Bitcoin (BTC) price is trading above $41,000 in the early trading hours of Jan. 22, after bulls swung in to avert a reversal below $40,000 with on-chain signals suggesting the sell-off is not over yet.

Bitcoin price has bounced between the $40,000 and $42,000 over the last 3 days as bullish investors look to avoid amplified losses that could arise from losing the $40,000 support.

Amid heightened market volatility, is BTC more likely to break above $50,000 or drop below $40,000?

Bitcoin miners cut reserves to 3-Year low

Since the spot Bitcoin approval verdict Bitcoin price has struggled to sustain an upward momentum. This has been majorly attributed to speculative traders ‘selling-the-news’ to book profits.

However, a closer look at the underlying on-chain data now shows that Bitcoin miners have been on a historic selling frenzy behind the scenes.

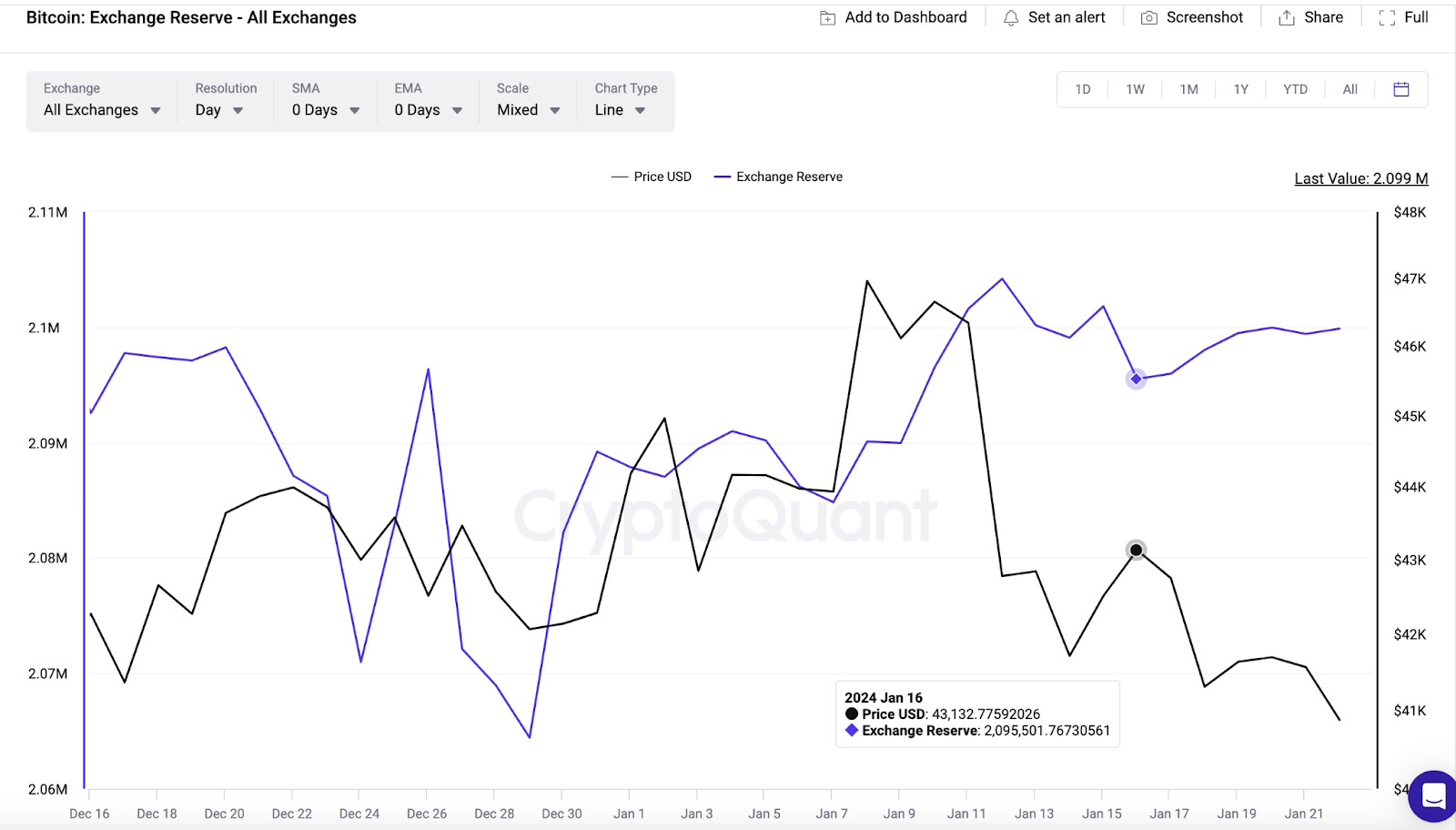

Cryptoquant’s BTC exchange reserves data captures real-time BTC balances deposited in wallets controlled by recognized Bitcoin mining companies and mining pools.

Bitcoin miners held a total of 1.84 BTC million in their cumulative reserves on Jan. 16. But just a week later, on Jan. 22, that figure had rapidly dwindled to 1.83 BTC, the lowest since August 2021.

As depicted in the chart below, the miners have offloaded about 10,000 BTC from their wallets between Jan. 16 and Jan. 22.

Bitcoin miners are highly influential to the global crypto ecosystem. Firstly, as things stand, they control about 9% of the 19.6 million total Bitcoin in circulation. Hence, a prolonged selling frenzy among the miners is likely to trigger panic among other stakeholders including retail investors.

Also, when valued at the current BTC price of $41,000, the coins offloaded over the past week are worth approximately $4.1 billion. If market demand remains weak, the intense sell pressure could promptly send BTC price spiraling below $40,000.

Investors are loading up their exchange wallets

Furthermore, Bitcoin exchange reserves data is another critical on-chain indicator flashing a bearish signal this week.

Often tagged as a proxy for checking accounts in tradfi, the exchange reserves chart tracks the real-time amount of BTC currently deposited with cryptocurrency exchanges and trading platforms.

Bitcoin investors deposited 4,000 BTC, worth approximately $164 million into crypto exchanges between Jan 16 and Jan 22 as per Cryptoquant data.

Increases in exchange reserves means that investors may be looking to exit or swap out their coins on short notice. As depicted above BTC reserves deposits in exchange wallets also increased significantly over the weekend. This further emphasized the hawkish sentiment among investors.

With more coins now available to be traded on exchanges, BTC will likely witness another price downswing, unless there a major shift in market sentiment

Prediction: will Bitcoin price drop below $40,000 or breakout above $45,000?

In summary, Bitcoin miners further cut their cumulative reserves to 1.83 million BTC, the lowest since August 2021. Meanwhile, traders also made deposits of $400, in the exchange wallets. These 2 vital indicators indicate a bearish outlook that could see Bitcoin price tumble below $40,000 in the week ahead.

However, for the bears to capitalize on the negative momentum, they have to scale the initial buy-wall at the $40,700 mark.

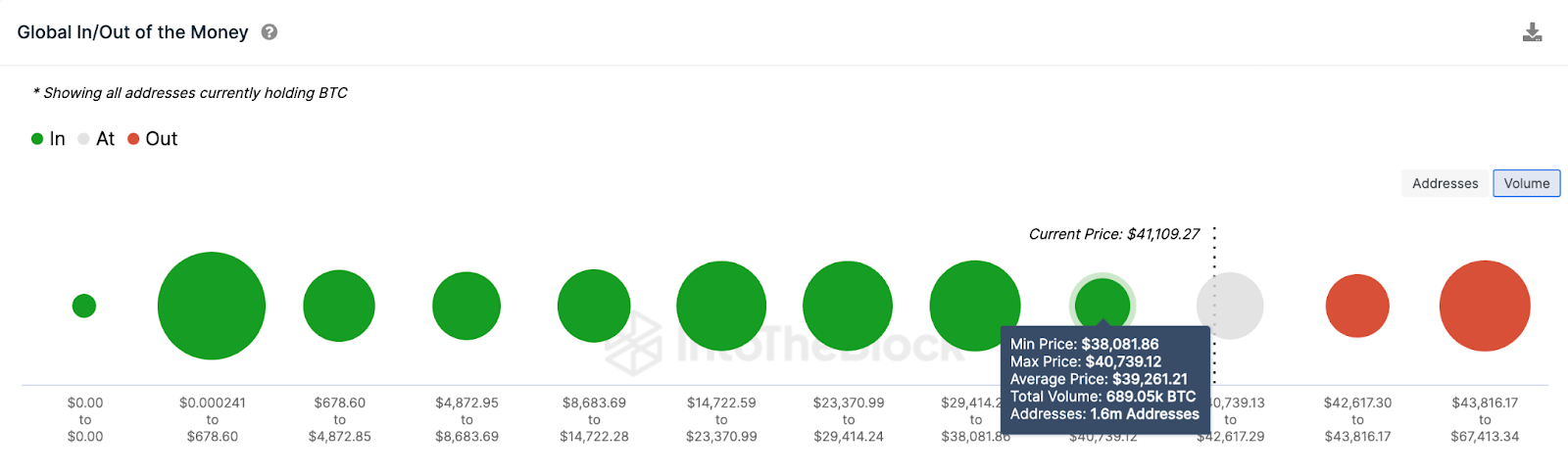

After days of bearish headwinds, the $40,000 support area now appears weaker than surrounding accumulation zones as depicted by IntoTheBlock’s In/Out of the Money around price data.

1.6 million current investors had acquired 689,050 BTC at the average price of $40,739. The chart below shows that this support level is significantly weaker than the current resistance cluster of 2.7 million investors that bought 1.07 million BTC around the $42,617 area.

If the $40,000 support caves as predicted, BTC price could rapidly slide toward $38,000.

On the upside, the bulls could invalidate this bearish forecast if Bitcoin price reclaims $45,000. However, in that case, the 2.7 million investors that bought 1.07 million BTC at the maximum price of $42,617 could pose major resistance.