alice Li, investment partner and head of US at crypto venture capital firm Foresight Ventures. Meanwhile, venture capitalist (VC) interest has slumped. The number of VC deals closed recorded its lowest month of the year in…

Tag: Regulation

South Africa Central Bank Argues ‘Outdated’ Exchange Control Law Still Valid for Crypto Regulation

The South African central bank has appealed a High Court ruling that criticized its use of an outdated exchange control law to regulate cryptocurrencies. Central Bank Says High Court Erred The South African Reserve Bank (SARB) has appealed a High Court ruling that criticized the central bank’s reliance on an outdated exchange control law to […] Source

Stablecoin Market Hits ATH as David Sacks Hints at Regulation

Key Notes Stablecoin market capitalization is reaching the $250 billion mark. David Sacks hinted at a trillion-dollar opportunity with the GENIUS Act. 15 democrats joined the republicans in supporting the stablecoin regulation. . The cryptocurrency market is seeing yet another bullish momentum, and investors are pouring funds into stablecoins before buying volatile assets. According to data from CoinMarketCap, the total value of stablecoins is close to an all-time high of $250 billion, thanks to the steady rise since January. Tether’s USDT is leading the pack with a $152.4 billion market…

Stablecoin regulation ‘next catalyst’ for crypto industry — Aptos head

Stablecoin regulation is “the next catalyst” for the crypto industry and could lead to unprecedented “appetite from institutional investors,” according to Ash Pampati, head of ecosystem at the Aptos Foundation. In an interview with Cointelegraph at Consensus 2025 in Toronto, Pampati said that “the whole world outside of the United States […] has already jumped onto this [stablecoins],” adding that “the US is […] at the doorstep.” “I really think about new use cases that can emerge because of the borderless nature of stablecoins, because of the efficiency of the…

Ripple CEO Sees Stablecoins Exploding Globally, Calls for Rapid US Regulation

Ripple’s CEO pushes for urgent U.S. action as stablecoins skyrocket globally, warning that without clear rules, America risks falling behind in the digital currency race. Ripple CEO Urges Congress to Act Fast as Stablecoins Erupt Worldwide Ripple chief executive Brad Garlinghouse raised alarms on social media platform X Thursday, following the U.S. Senate’s failure to […] Source CryptoX Portal

India’s Top Court Slams Lack of Crypto Regulation, Links Bitcoin to Hawala

India’s top court just ignited a regulatory firestorm, slamming bitcoin trading as refined Hawala and blasting government delays that leave the crypto market in legal limbo. Indian Supreme Court Calls Bitcoin Refined Hawala, Decries Absence of Regulatory Framework The Supreme Court of India compared bitcoin trading to “a refined way of Hawala business” on Monday […] Original

SEC Signals Major Shakeup for Crypto Funding With Regulation A Under Fire

SEC leadership is turning up the heat on outdated capital-raising rules, with bold signals that long-overdue Regulation A reforms could finally open floodgates for crypto ventures. SEC Chair Blasts Regulation A Limits, Calls for Reform to Empower Crypto Issuers and Small Businesses U.S. Securities and Exchange Commission (SEC) Chairman Paul S. Atkins urged a reassessment […] Source BitcoincryptoexchangeExchanges CryptoX Portal

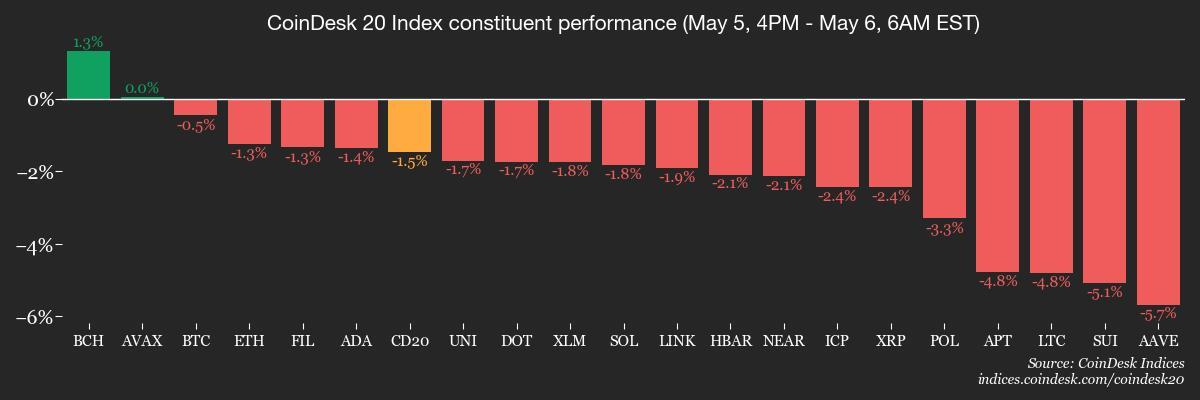

Crypto Daybook Americas: Bitcoin Threatened by Regulation Hiccup, Weakening Demand

By Omkar Godbole (All times ET unless indicated otherwise) As bitcoin (BTC) and the wider crypto market await the Fed’s rate decision on Wednesday, an anomaly has emerged that could weigh heavily on market mood: renewed doubt over the passing of U.S. crypto regulation. Early Tuesday, CoinDesk reported that Senate Democrats are hesitant to push forward landmark stablecoin legislation, citing concerns over President Donald Trump’s growing personal gains from his crypto ventures. When Trump took office, many observers felt crypto regulation would proceed smoothly. Looking back, that optimism was probably…

The SEC Can Learn From the IRS in Making Regulation Simpler for Crypto

In February, the Department of Government Efficiency (DOGE) began soliciting public input pertaining to the U.S. Securities and Exchange Commission (SEC) — a move suggesting reform at the agency is imminent. Since then, the SEC, in line with President Trump, has taken a far less adversarial stance towards the cryptocurrency industry, as evidenced by the appointment of crypto-friendly personnel and the abandonment of numerous lawsuits and investigations into crypto companies. But DOGE has the potential to implement further change, and interest in the SEC signals growing pressure towards regulators to…

UK FCA Seeks Public Feedback on DeFi Regulation

Key Notes FCA opens discussion on regulating DeFi, staking, and crypto lending in the UK. Feedback invited from public and industry before June 13, 2025. Part of FCA’s 2025–2030 strategy for smarter crypto oversight. The UK’s Financial Conduct Authority (FCA) has asked the public and those in the crypto industry to share their views on how some digital asset services should be handled under British law. This is part of a broader effort to introduce rules that protect users and give businesses clear guidance. FCA Outlines Next Steps for Crypto…